Refinance Student Loan

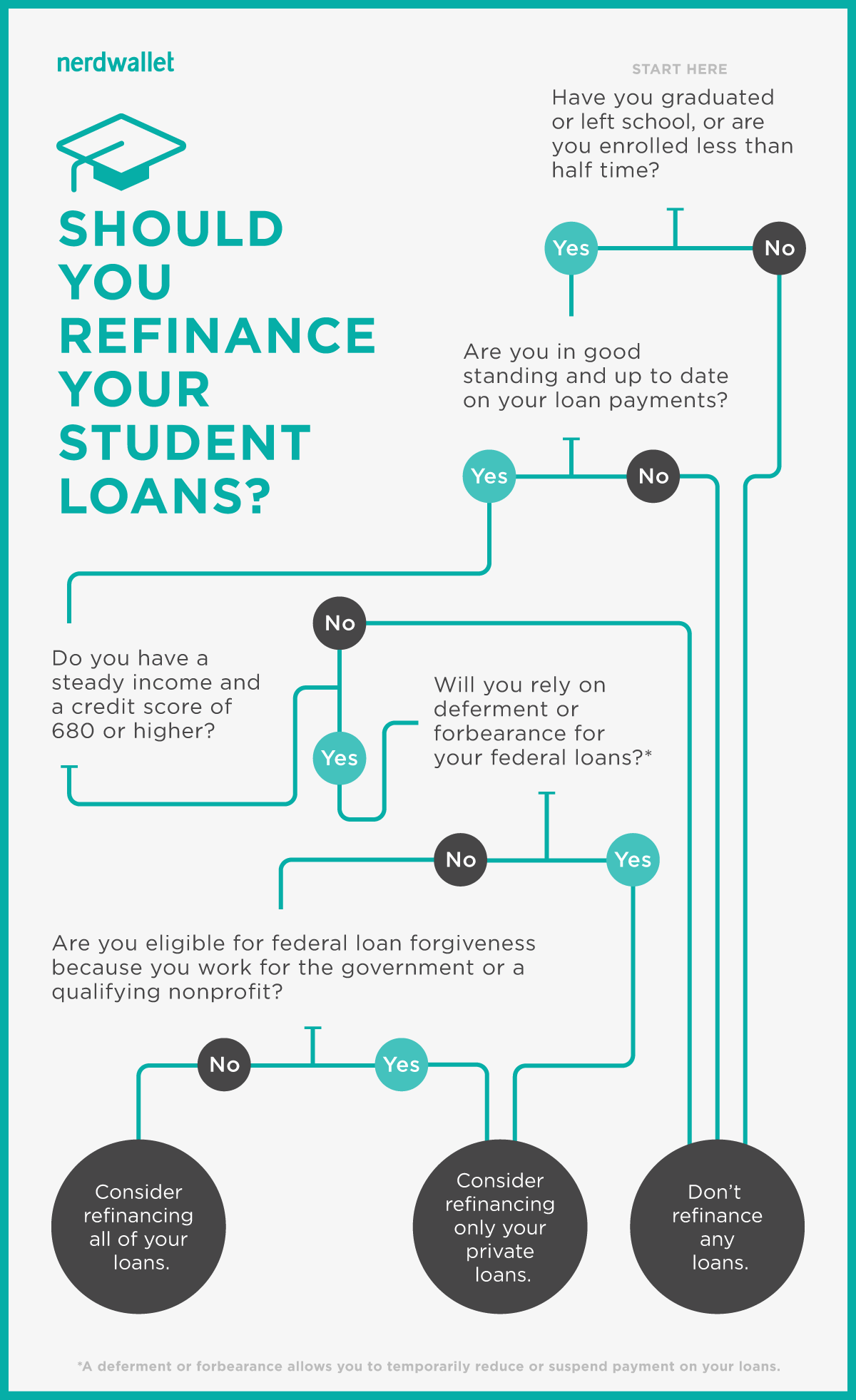

Student loan refinancing can mean big savings in the right circumstances.

Refinance student loan. Refinancing a student loan in order to score a better interest rate requires taking out a new loan with a private lender and losing federal benefits in the process. Refinancing is available for federal private and parent plus loans including undergraduate graduate mba law dental and medical loans. For starters student loan consolidation which is included in the student loan refinance process simplifies the management of your monthly payments into a single loan. A specialized refinance program is offered for doctors completing their residency or fellowship.

If you feel bogged down by your student loan debt and finances are tight there are several factors that might motivate you to refinance student loans. If you qualify you could snag a lower interest rate on this new loan. Student loan refinancing allows you to consolidate both your private and federal loans including parent plus loans select a repayment term that makes sense for you and often get a lower interest rate. Here s how it works.

You can also choose new repayment terms to pay off your debt faster or lower your monthly bills. Credit scores at least in the. Splash financial is a student loan refinance lender operating in all 50 states. For one student loan refinancing is a form of debt relief and can help ease the burden of your debt load and provide solutions to several issues that make it difficult to pay off your loans.

Student loan refinancing allows qualified borrowers to adjust the interest rate and repayment terms on their private and federal student loans by taking out a new loan that pays off some or all of their existing education debt. You can refinance student loans through many private lenders. When you refinance student loans you take out a new loan from a private lender to pay off one or more of your old loans. A new private company typically a bank credit union or online lender pays off the student.