Refinance My Private Student Loans

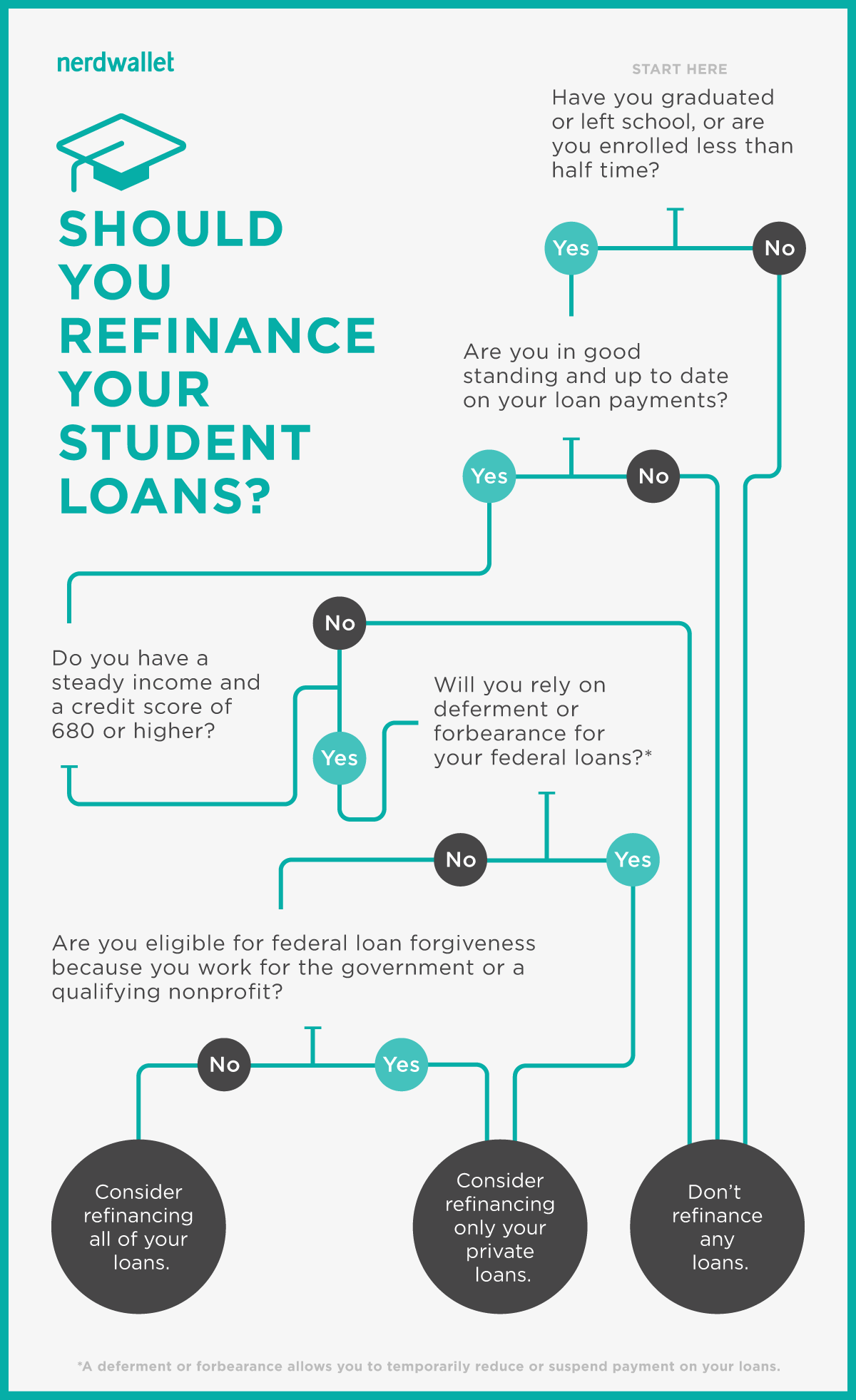

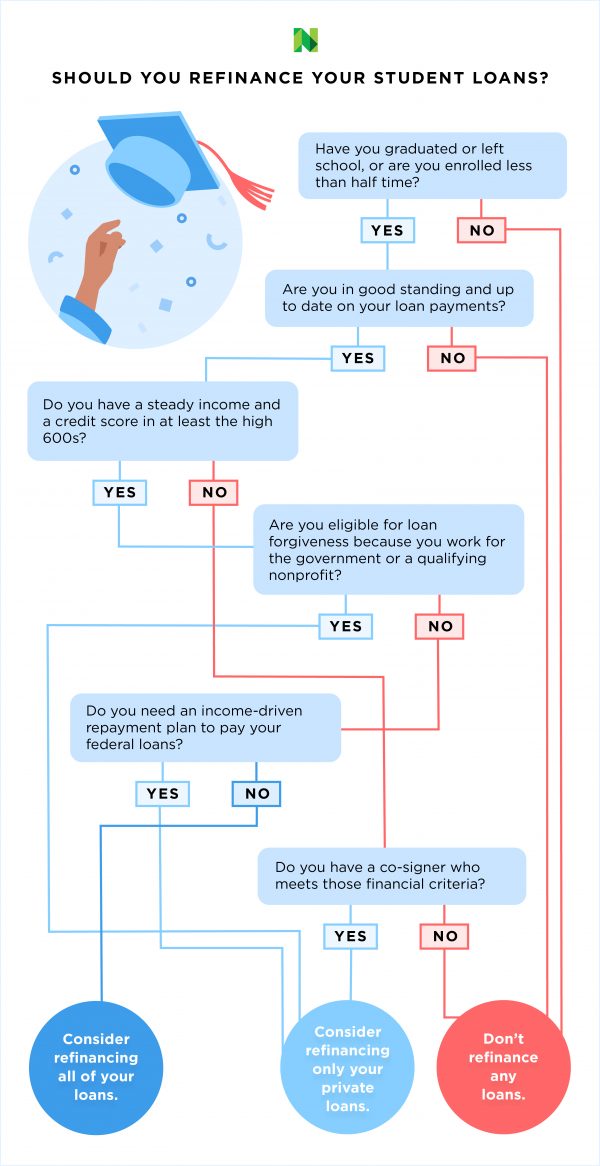

Refinancing your student loans can save you thousands or lower your monthly payment.

Refinance my private student loans. When you want a lower interest rate. When you refinance student loans you take out a new loan from a private lender to pay off one or more of your old loans. For example let s say you. Splash financial is a student loan refinance lender operating in all 50 states.

Refinancing is available for federal private and parent plus loans including undergraduate graduate mba law. You could lower your monthly payments or consolidate multiple loans into one simple low interest monthly payment. Should i refinance my private student loan into one with a lower rate. This could result in a lower interest rate and or a lower monthly payment.

A private consolidation loan is a private student loan that combines and refinances multiple education loans into one new loan with a new interest rate repayment term and monthly payment amount. The best reason to refinance private student loans is to save money. Many people who refinance their student debt repay their student loans faster or use the money they save for other big purchases. A longer repayment term may help you reduce your monthly payments but will result in an increase in the total amount you will need to repay.

Here s how it works. Sofi refinance loans are private loans and do not have the same repayment options that the federal loan program offers such as income based repayment or income contingent repayment or paye. Lowering your interest rate can decrease your monthly payments the amount you repay overall or both. Student loan refinancing saves borrowers money by replacing existing education debt with a new lower cost loan.

A new private company typically a bank credit union or online lender pays off the student loans you. Refinance your student loans with today s low interest rates. Student loan refinancing can mean big savings in the right circumstances. You can also choose new repayment terms to pay off your debt faster or lower your monthly bills.

When borrowers first take out private student loans many have a limited credit profile and are treated as higher credit risks by lenders. Licensed by the department of business oversight under the california financing law license no.

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)