Return Of Premium Term Life Insurance Quotes

/HavenLife-4ae44d7846af46f4b41c8e6331cbaa9e.png)

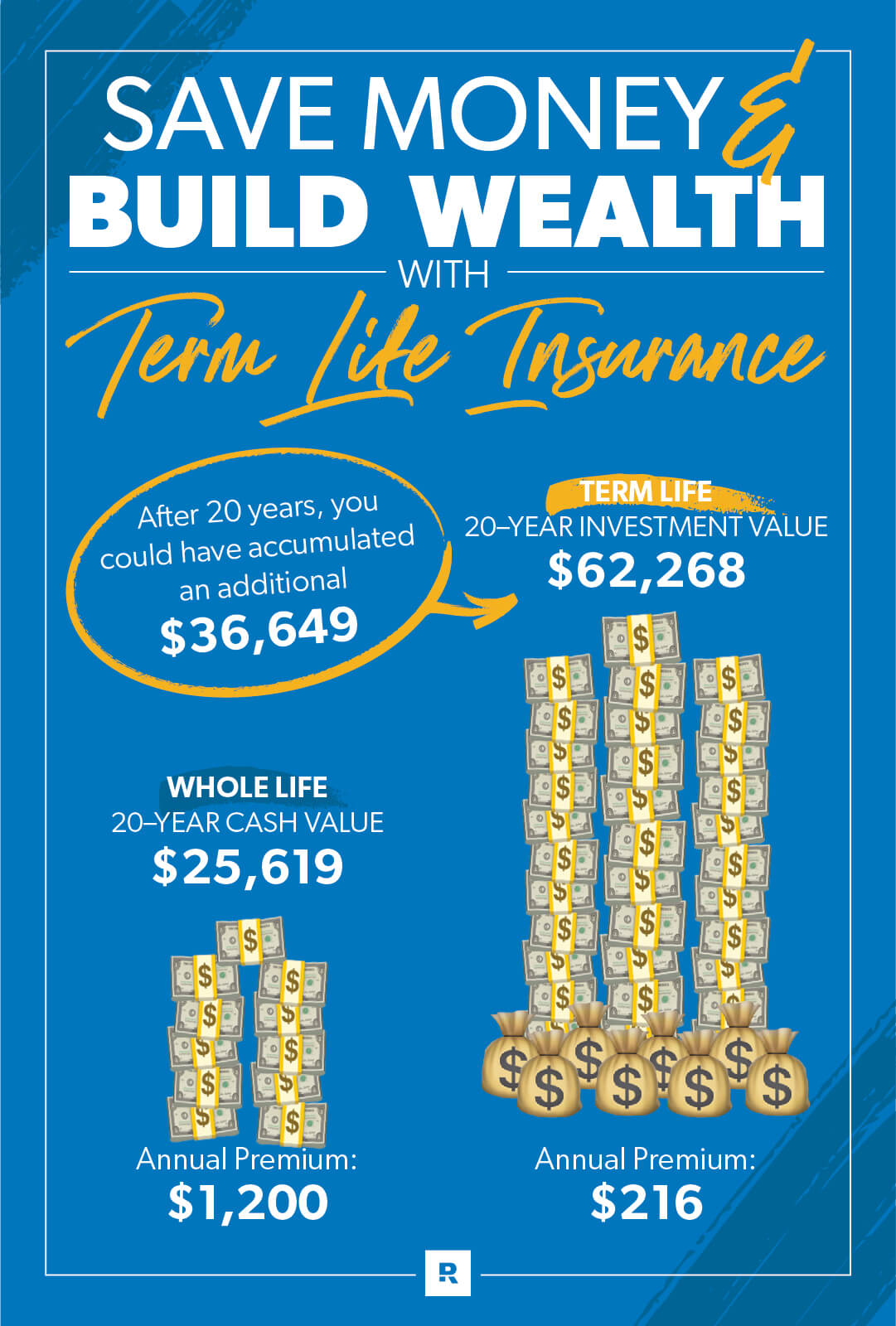

This benefit however doesn t come without a cost these policies are more expensive than traditional term life policies.

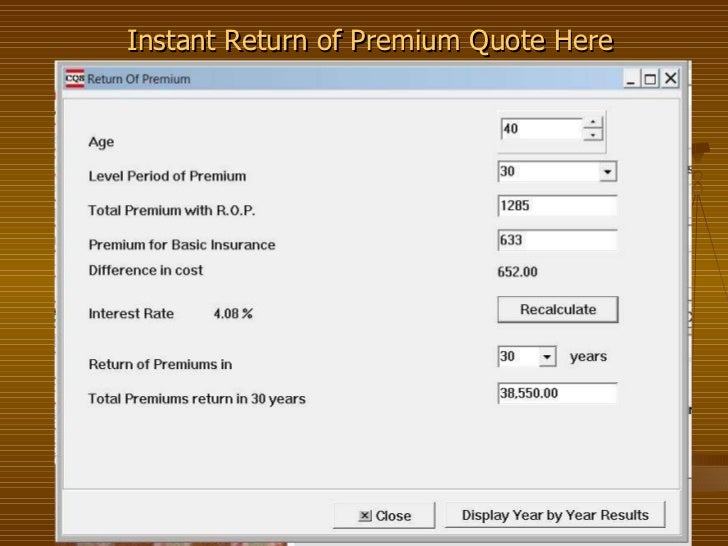

Return of premium term life insurance quotes. Return of premium term life insurance is term life insurance with the added benefit of a return of all premiums paid at the end of the policy term provided you outlive the policy. The policyholder makes monthly or annual payments called premiums to keep the policy in force. Return of premium life insurance return of premium term life insurance offers security with a refundable premium. Start shopping rop term life insurance quotes now to get the best term life insurance policy for you.

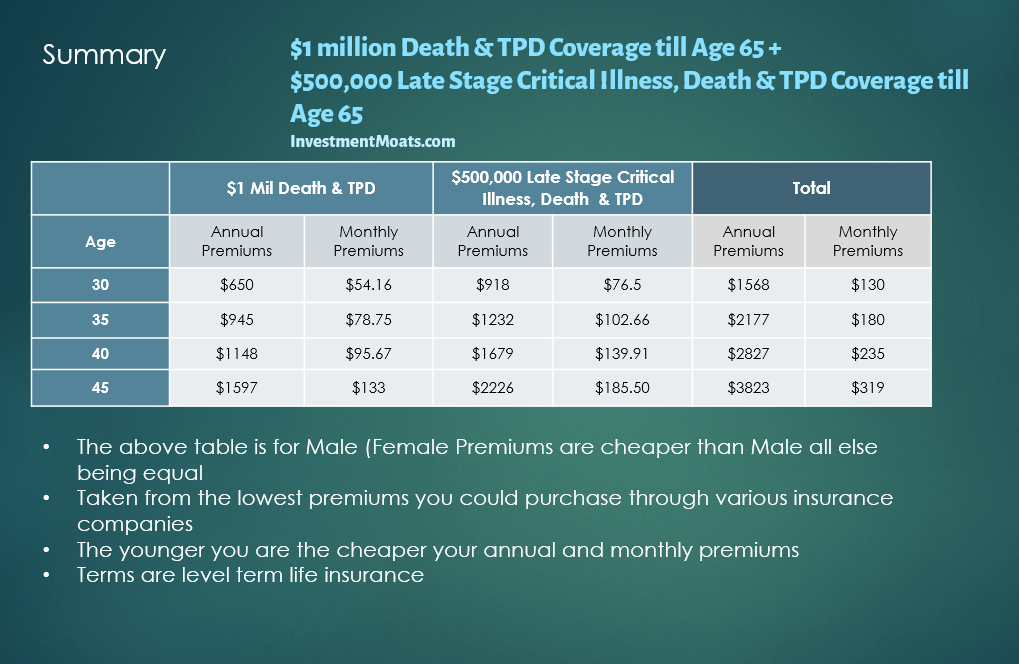

The example below shows the quotes for a 1 million term life insurance policy quote for a 35 year old male who is a healthy non smoker. Return of premium life insurance sometimes referred to as a rider or add on to a standard term life insurance policy is sold for a set term usually 10 20 or 30 years. These figures show both the premium cost of a regular term insurance policy as well as the premium cost of 15 20 and 30 year return of premium policies. Return of premium life insurance can protect you for just 26 50 per month.

How does life insurance with return of premium work. The extra premium you pay for the return of premium rider guarantees the return of all of your premium payments at the end of the life insurance policy s initial term period. Return of premium life insurance is a type of term life insurance policy that offers a full tax free payout of all premiums paid at the end of the policy s level premium term should you still be living at that time. This essentially means that the policy s net cost would be zero should you survive the length of the policy.

A regular term life insurance policy does not offer this. We value your privacy. We may collect personal information from you for business marketing and commercial purposes. As mentioned earlier return of premium is a policy rider attached to a term life insurance policy.

Quick introduction to return of premium life insurance. When the return of premium rider is added to a term life insurance policy it guarantees that 100 of all premium payments paid into the life insurance coverage will be refunded at the end of the policy contract. Pay your premiums on time and keep the term policy and the return of premium rider active. Return of premium term life insurance offers a level premium while protecting your family then returns your premiums if you outlive the term of the policy.

The life insurance return of premium is considered income tax free because you aren t receiving back more than you put into the return of premium life policy. The endowment benefit is paid to the owner at the end of the term period. So if you have a 20 year 100 000 return of.