Refinance Business Debt

Even more every dollar paid in interest is one less dollar in profit.

Refinance business debt. Refinancing or business debt consolidation means consolidating multiple business debts into one or changing one loan for another. Existing 504 loans are not eligible for refinancing. If the sba 7 a loan is used to refinance a business acquisition the maximum term is 10 years and 25 years if the largest percentage of the business assets is real estate. Let connect2capital match you with a small business lender that can help you obtain a loan to refinance debt.

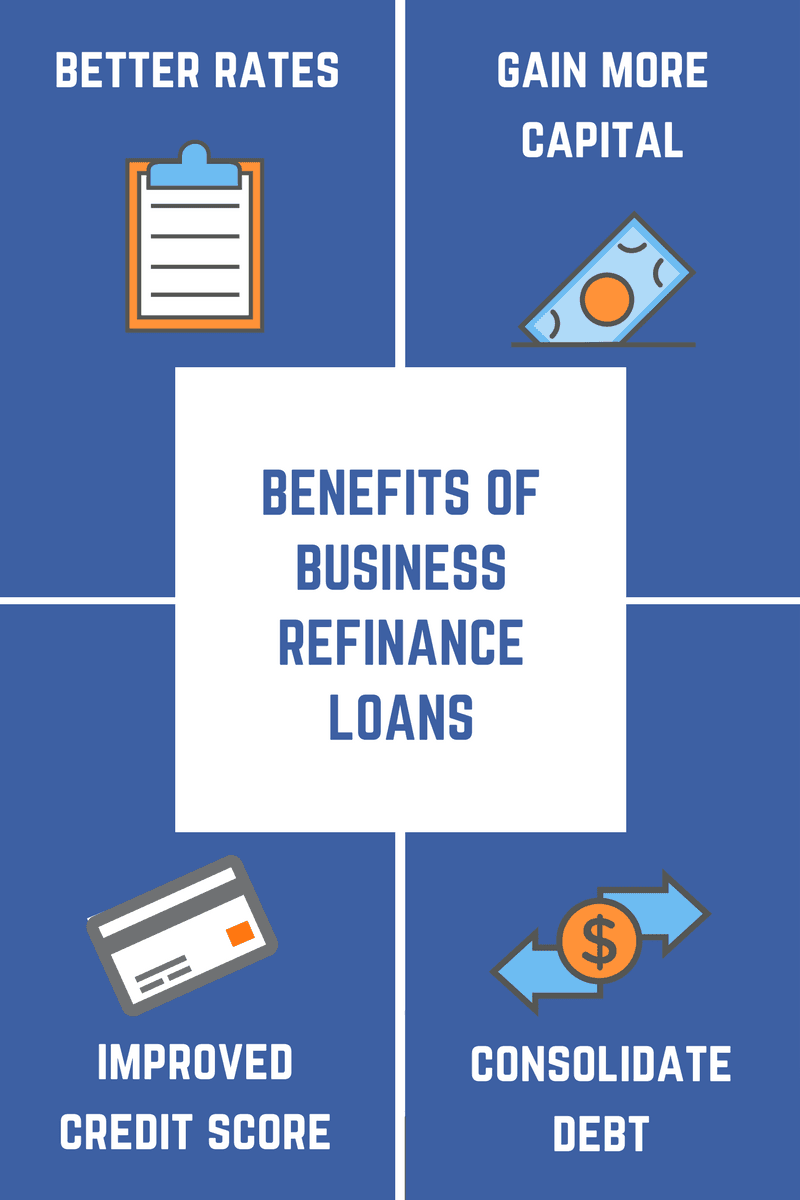

Usda non streamlined refinancing is available to homeowners who. Refinancing business debt can help free up cash to reinvest in your business and reduce the overall cost of your debt as well as your monthly payments. Getting out from underneath small business debt is a challenge for many entrepreneurs. The overall idea is that a business can swap expensive debt for more affordable debt and give themselves a little extra breathing room in terms of working capital.

If your business currently has multiple forms of debt outstanding in the form of short term loans lines of credit or business credit cards you may be looking for a way to consolidate those. Refinancing of same financial institution debt is possible but must document a 36 month payment history with no unjustified past dues 30 days. Refinancing of an existing sba loan is generally not allowed but may be considered if the borrower has new financing needs that the existing lender has declined or the existing lender has refused to modify the terms of the existing sba loan to. For small companies looking to refinance their business debt an excellent option would be an small business administration enhanced loan used by many firms as a refinancing lifeline.

Besides banks you can turn to online small business loans for business debt consolidation and refinancing. Sba 7 a refinancing can be used to refinance existing business debt provided the new loan is secured with at least the same security as the old debt. The sba also maintains several other loan programs which in certain instances may be used for debt refinancing. But to understand sba refinance one must first understand what an sba loan is.

Here are our top three recommendations ranked by cost of financing. Other refinancing loans to consider. Learn more about the benefits of debt refinance. A mortgage refinancing option offered by the united states department of agriculture usda.

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)