Recievable Factoring

Factoring companies will usually focus substantially on the business of accounts receivable financing but factoring in general may be a product of any financier.

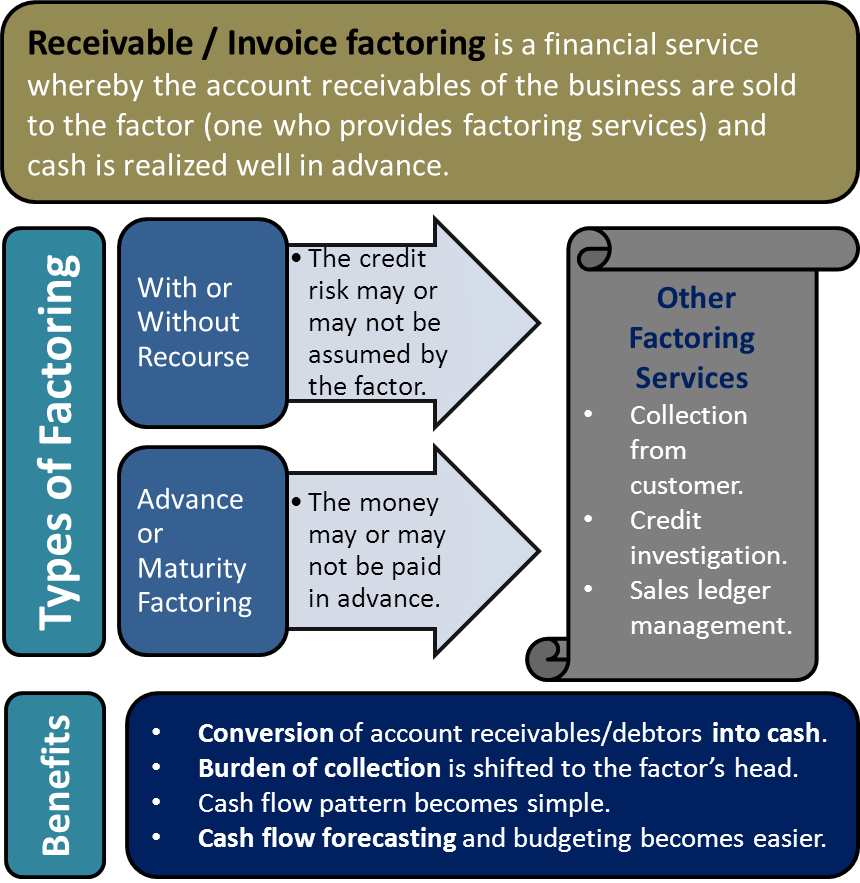

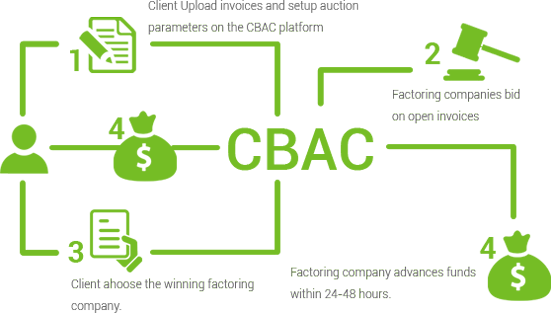

Recievable factoring. Accounts receivable factoring is a solution that allows business owners to quickly turn invoices into working capital. Factoring a transaction whereby you sell your accounts receivable to a factor is a type of accounts receivable financing. It s a common form of financing businesses use to improve cash flow and eliminate the wait for payments from customers. Lastly accounts receivable factoring is far from the only solution to late paying customers.

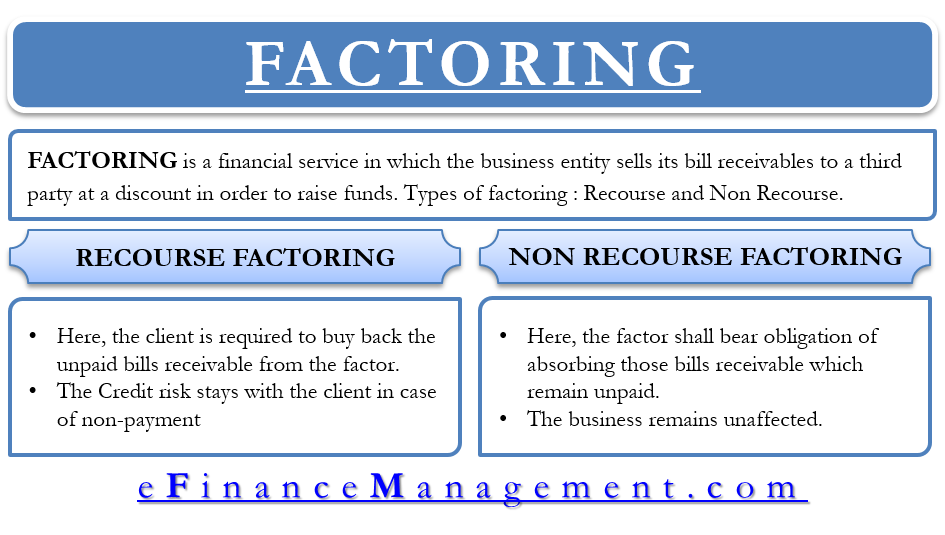

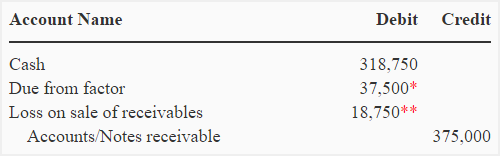

For this reason accounts receivable factoring works best for established customers with many partners. Accounts receivable factoring popularly known as factoring is a financial instrument used by businesses for raising quick money by selling their accounts receivable to another specialized company known as factor it is also known by the name of invoice factoring. Accounts receivable financing is a type of business loan where the lender provides an advance on the business unpaid invoices typically less than 90 days old in order to provide the business with additional working capital. Accounts receivable factoring also known as accounts receivable financing is a form of business finance where a company sells their open invoices to a factoring company in exchange for an immediate cash advance.

What is accounts receivable factoring. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Customers are to be notified of this by a notification of assignment letter which will also contain the new payment instructions.

Factoring accounts receivable allows you to obtain cash advances from the factoring company which frees up cash from working capital. Instead of waiting for weeks or months for customers to pay their invoices accounts receivable financing lets business owners get an advance on those invoices and use the cash for pressing business needs instead of waiting for weeks or months for customers to pay their invoices. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Accounts receivable factoring also known as factoring is a financial transaction in which a company sells its accounts receivable accounts receivable accounts receivable ar represents the credit sales of a business which are not yet fully paid by its customers a current asset on the balance sheet.

Companies allow their clients to pay at a reasonable. Lesser known businesses don t have the reputations or business credit profiles of their larger competitors.