Refinance Student Loans Without Cosigner

Here s the process to follow when you re refinancing student loans with a cosigner.

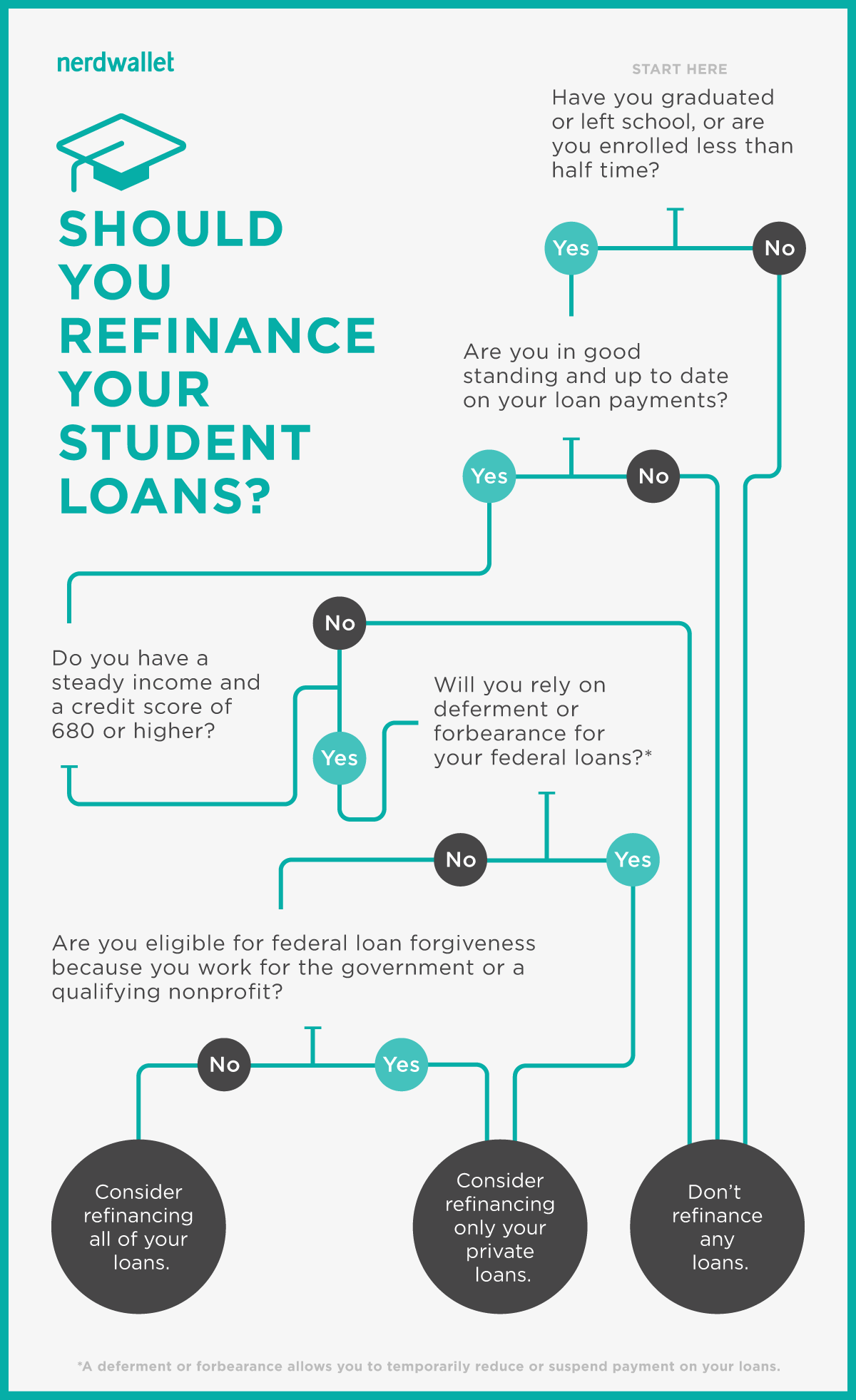

Refinance student loans without cosigner. Compare the best student loan refinance rates. How to refinance student loans with a cosigner. Your refinanced loan may have a longer or shorter repayment period than your previous loans a different monthly payment a different interest rate and either a variable interest rate or fixed interest rate. Laurel road is a division of darien rowayton bank that provides low rate student loan refinancing personal lending and mortgages.

Private student loans without a cosigner exist. The process of adding a cosigner to a loan is similar to applying for a loan with a few added steps. If you ve exhausted your federal aid and need to turn to a private loan a few lenders do offer funding to students without co signers. You can receive federal student loans without a co signer.

After all student loan refinancing typically offers borrowers reduced interest rates and the ability to remove cosigners from old loans. There is currently no refinancing program through the government though you can refinance federal student loans with a private lender as well as private loans. A private consolidation loan is a private student loan that combines and refinances multiple education loans into one new loan with a new interest rate repayment term and monthly payment amount. Ascent is a student loan lender offering multiple types of loans with a 1 cash back reward at graduation.

The ascent non cosigned future income based loan is available to juniors and seniors without a cosigner. Get a cosigner on board to refinance. But don t give up hope as the cosigner on a student loan try the following strategies. The truth is that it s possible you ll need this new cosigner or another assist from your original one to unlock the lowest of low rates.

Find a lender that allows cosigners on student loan refinancing 2. As a college student you re unlikely to meet the lenders income or credit requirements and adding a cosigner improves your chances of getting a loan and qualifying for a low interest rate. This could result in a lower interest rate and or a lower monthly payment. There are certain things you should look for to figure out when you can proceed without needing a third party.

Luckily there are ways to refinance your student loans without a co signer.

/earnest-inv-3887797747394897b9f7f51ae5b24814.png)