Receivable Financing Companies

Companies allow their clients to pay at a reasonable extended period of time provided that the terms are agreed upon.

Receivable financing companies. The only disadvantage of accounts receivable financing is that a there is a financing cost paid to the lender or factoring company that is providing the accounts receivable financing. An established heavy construction company located in illinois was in financial trouble. If your client is a good credit risk and your volumes are over 500 000 annually you may qualify for our bank prime rate plus program please fill out our quick request form to see if our bank prime program suits your business or call us 1 800 808 8802. Accounts receivable financing helped a heavy construction company dig out of a hole.

Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing. To a financing company that specializes in buying receivables called a factor at a discount. A r financing is based on the value of outstanding receivables. Many companies need additional cash flow to support seasonal demands growth business opportunities or solve a short term.

Companies like fundbox offer accounts receivable loans and lines of credit based on accounts receivable balances. Accounts receivable financing has the major advantage of providing the money for the goods and services you sold 30 or more days before a typical a r cycle. What does it cost. Receivables or accounts receivable are debts owed to a company by its customers for goods or services that have been delivered but not yet paid for.

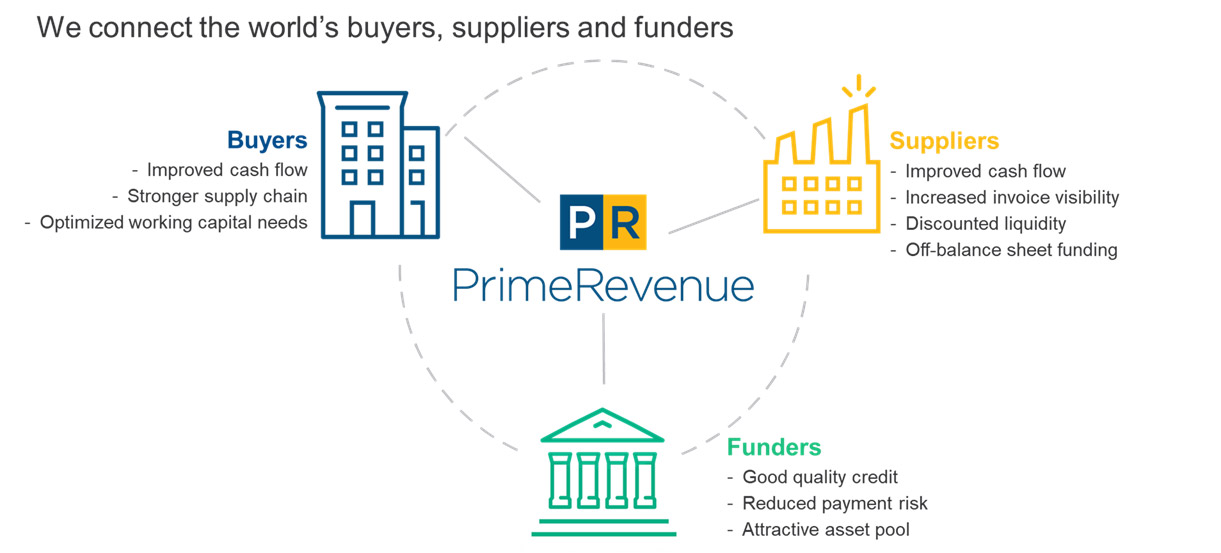

Although work was plentiful most of the time the winter months were a drain on the company s bottom line. A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee. Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. Accounts receivable financing allows companies to receive early payment on their outstanding invoices.

The factoring company assumes the risks on the receivable and in return issue your business. In simple terms it is a process that entails the selling of receivables or outstanding invoices at a markdown to a specialized factoring or finance company normally called the factor. The calculator below shows the approximate daily cost per 1000 of receivables factored. If approved fundbox can advance 100 of an accounts receivable balance.