Refinance Mortgage To Buy Second Home

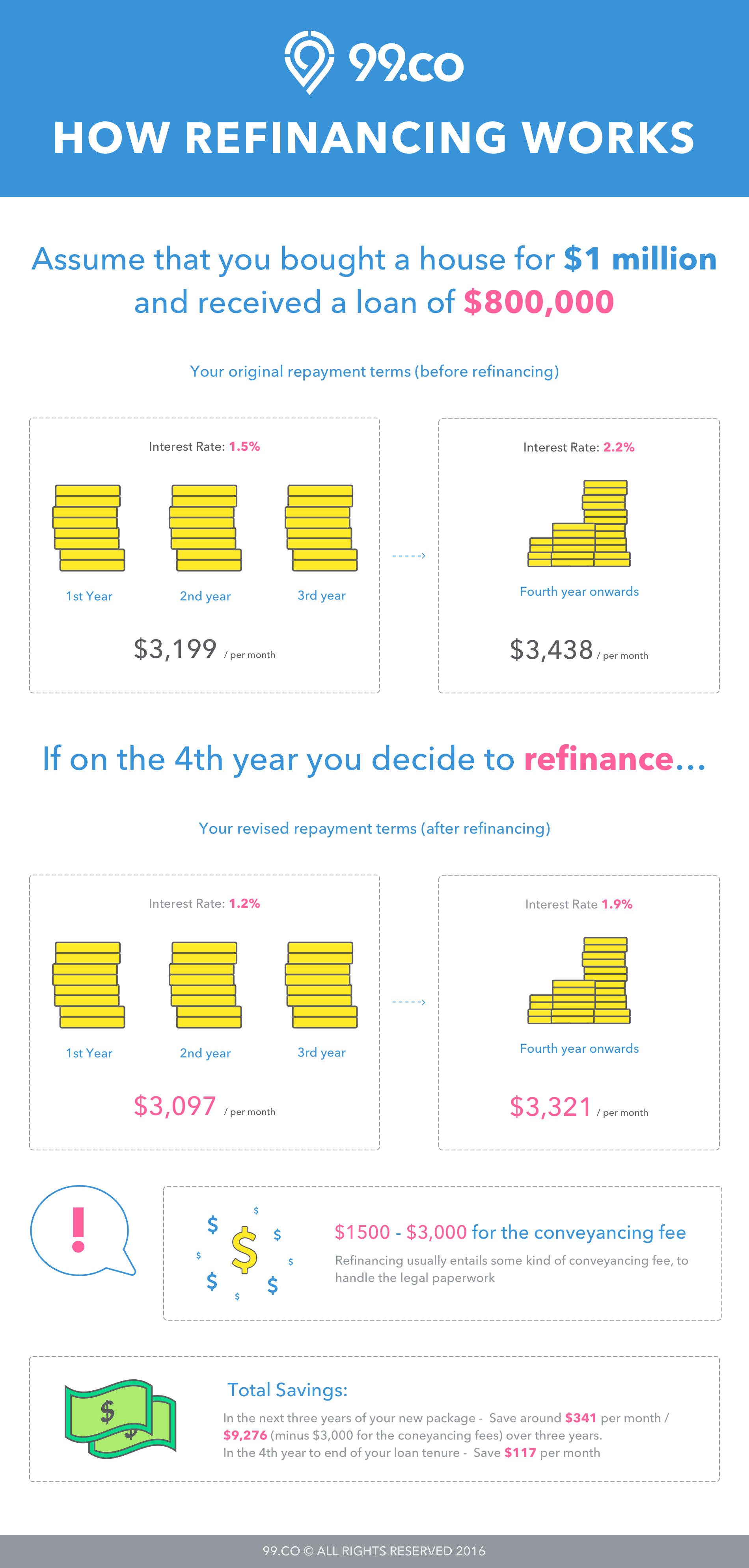

While rates vary it s not unusual for lenders to charge 3 or more of the total mortgage as the refinance fee on a 100 000 loan that s 3 000.

Refinance mortgage to buy second home. And in some states more than 20 000. There s nothing wrong with refinancing one mortgage at the same time that you are buying an investment property or second home with a mortgage according to andrew weinberg principal and licensed. Some costs are much the same as your first purchase. Steps to refinancing a second mortgage.

The average homeowner gained about 5 300 in equity in 2019. Determine if refinancing the second mortgage is right for you. Homeowners can profit from that. These usually carry fixed rates and are paid back in full by the end of the loan term although interest only home equity loans and balloon payments do exist.

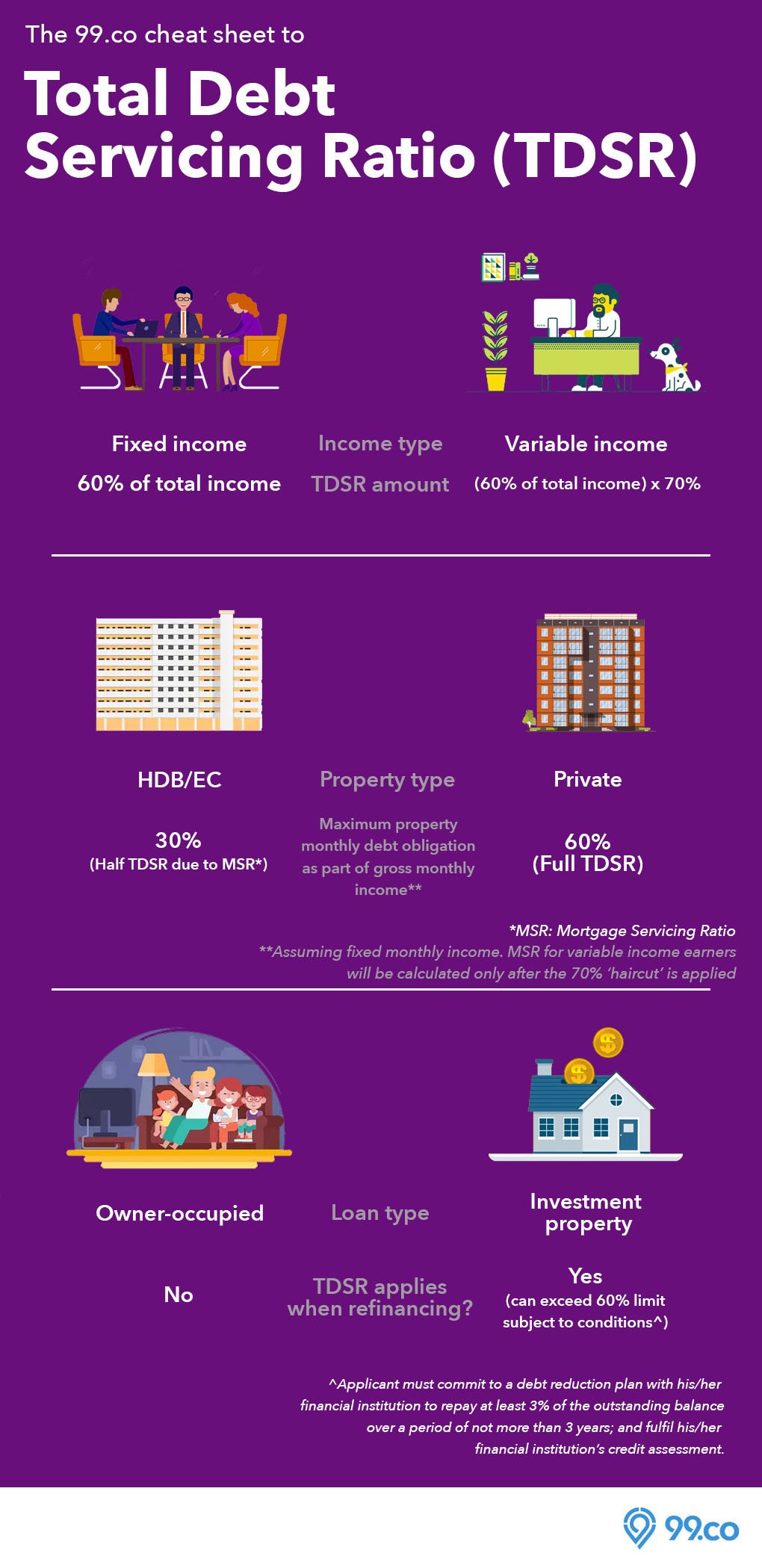

Learn more about. If a buyer s deposit is less than 20 of the purchase price or value of the property whichever is lower the mortgage must be insured against payment default by a mortgage insurer such as cmhc. If you have a vacation home or investment property with an older expensive mortgage consider a refinance so you can take advantage of still historically low mortgage rates. Second mortgage home equity loan also referred to as a fixed rate home equity loan second mortgages are lump sum payments that have set terms for repayment.

Recent low rates and reasonable home prices have prompted record second home sales. Valuation fees legal fees and a title search. Your home s equity or the difference between the outstanding loan balance and the appraised value of the property is an asset and you can make use of. The canadian home buyers plan for using rrsp s is not eligible on a second property.

Cash out refinance your current home to buy a second home. Low rates easier terms for second home refinances. Unless you buy the vacation home outright you will need enough money to cover the mortgages on two homes. Interest rates for a second home can be a bit higher than those for primary home purchases.

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)