Receivables Financing

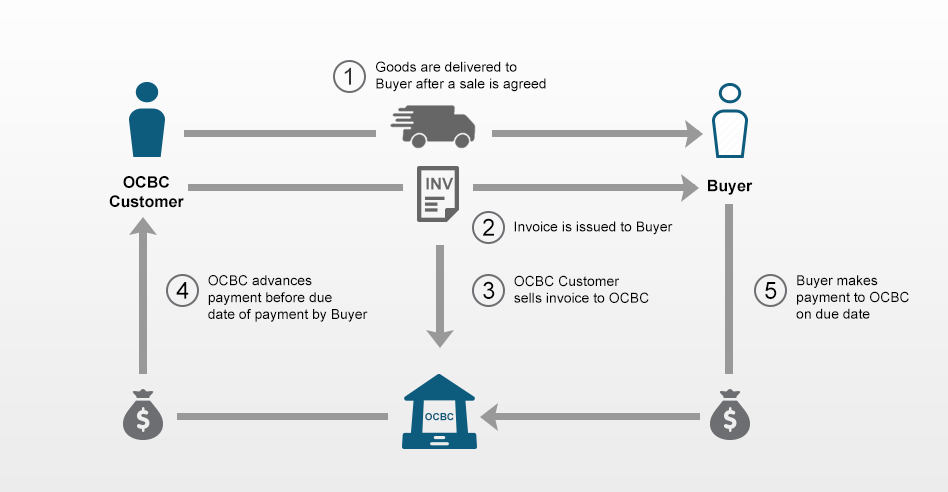

A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee.

Receivables financing. Receivables financing gscf services programs based on accounts receivable ar of companies. Accounts receivables finance require companies to have receivables or book debts. Receivables finance is part of a sound treasury strategy that reduces customer credit risk and provides faster access to cash. They are considered a liquid asset because they can be used as.

Accounts receivables financing is essentially the process of raising cash against your book s debts so an asset finance product rather than lending. Ar financing programs involve an originating company vendor and its customers buyers. Receivables are created by extending a line of credit to customers and are reported as current assets on a company s balance sheet. What are the three primary types of receivables finance.

When the invoice is paid you receive the balance in the case of undisputed receivables where a customer defaults or becomes insolvent if you have taken out credit protection on the customer with us we will pay you the outstanding balance up to the value of the agreed credit protection limit. What is receivables financing and how much does it cost. Receivables are defined as amounts owed to a business essentially outstanding invoices and are considered to be assets. This allows the company to generate immediate cash flows without the need to put up physical assets as collateral.

In a receivables financing agreement a business borrows against the amount of its outstanding invoices for cash. Accounts receivable financing allows companies to receive early payment on their outstanding invoices. Receivables financing allows companies to generate additional immediate liquidity by assigning its accounts receivables to orix leasing singapore limited. Accounts receivable ar financing is a type of financing arrangement in which a company receives financing capital related to a portion of its accounts receivable.