Receivables Factoring Company

The industry that the company is in.

Receivables factoring company. A free and impartial resource your business can search compare and contrast over 125 listings. Factoring uses an intermediary a factoring company to buy your invoices and advance you money against them. A maryland healthcare company paid a 3 factoring fee for customer payments received within 30 days plus an additional 1 per 10 days of overdue payments. Let s say you sold 20 000 of outstanding receivables.

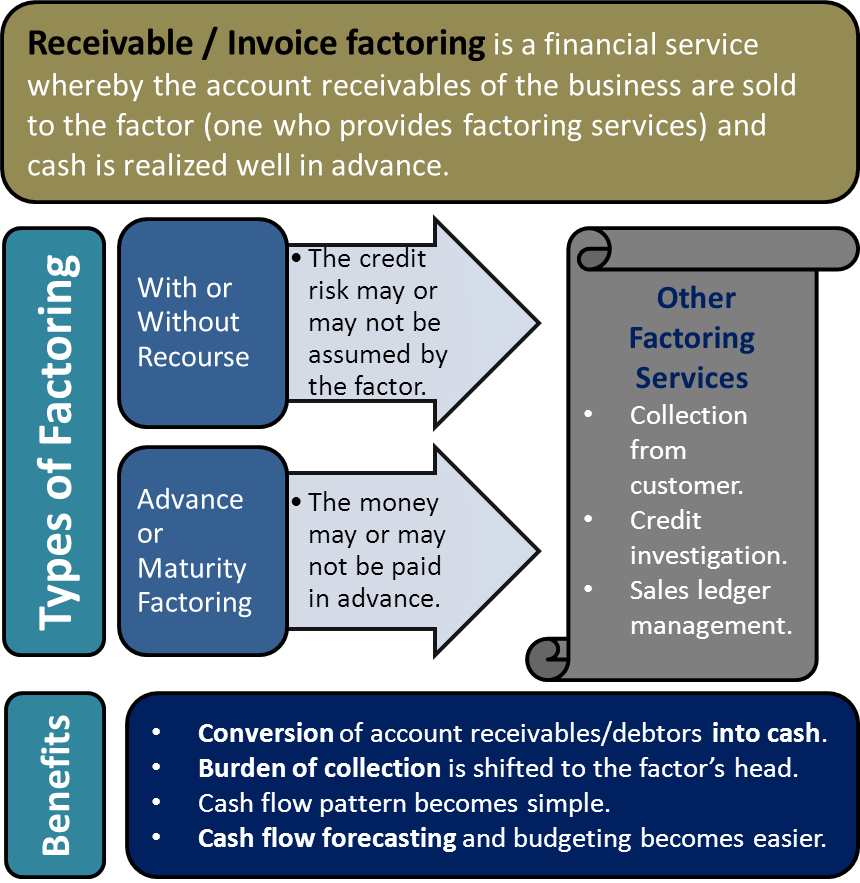

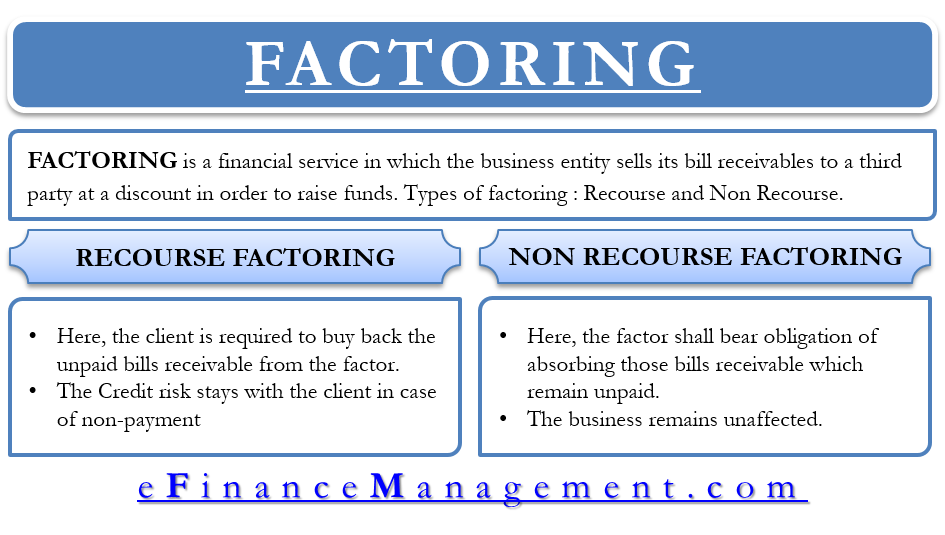

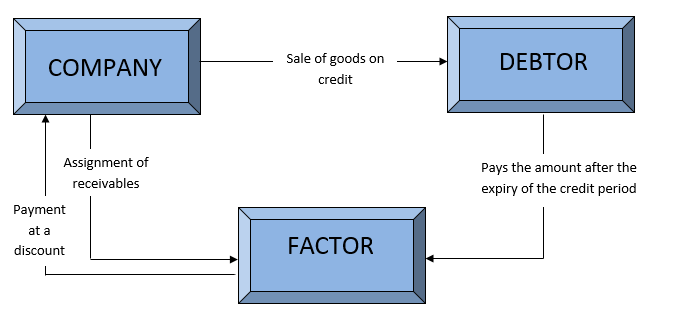

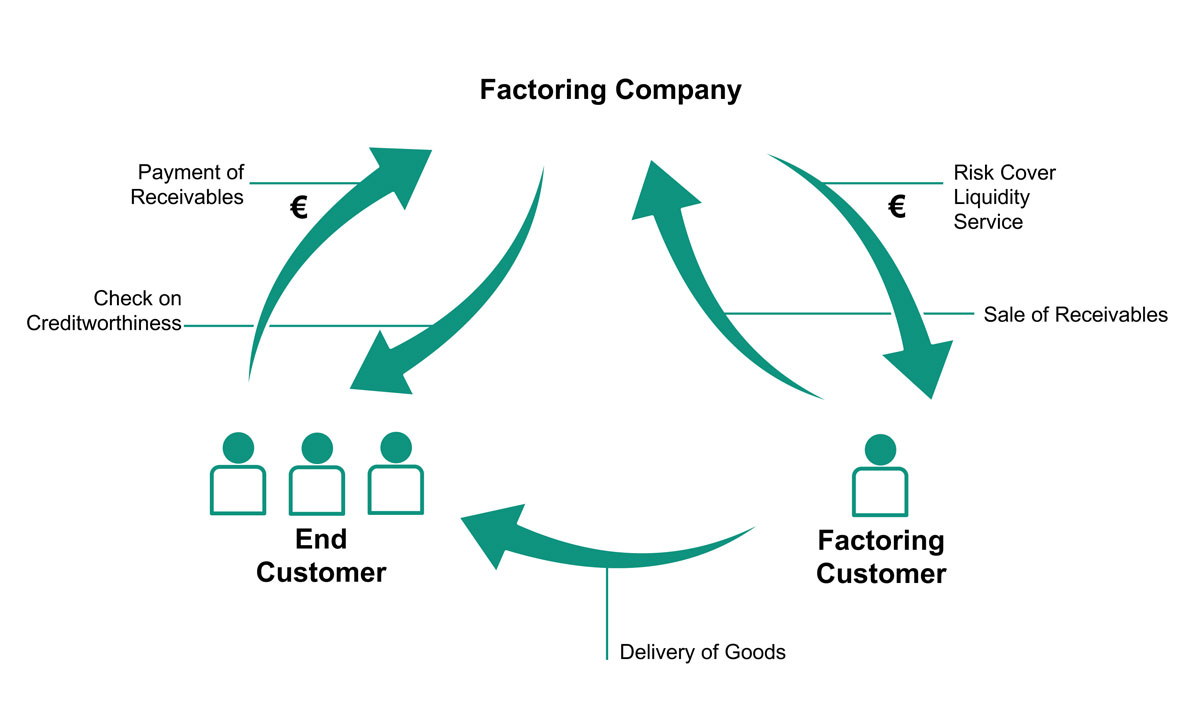

How accounts receivables are priced by factoring companies. The rate charged by factoring companies depends on. Factoring company pays your business the balance of the invoice after deducting a commission fee based on a percentage of the invoice value. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount.

That s why even when a business hits a rough patch or has a bad year a receivables financing company can continue to stand strong and be a reliable source of capital. Compare find factoring companies fast. The volume of receivables to be factored. Whatever your industry location or size factoring directory helps you find a factoring company that most closely aligns with your business needs.

Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. So when you sell your accounts receivables to a third party factoring company the discounted purchase price gets calculated using what s known as a factor rate. Factoring receivables is one of the most popular ways to finance companies that are struggling with limited cash flow. In case any bad debt arises at a later date due to nonpayment of dues by the customer resulting in a loss the business will make it good for the accounts receivables factoring companies.

Factoring company collects the accounts receivable from the customer. After you deliver a product or service to your client you send them an invoice. Factoring companies charge what is known as a factoring fee the factoring fee is a percentage of the amount of receivables being factored. And let s say the factor rate is 3.

Factoring companies are more concerned with the creditworthiness of a client s customers and not just on the strength of the client itself. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. A florida equipment company paid a 700 set up fee and a 4 factoring fee. An example of accounts receivables factoring.

Under this invoice factoring arrangement only early payment of invoices is provided by the accounts receivables factoring companies in return for factor fees to the business.