Refinance Home Meaning

Refinancing your home a housing specialist s home ownership fact sheets with information on the best time to refinance.

Refinance home meaning. Refinancing a mortgage means paying off an existing loan and replacing it with a new one. For example a recently graduated professional might have a package of debt that includes private loans subsidized federal loans and unsubsidized federal loans. You d have the loan paid off in 15 less years. For instance if a homeowner owes 50 000 on a property worth 200 000 that property has equity worth 150 000.

Refinancing means basically applying for a loan all over again. Home refinance loans are great for extracting equity out of a property. Refinancing and the us economy the issues regarding the costs and benefits of mass refinancing by the american people. For example you might want to refinance a 30 year home loan into a 15 year home loan that comes with higher monthly payments but a lower interest rate.

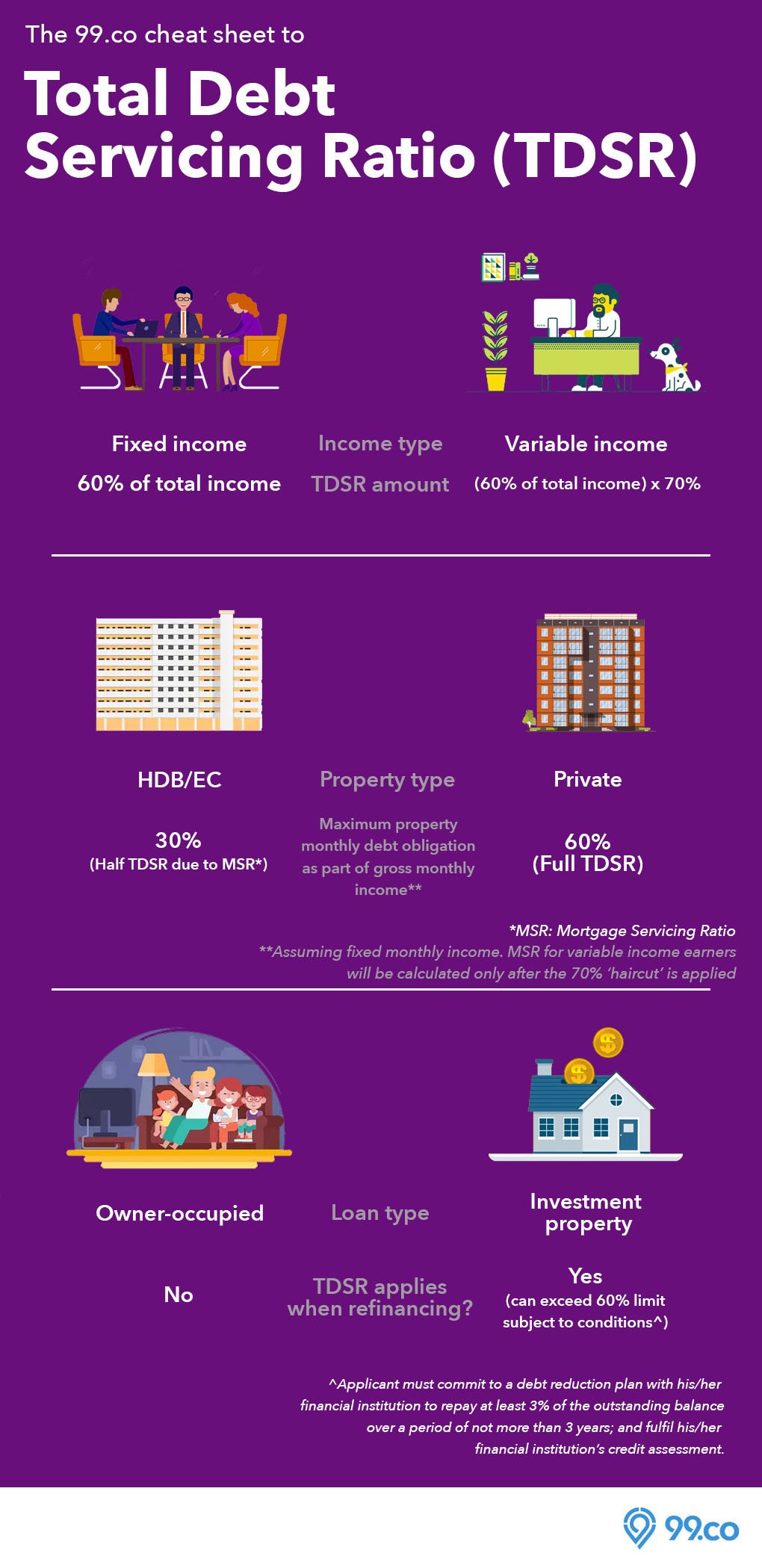

There are many reasons why homeowners refinance. Refinancing is the replacement of an existing debt obligation with another debt obligation under different terms. Equity refers to the value of a property above the outstanding balance of the home loan securing that property. Refinancing is the process of paying off an existing loan by taking a new loan and using the same property as security.

A mortgage refinancing option offered by the united states department of agriculture usda. Usda non streamlined refinancing is available to homeowners who. It might make sense to consolidate multiple other loans into a single loan if you can get a lower interest rate than what you re currently paying. Homeowners may refinance to reduce their mortgage expense if interest rates have dropped to switch from an adjustable to a fixed rate loan if rates are rising or to draw on the equity that has built up during a period of rising home prices.

Lenders require new home appraisals for refinance transactions even if the original appraisal is only a few years old.

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-1006671124-fe0a396be99740e699238edc273e4311.jpg)

/loan-to-value-ratio-315629_FINAL_v2-6fd1a550be4f4cd19dd4eea140143f44.png)

:max_bytes(150000):strip_icc()/GettyImages-951640954-90cdbd0100684fdeb234ffc5a31829fc.jpg)