Recourse Vs Nonrecourse Factoring

Non recourse terms vary between factoring companies but generally non recourse does not cover all situations.

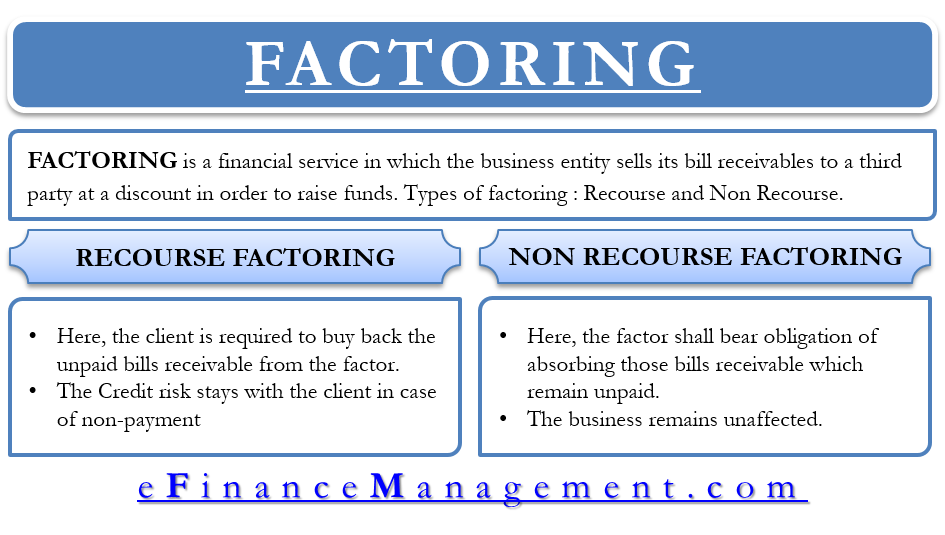

Recourse vs nonrecourse factoring. You re off the hook. It is a safer alternative to recourse factoring in that the factoring company assumes a higher level of risk for unpaid invoices. Full recourse factoring is the most common type of invoice factoring. Factoring is when you sell your invoice to a third party factor with the intent of having the factor pay you quickly for the invoice minus the agreed upon fees.

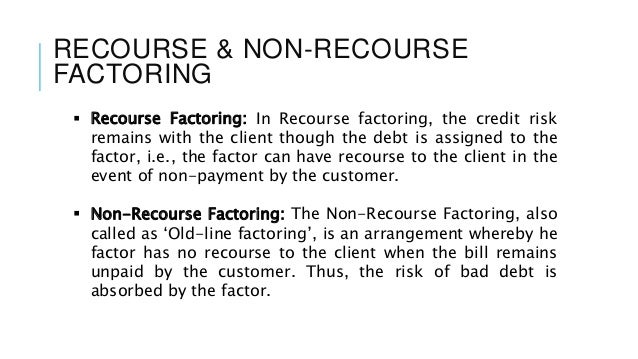

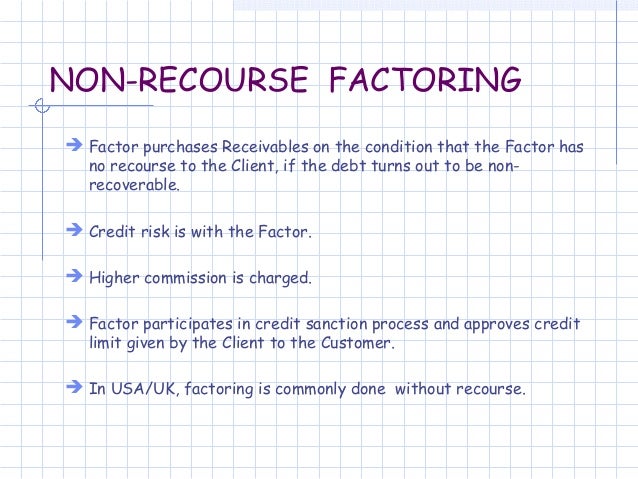

If you are risk adverse and hate the thought of your customers not paying your invoices then you may find comfort in non recourse factoring. What is the difference. There are usually stipulations associated with non recourse factoring and the situations in which you are not responsible for customer non payment are very specific. Non recourse does not necessarily protect your company from all risk though.

Non recourse factoring protects trucking companies from customer insolvency and places the responsibility of repayment on the factor. Invoice finance is effectively a line of credit obtained on the value of your outstanding sales ledger. For example if issues of non payment or short payment arise out of negligence or fraud from the factoring client in those cases the client would still be responsible for the repayment or exchange of that invoice. Non recourse factoring as the name suggests is an invoice factoring program in which there is no timeframe for your invoice to be closed.

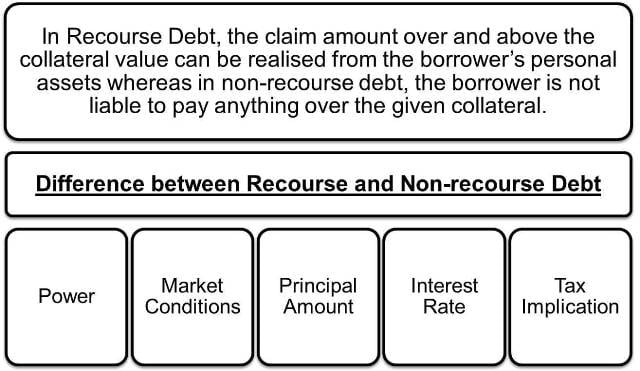

In other words when a borrower fails to repay a non recourse loan. Some factoring companies offer non recourse factoring only. The industry defines the two forms of factoring by risk. Recourse whether full recourse or non recourse determines if and when the factor can return the invoice to the client and demand to be made whole.

Here s what happens if your debtors fail to pay the invoices after you have financed them. Non recourse factoring means the factoring company assumes most of the risk of non payment by your customers. Most factoring companies only offer recourse factoring and do not offer non recourse as an option. Recourse vs non recourse factoring.

Other factoring companies offer a non recourse option or an as needed feature to recourse factoring. In a non recourse factoring agreement the factoring company assumes the risk of non payment if your customer fails to pay outstanding invoices.