Reverse Morgage Calculator

Thinking about borrowing a reverse mortgage.

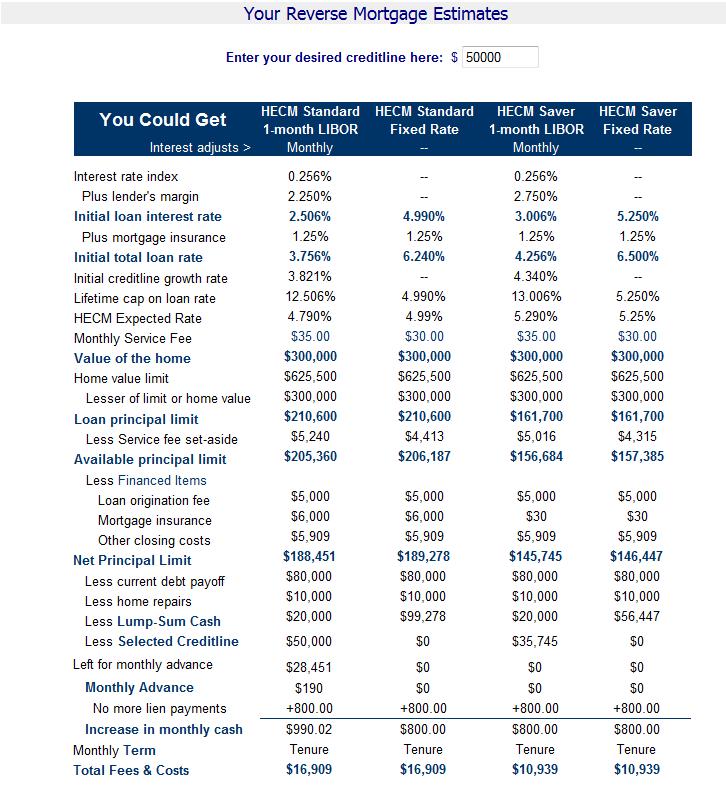

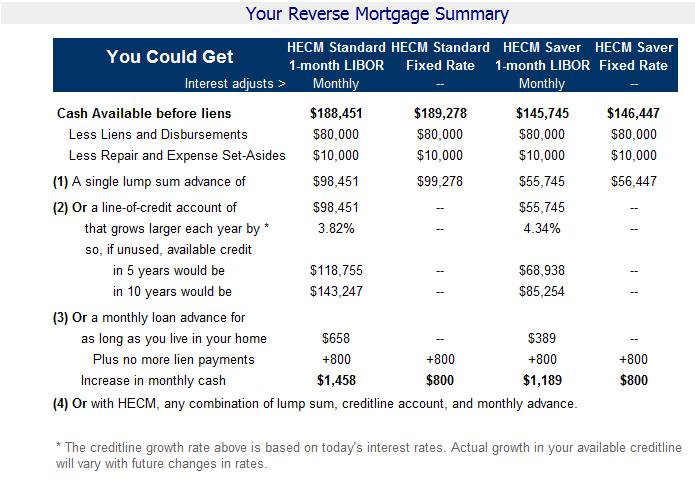

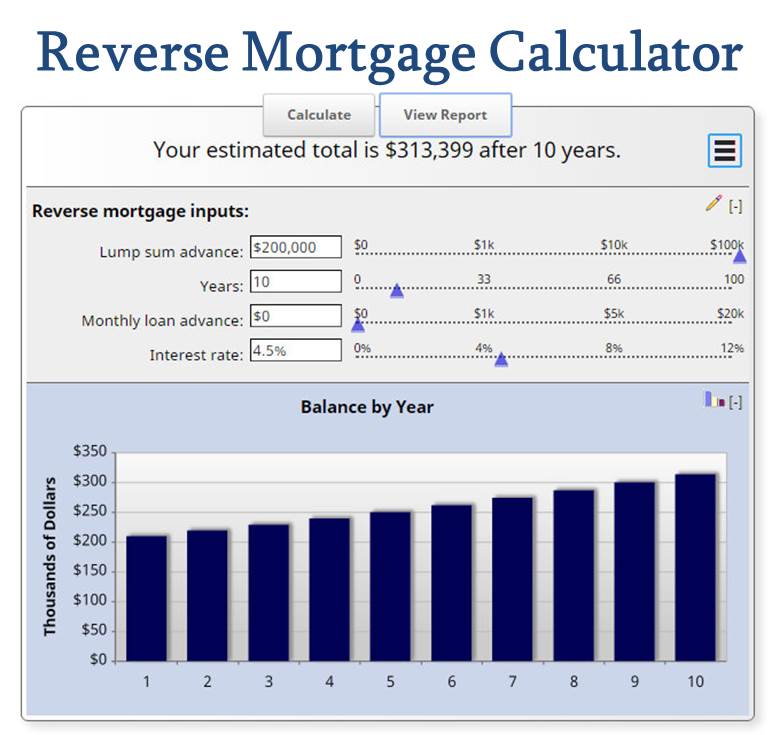

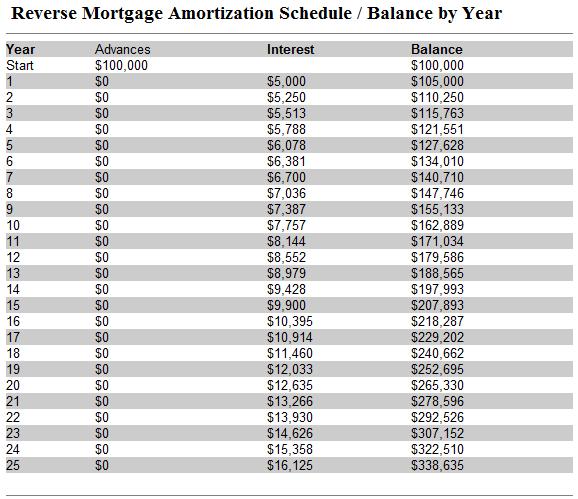

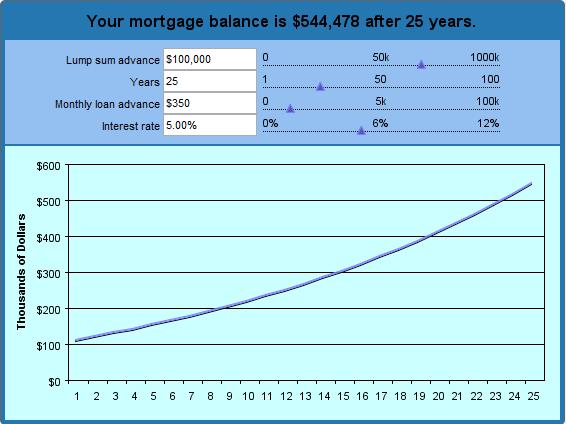

Reverse morgage calculator. The information contained in the payout levels generated by the calculator is for reference and illustration purposes only and should not be relied upon as an accurate indication of the actual amounts of monthly payouts. Request your free information kit here or call us at 800 224 0103. The margin used in our calculator is 175 basis points 1 75. Use this free calculator to help determine your future loan balance.

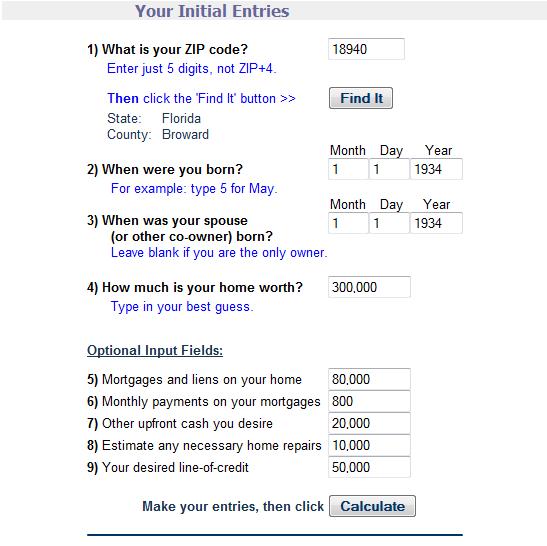

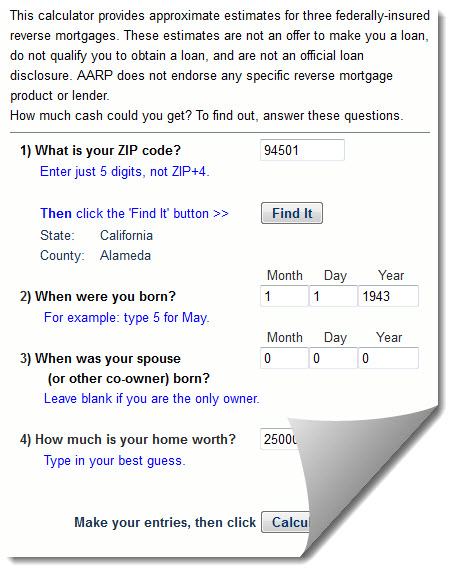

You might find reverse mortgage originators that offer higher or lower margins and various credits on lender fees or closing costs. Supporting canadians in their homes. Enter some basic information to find out how much money you qualify for with the chip reverse mortgage. I have created a calculator that allows users to get a sense of the principal limit available with a hecm reverse mortgage on their homes using the most popular one month variable rate option.

Need reverse mortgage help. Find reverse mortgage financial information tools reverse mortgage calculator and tips. A reverse mortgage which is a loan that allows homeowners to borrow money against their home s equity can give senior homeowners the income they need to maintain their lifestyle pay off debt cover home improvement expenses or meet other financial goals. Decide how much you would like to borrow.

Speak to a real person now. Use aag s reverse mortgage calculator to estimate the funds available to you based on your home value equity your age and more. Reverse mortgage calculator learn how much equity you can unlock from your home how much can you borrow with a reverse mortgage. This tool is designed to show you how compounding interest can make the outstanding balance of a reverse mortgage rapidly grow over a period of time.

Free reverse mortgage calculator. Use our free reverse mortgage calculator to determine how. The lender will add a margin to the index to determine the rate of interest actually being charged. Do you want to estimate what your remaining equity balance will be a few years out from today.

Work out how much you could borrow.