Retail Business Insurance Cost

Sum insured from s 100 to s 500 per day.

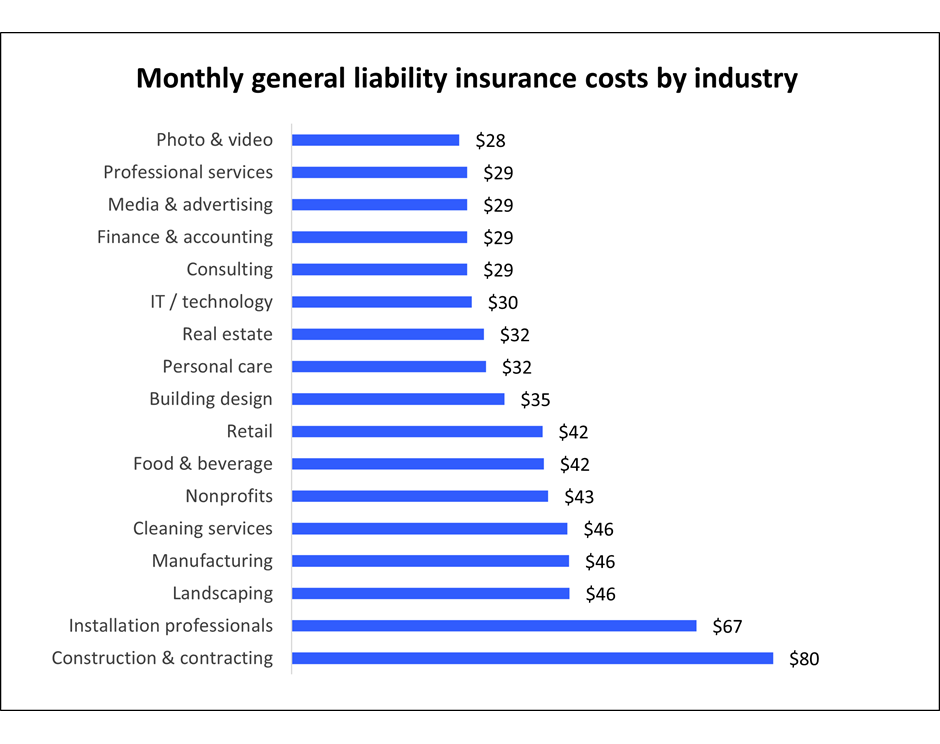

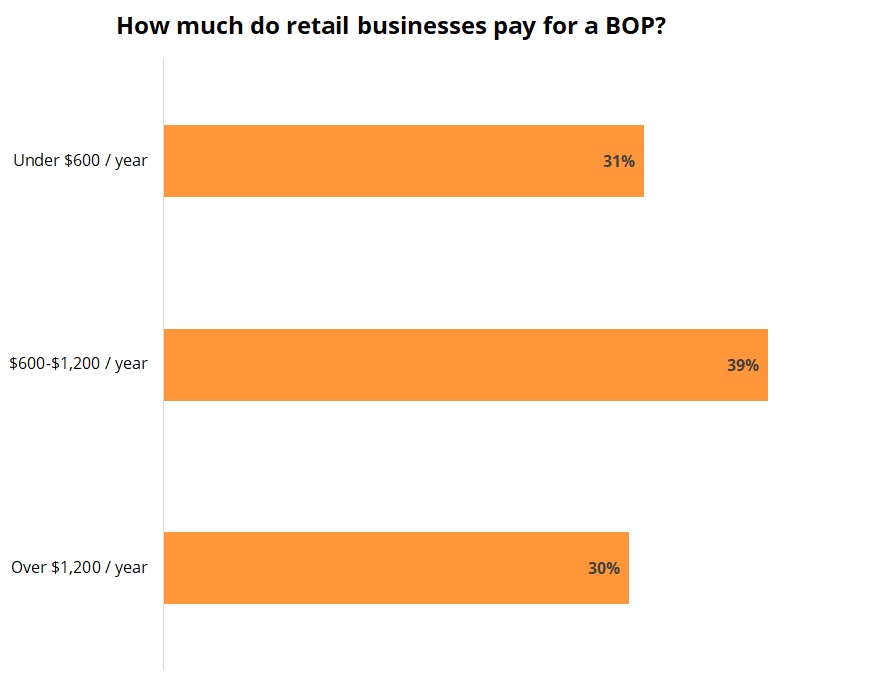

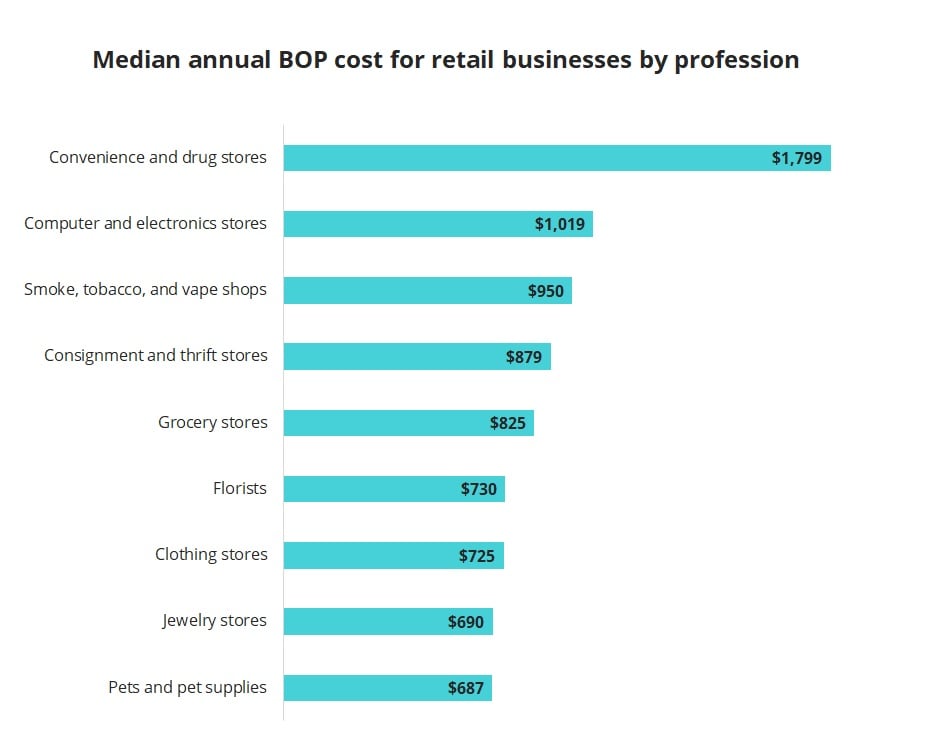

Retail business insurance cost. The annual median cost for a convenience store is 1 800 while the median for a pet shop is about 690 or less than 35 a month. That means you won t have to drain your bank account on an unanticipated expense like legal bills. Starting a retail business isn t cheap. Most small business retailers need at a minimum general liability and commercial property insurance and can expect to pay at least 1 000 2 000 per year in combined premiums.

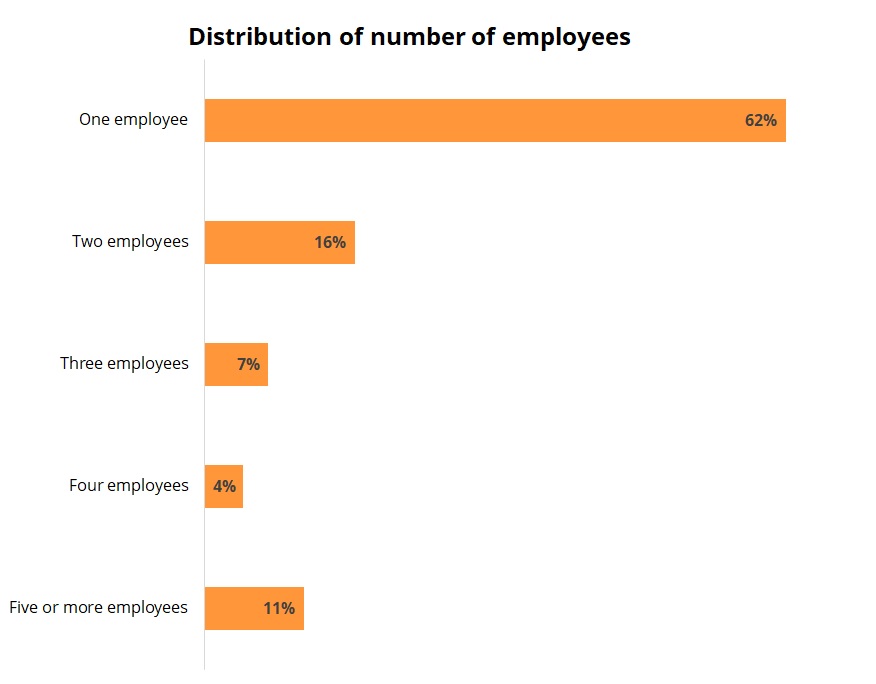

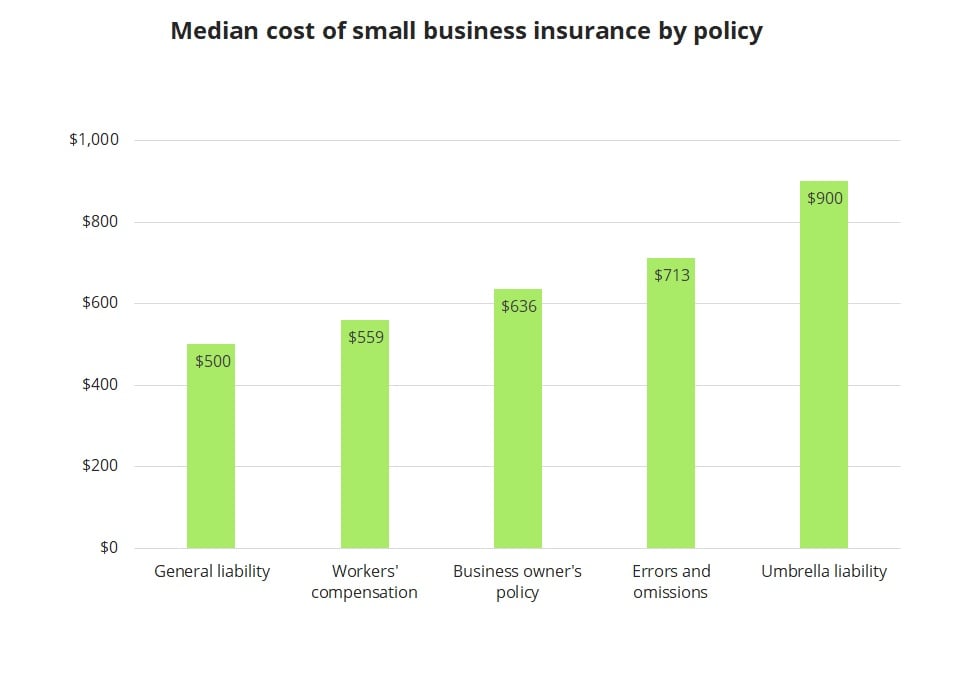

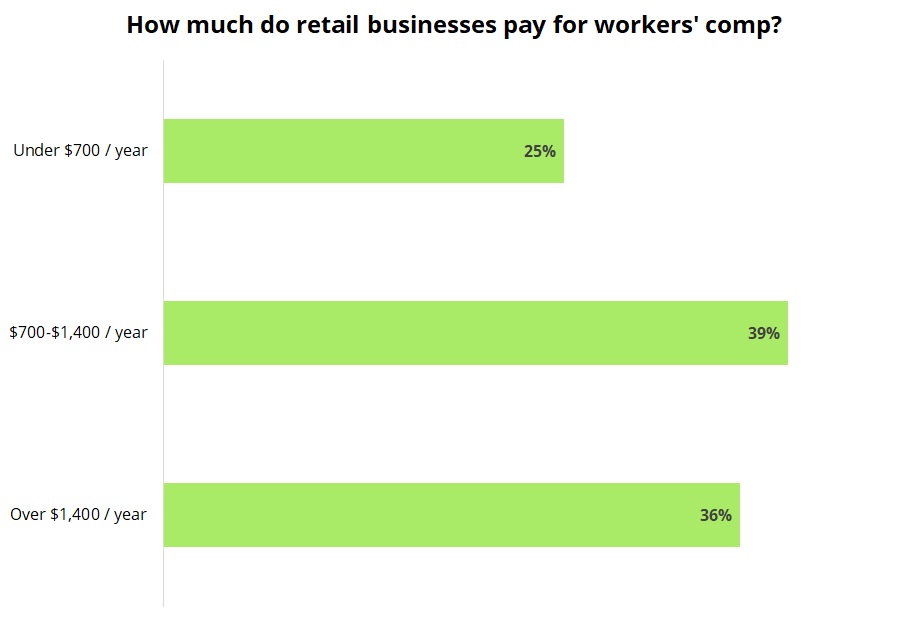

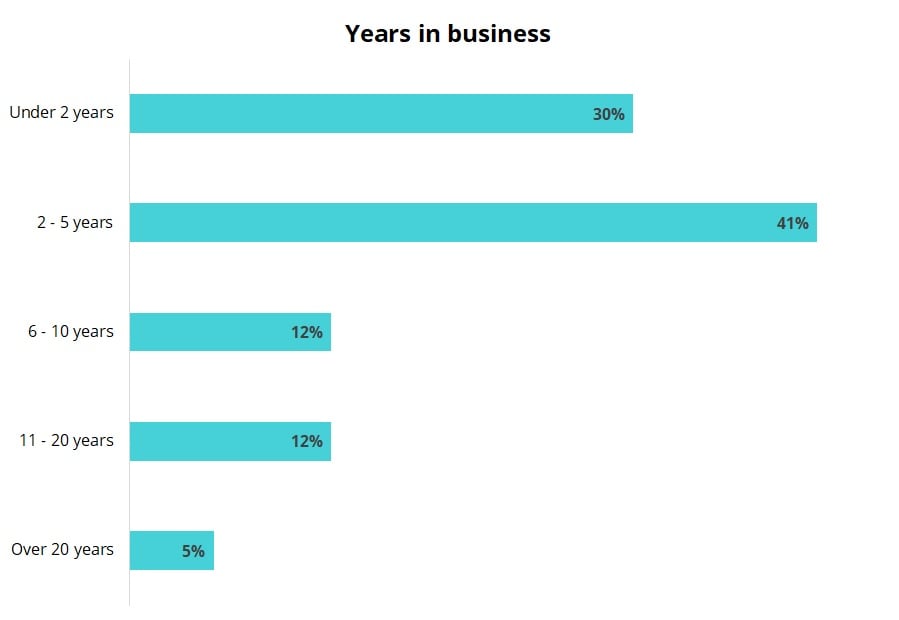

If you employ more workers or generate significantly higher revenue you may pay more than the median indicated. Increased cost of working covers increased costs incurred to avoid or minimise reduction in the business turnover up to 100 days. Many of insureon s customers have fewer than five employees and generate less than 100 000 in annual revenue. The average cost can be as low as 250 to 450 per year for only business liability insurance.

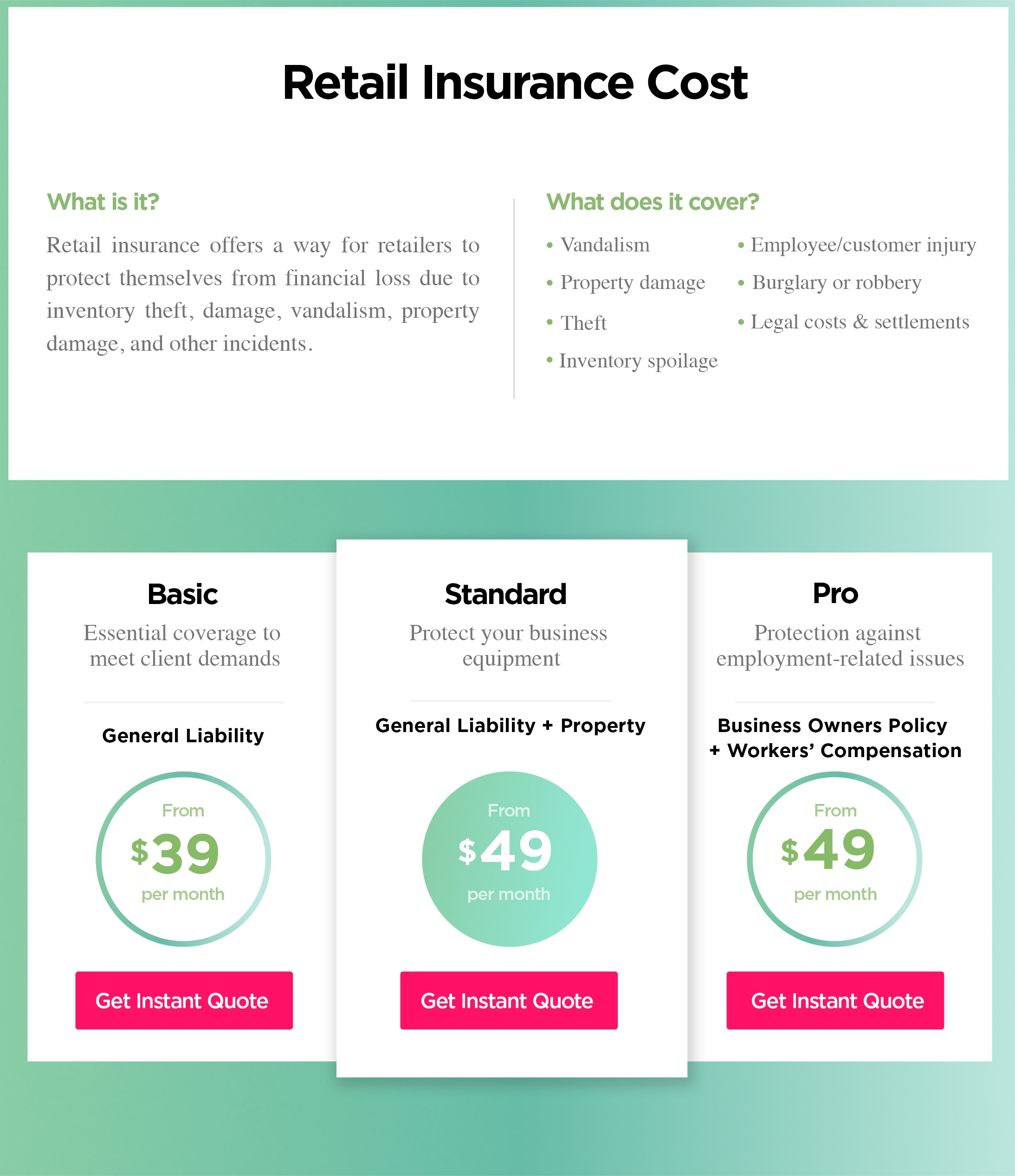

Retail insurance refers to the various insurance policies retail businesses need in order to cover the liability they face in their day to day operations. You can use a comparison tool to compare business insurance quotes. Average cost of retail business insurance. Public liability insurance tends to be at the centre of a retail insurance policy.

Building your retail insurance policy. Moneysupermarket has teamed up with simply business to help you compare personalised business quotes and make sure you re properly covered. Calculating the cost of a public liability insurance policy involves considering a range of factors such as the size of the business the number of employees location and industry. Below is an informative outline of retail business insurance costs for the retail industry across the nation.

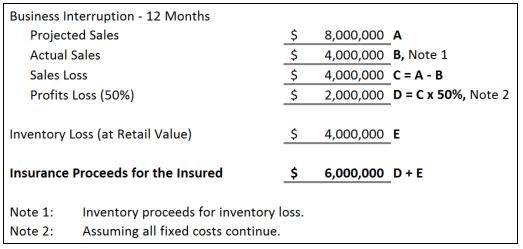

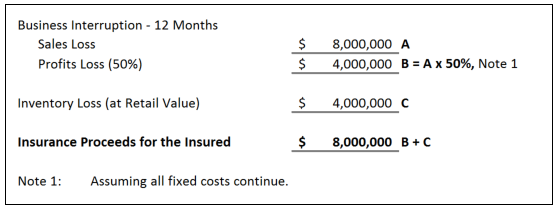

As a guide to help other prospective entrepreneurs understand the startup costs associated with a retail shop. Business interruption gross profit covers loss of profit in the event business is disrupted due to property damage. Retail businesses with large premises such as drug store with two floors typically pay more for a business owner s policy than a small store like a mom and pop pet shop your store s specialty and inventory will also affect your premium. Liability insurance 185 quarterly.

It can step in to pay the costs if a member of the public a customer or a supplier for example is injured or suffers property damage due to your business. Every retail business is different with its own particular exposure to risks making their insurance needs unique. Small business owners can use this data to estimate their cost of insurance. Clothing store insurance can cover costs related to theft lawsuits and injuries.

:max_bytes(150000):strip_icc()/AppleISdec2018OpCosts-5c6edec5c9e77c000151b9d2.jpg)