Revenue Recognition Us Gaap Vs Ifrs

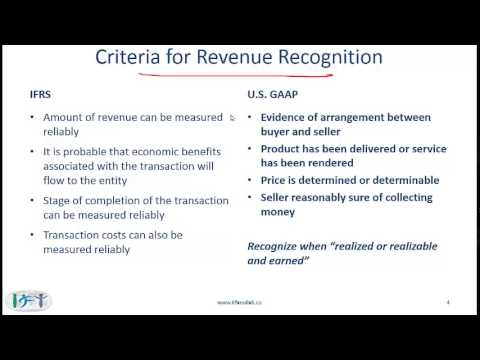

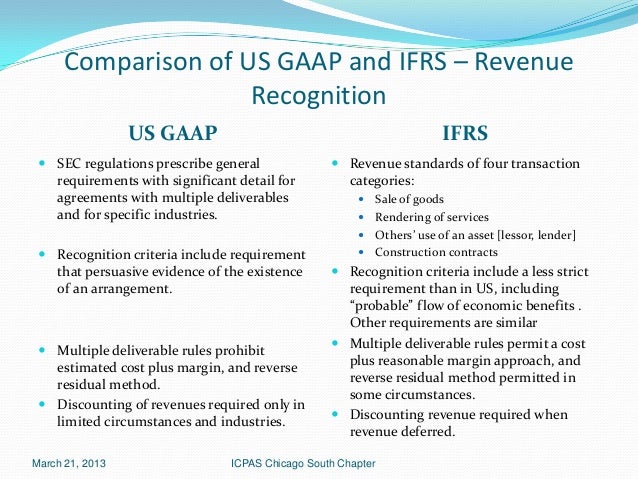

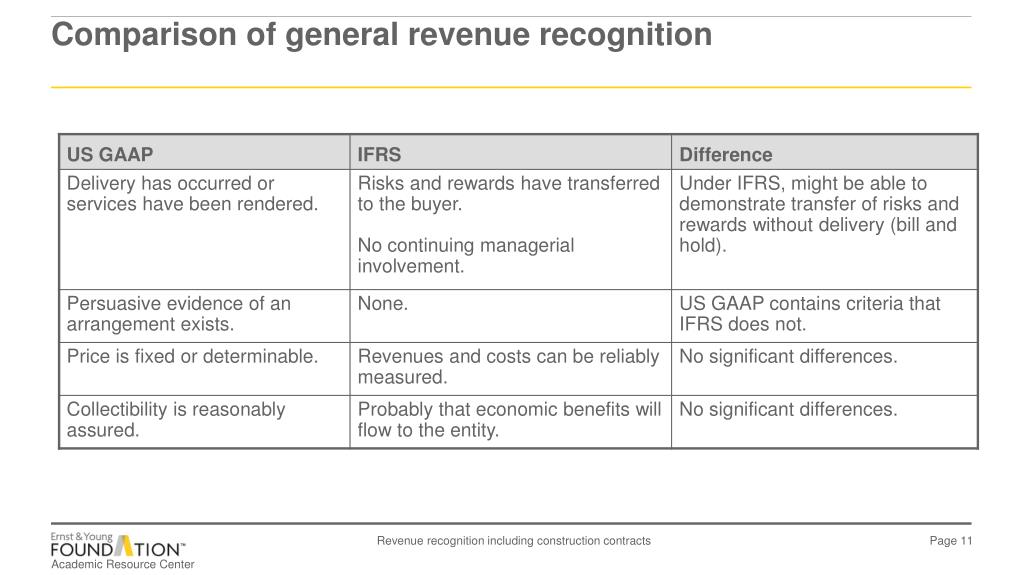

The reason is that the guidance on revenue recognition is significantly more extensive in us gaap than in ifrs.

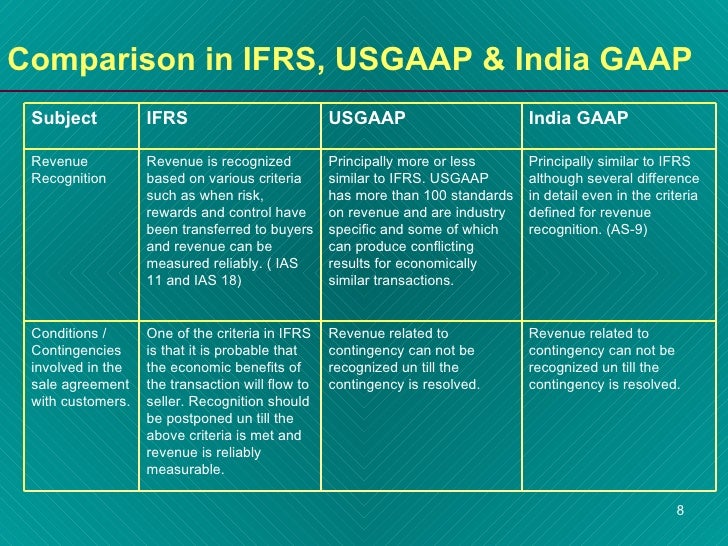

Revenue recognition us gaap vs ifrs. More than 110 countries follow the international financial reporting standards ifrs which encourages uniformity in preparation of financial statements. The ifrs vs us gaap refers to two accounting standards and principles adhered to by countries in the world in relation to financial reporting. The two main systems used in today s economy for revenue recognition are gaap or generally accepted accounting principles and ifrs which stands for international financial reporting standards gaap is a set of accounting principles and rules used in the united states. In the united states financial reporting practices are set forth by the.

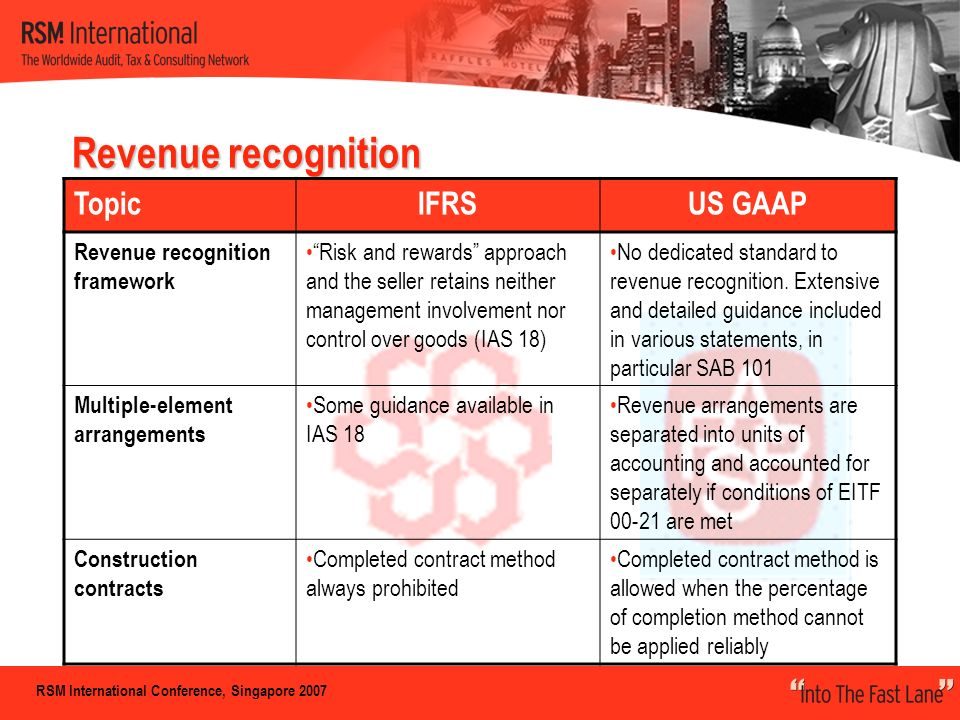

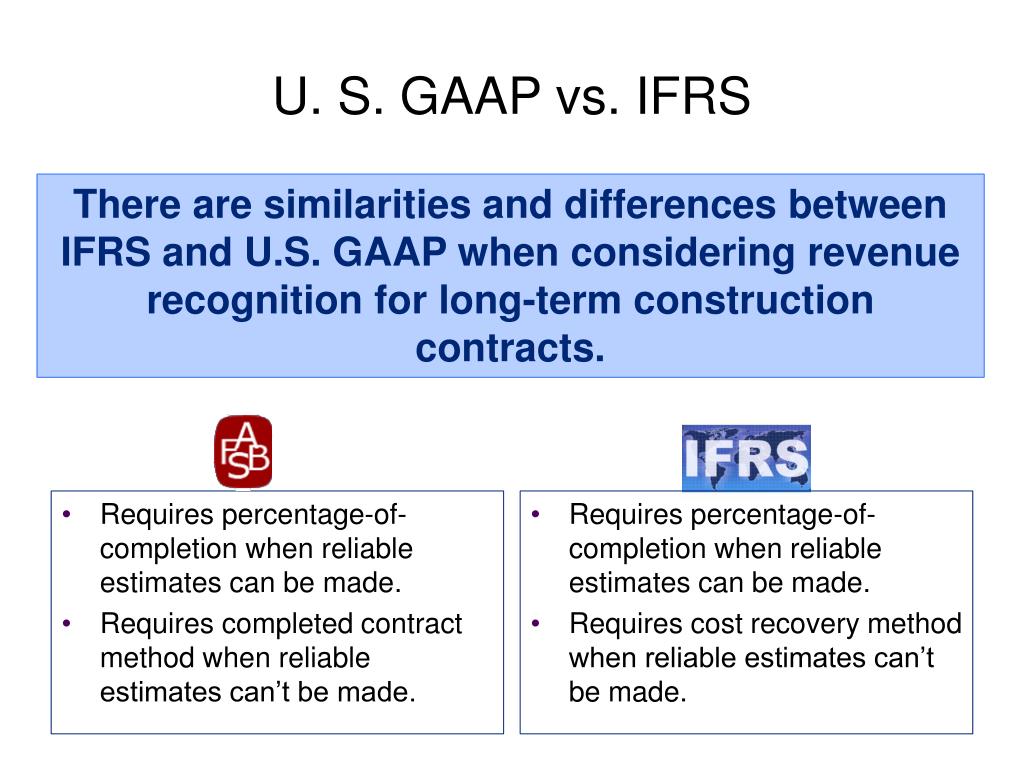

Ifrss deal with revenue recognition in 2 specific standards. The us gaap policy election simplifies the accounting and accelerates recognition of the revenue and costs relating to the shipping and handling activities in comparison to ifrs. In my opinion it is very difficult to simply list all the differences between us gaap and ifrs related to revenue recognition. It also discusses standard setting activities at the fasb and the iasb and has.

This guide was fully updated in october 2019 which included adding a chapter describing the differences related to accounting under the new leases standard. Gaap vs ifrs on revenue recognition in recent years the overall market has tremendously evolved and many companies begin to have stakeholders from around the world. Industry specific rules in terms of revenue recognition the ifrs guidelines are much more general in their requirements than gaap. Similarities and differences guide outlines the major differences between ifrs and us gaap that exist today.

Ifrs revenue recognition is guided by two. However there are many other differences between us gaap and ifrs which will be covered in this article going forward. The ifrs and us gaap. These stakeholders may require the financial information to be prepared under local accounting standards.

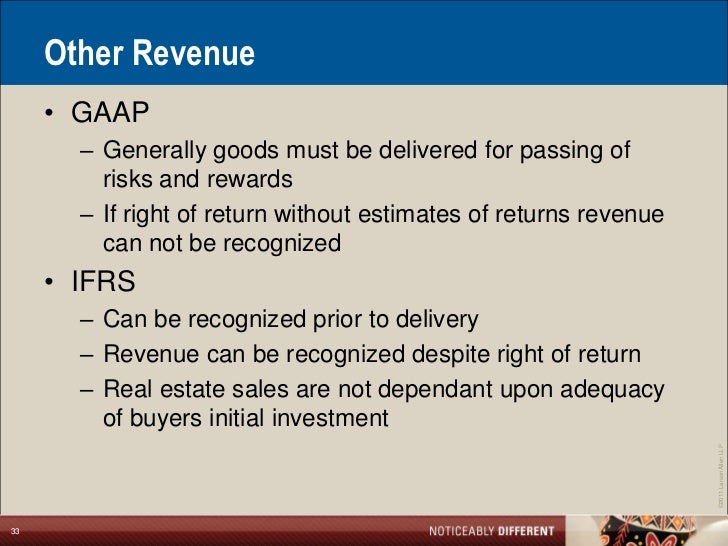

The standards that govern financial reporting and accounting vary from country to country. Measurement date for noncash consideration. Ifrss with respect to revenue recognition the ifrs framework is general in nature in their requirements if compared to the gaap.