Reputational Risk Management

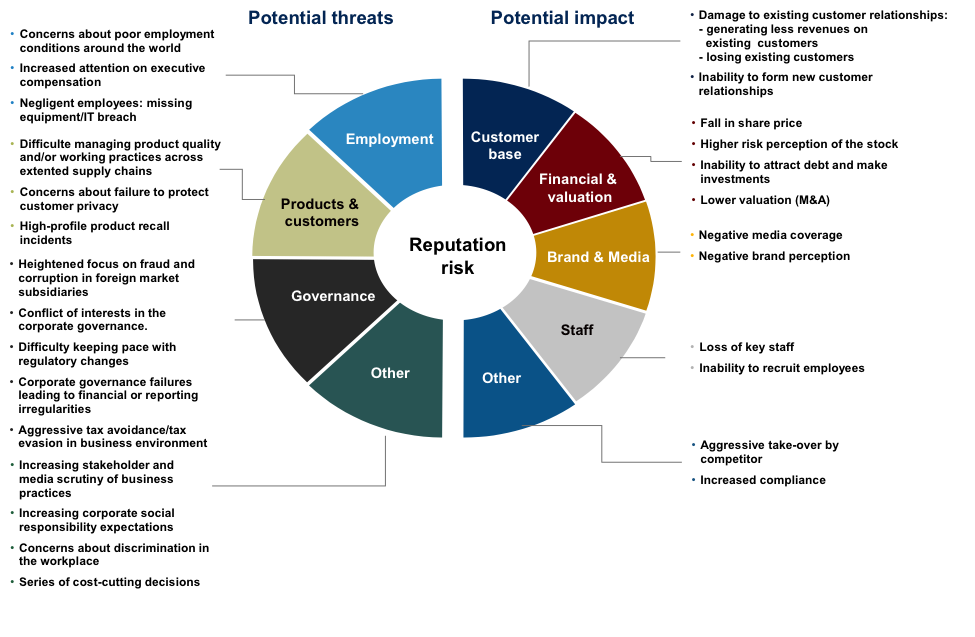

Reputational risk is a hidden threat or danger to the good name or standing of a business or entity and can occur through a variety of ways.

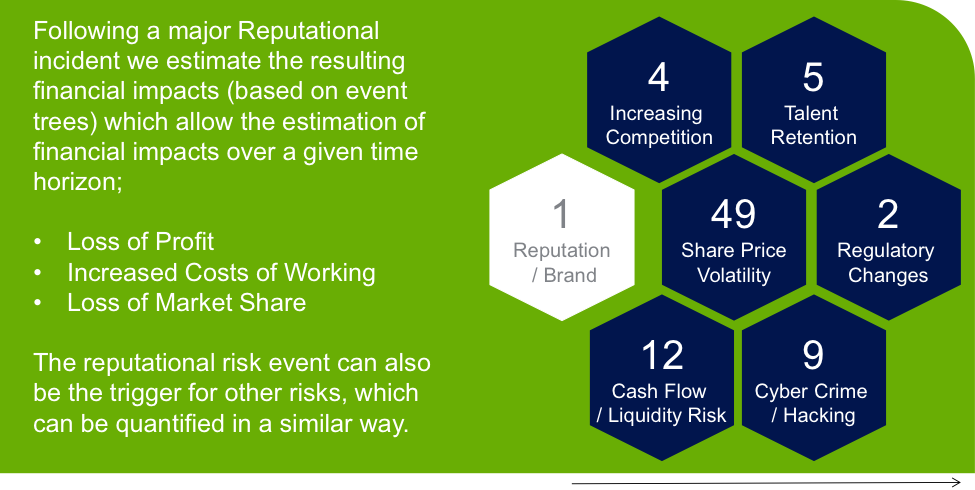

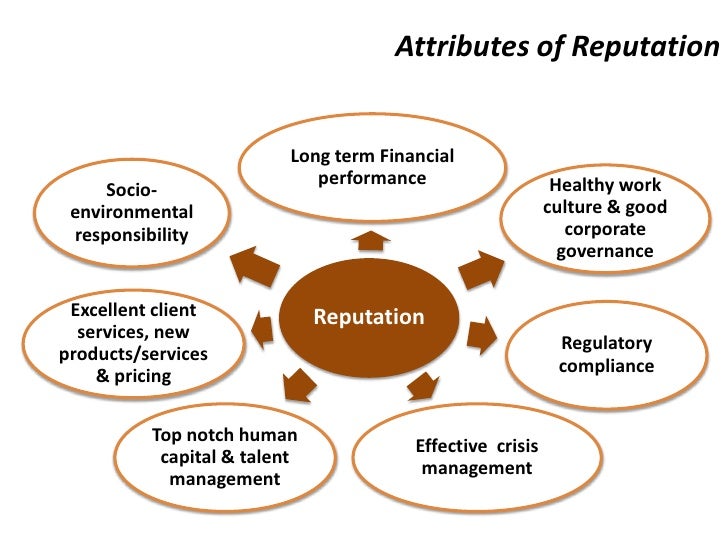

Reputational risk management. Reputational risk often called reputation risk is the potential loss to financial capital social capital and or market share resulting from damage to a firm s reputation. What is bank reputation risk management. This is often measured in lost revenue increased operating capital or regulatory costs or destruction of shareholder value. Bank reputational risk is the risk of loss of reputation.

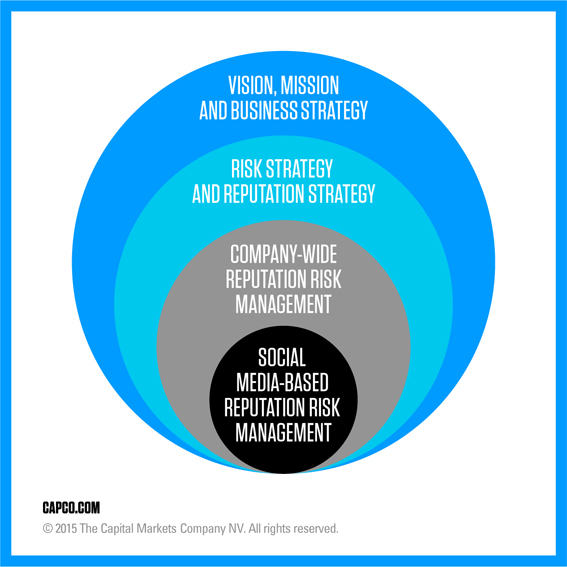

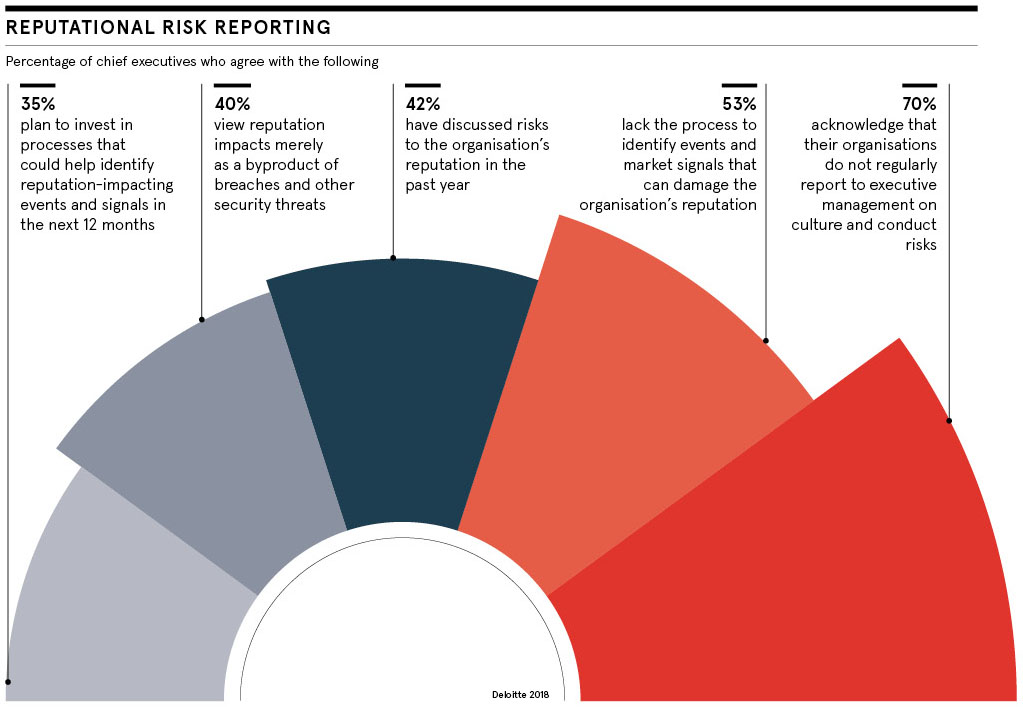

Responsibility for reputation risk resides with the highest levels of the organization board and c how. Unfortunately reputational risk is often neglected or confused with other types of corporate risk. Our team will help develop manage and maintain a tailored reputational risk and crisis management program specific to your needs and circumstances. This leads us to the question.

The group chief risk officer group cro is the risk steward for reputational risk. This view has been gradually changing because it is increasingly clear that reputation is critical to the viability of a company. The group reputational risk committee chaired by the group cro is the formal governance committee established to provide recommendations and advice to the group s senior management on reputational risk and customer selection matters that either present a serious potential reputational risk to hsbc or merit. Let s start by defining what reputation or reputational risk is.

Unlike other risks that banks have to manage credit market operational liquidity etc. Reputational risk is consequential of an adverse or potentially criminal event even if the. Let s look at how they all relate to one another. A reputation risk that is not properly managed can quickly escalate into a major strategic crisis.

Enterprise risk management is the process of minimizing the costs and damage of strategic risk. Risk management in practice the conceptual framework of reputation risk management can help a risk professional quickly analyze gaps in enterprise level controls conceptualize an ideal state and implement a roadmap to reduce reputation risk. Reputational risk at deutsche bank is defined as the risk of possible damage to deutsche bank s brand and reputation and the associated risk to earnings capital or liquidity arising from any association action or inaction which could be perceived by stakeholders to be inappropriate unethical or inconsistent with the bank s values and beliefs. Risk management and strategic risk.

Reputational risk has traditionally been seen as an outcome of other risks and not necessarily a standalone risk. Those vital to the success of the business employees customers partners lenders regulators communities and so on. What reputation risk is a top strategic business risk being a key business challenge. Reputational risk is intangible and hard to measure.