Reverse Mergers

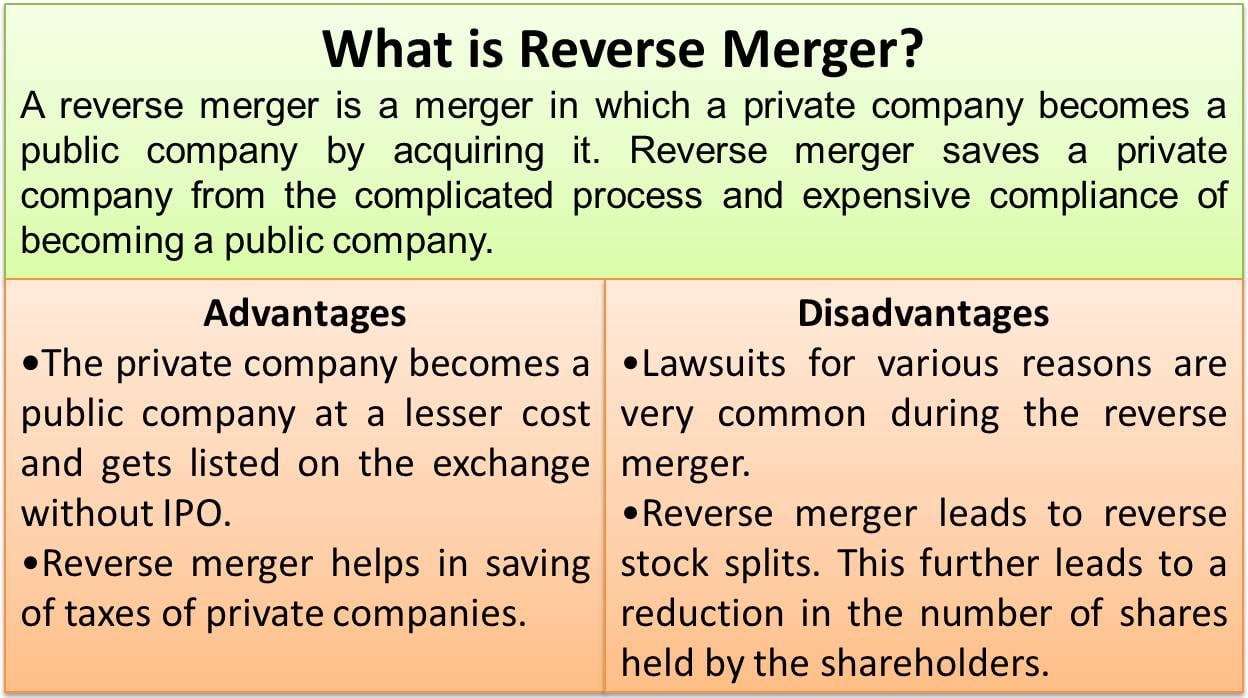

A reverse merger is a merger in which a private company becomes a public company by acquiring it.

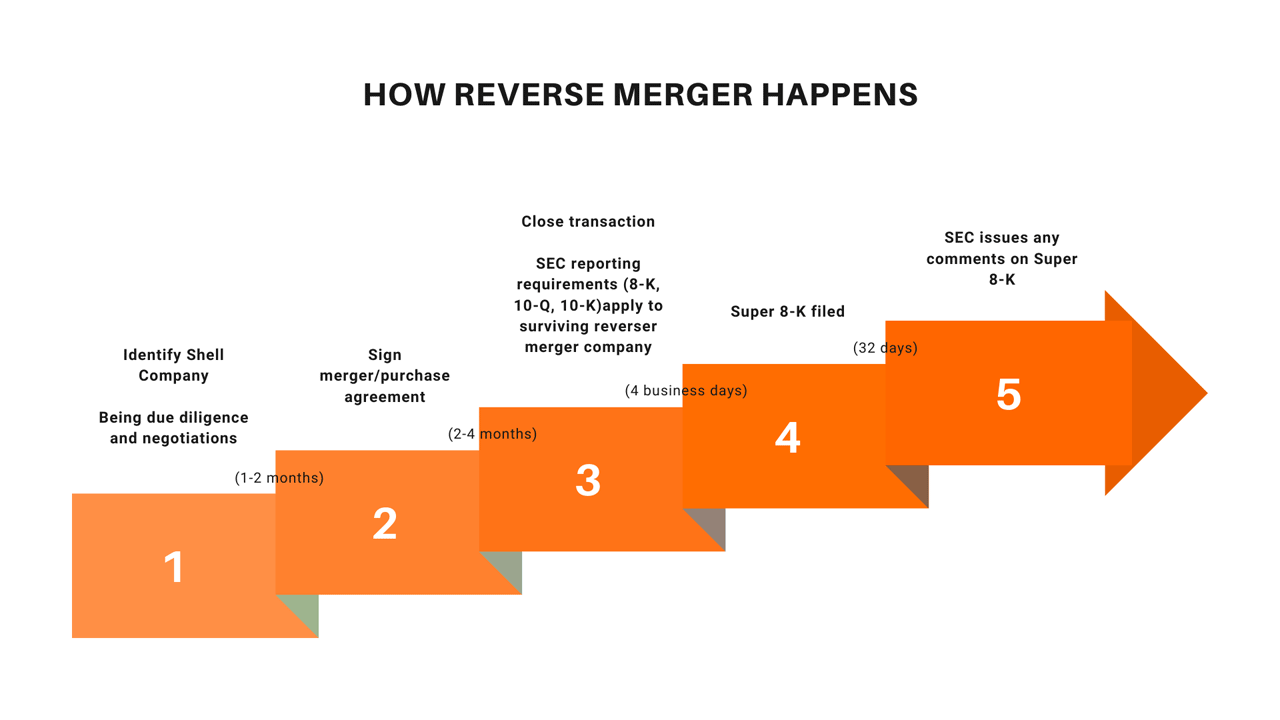

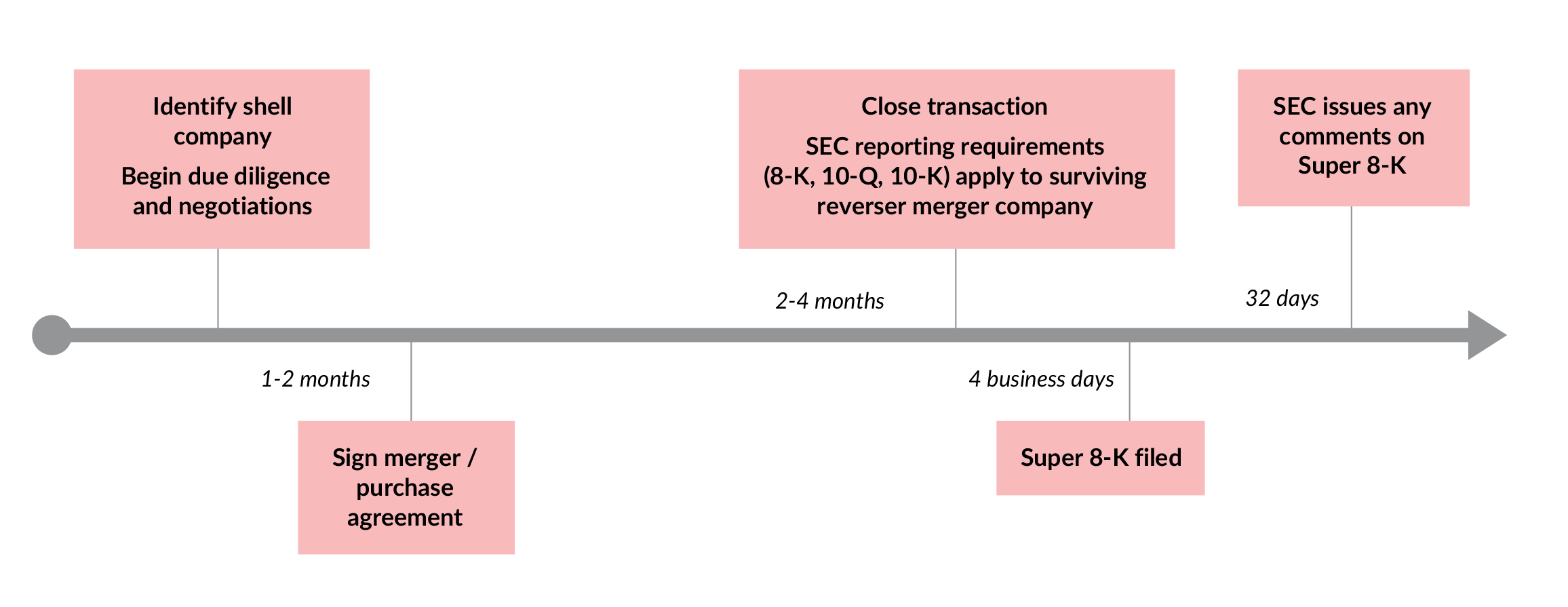

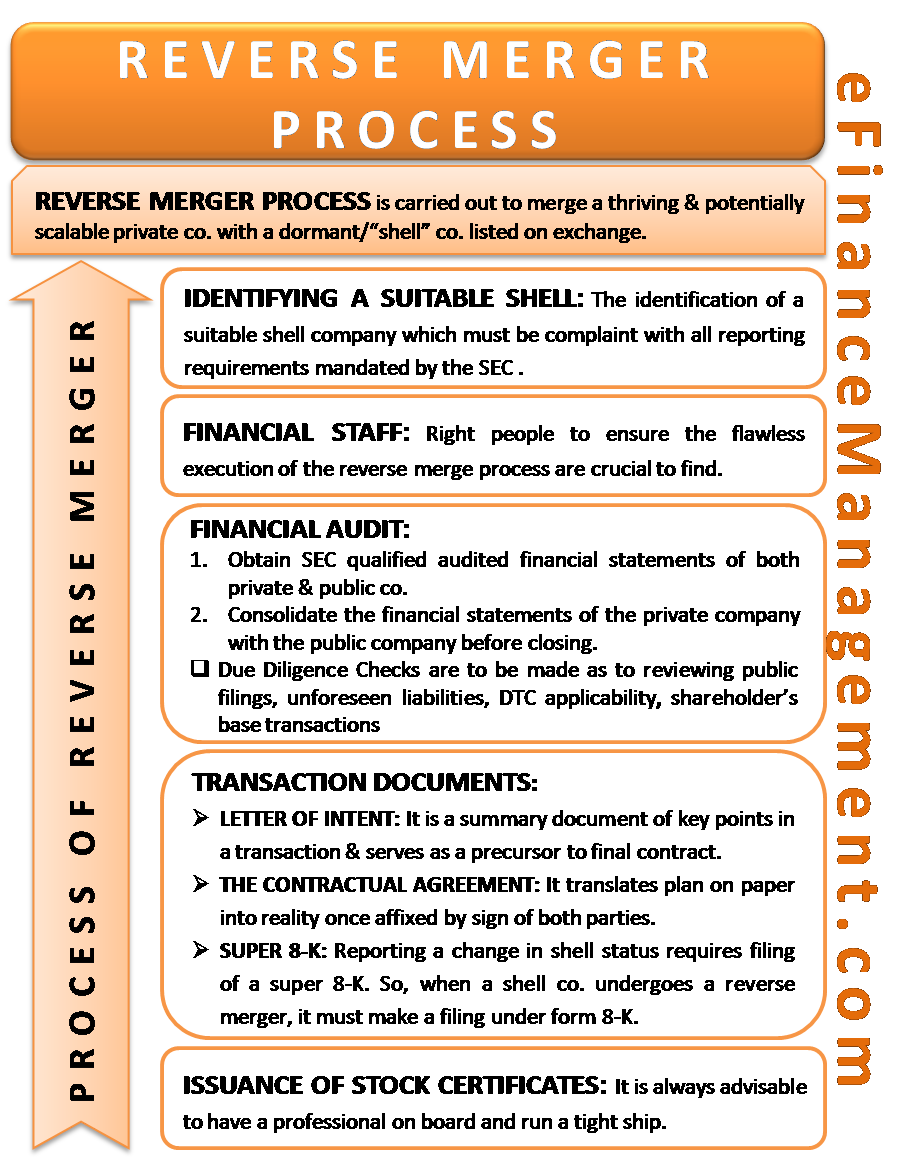

Reverse mergers. In some cases the public company is a shell company owned by the investors in the private firm. With a reverse merger a private company is merging with an existing smaller company that s already listed on an exchange. Acquires a private oper ating company usually one that is seeking access to funding in the u s. Sometimes conversely the public company is bought by the private company through an asset swap and share issue.

Reverse merger refers to a type of merger in which private companies acquire a public company by exchanging the majority of its shares with a public company thereby effectively becoming a subsidiary of a publicly traded company. Reverse mergers are also commonly referred to as reverse takeovers or reverse initial public offerings ipos. A reverse merger also sometimes called a reverse takeover or a reverse ipo is often the most expedient and cost efficient way for a private company that holds shares that are not available to the. It is also known as reverse ipo or reverse take over rto forms of the reverse merger.

Instead it acquires a public company as an investment and converts itself into a public company. A reverse merger allows a private firm to go public much faster and with lower legal and accounting fees. In a reverse merger transaction an existing public shell company which is a public reporting company with few or no operations 1. A reverse takeover rto reverse merger or reverse ipo is the acquisition of a private company by an existing public company often a spac so that the private company can bypass the lengthy and complex process of going public.