Reverse Mort

Aag is the nation s leading reverse mortgage lender.

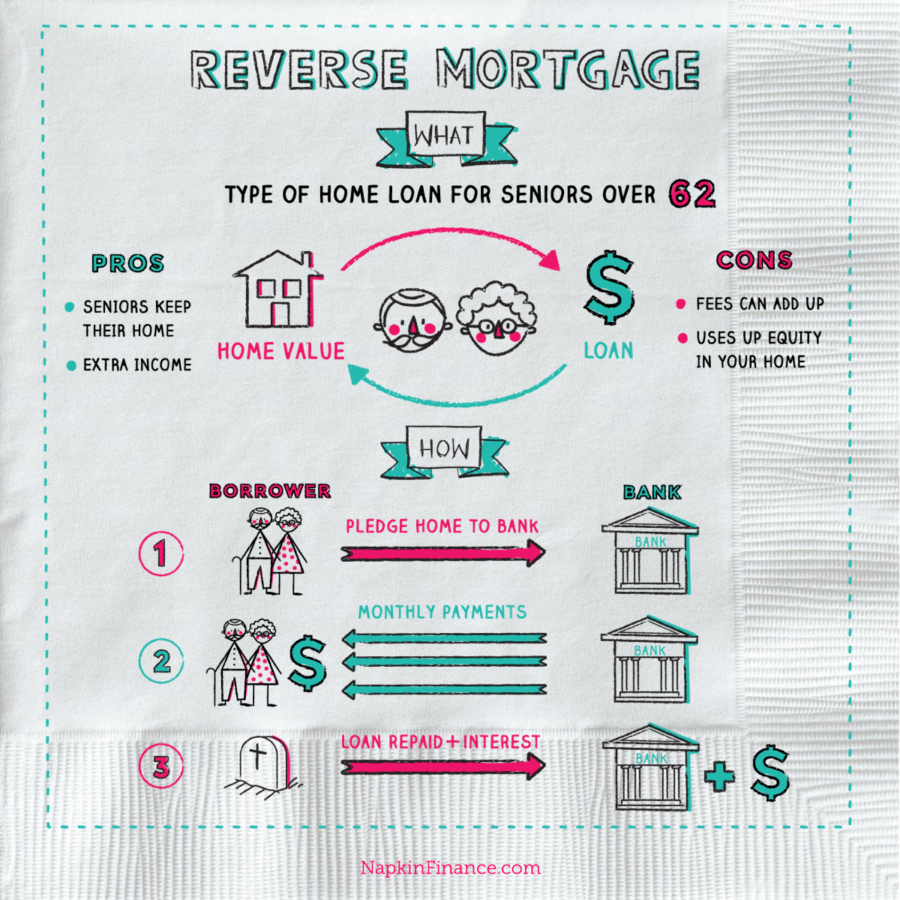

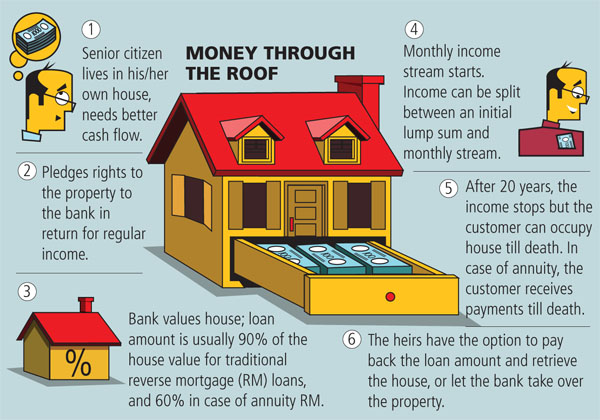

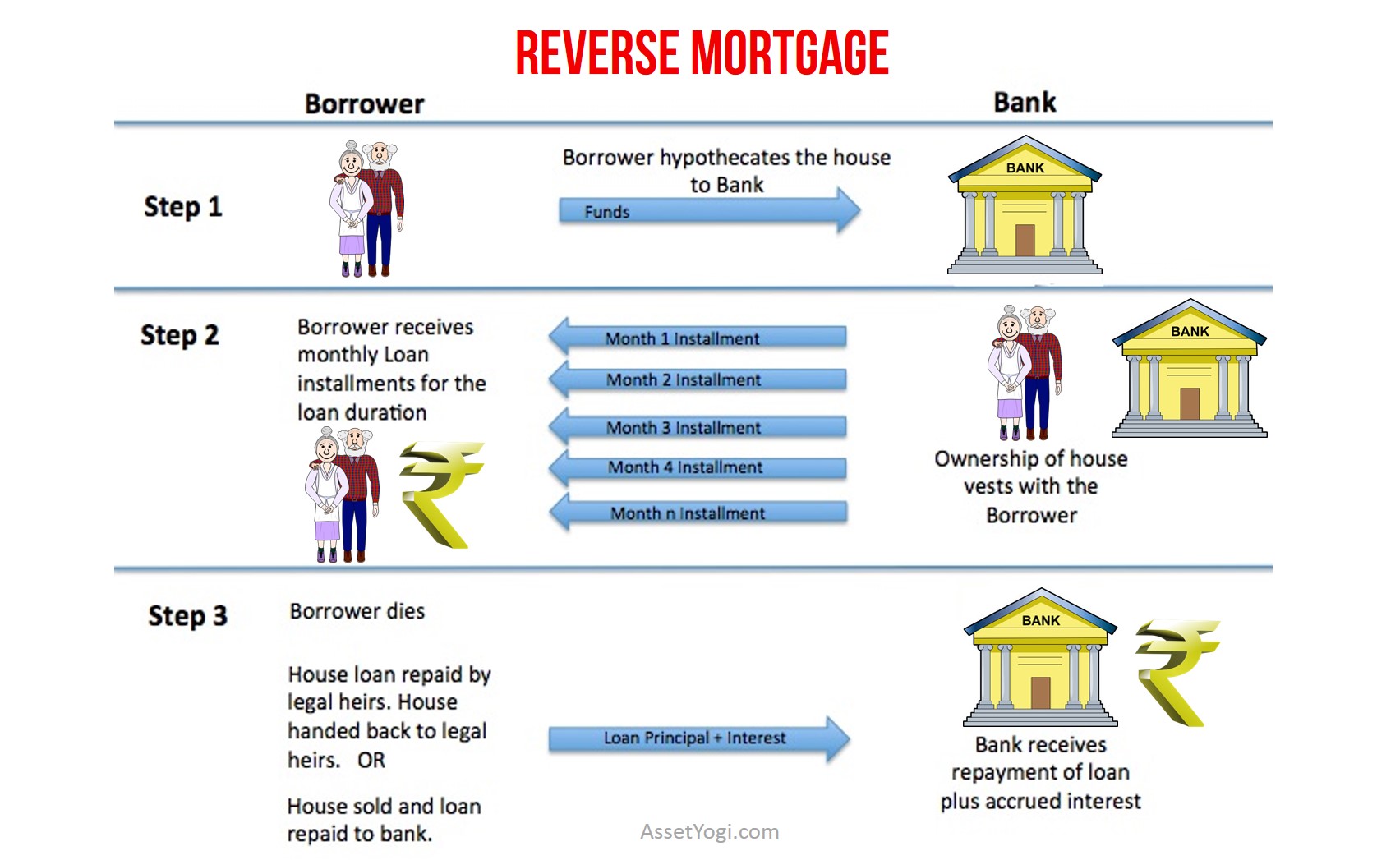

Reverse mort. Rather than making a mortgage payment each month borrowers receive income from their lender in the form of a lump sum monthly payout or line of credit. Reverse mortgages take part of the equity in your home and convert it into payments to you a kind of advance payment on your home equity. You may be able to borrow up to a certain percentage of the current value of your home. A reverse mortgage is a type of loan that allows homeowners ages 62 and older typically who ve paid off their mortgage to borrow part of their home s equity as tax free income.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Reverse mortgages are actually loans available to homeowners aged 62 or older who have sufficient equity in their homes. Generally you don t have to pay back the money for as long as you live in your home. Borrowers are still responsible for property taxes and homeowner s insurance.

Reverse mortgage loans allow homeowners to convert their home equity into cash income with no monthly mortgage payments. A reverse mortgage is a type of loan for seniors ages 62 and older. Here are 25 questions to test your knowledge of reverse mortgages knowledge that you may be able to put to work to help you live and retire better. They are relatively new financial products that provide older consumers with.

A reverse mortgage is a type of home loan that lets borrowers access the equity they ve built over the years. The borrower may also borrow lump sum payouts for specific purposes. Who qualifies to get a reverse mortgage. A reverse mortgage is a loan that allows you to get money from your home equity without having to sell your home.

In general the borrower does not need to repay the reverse mortgage loan during his lifetime unless it is terminated under specific circumstances. In a reverse mortgage you get a loan in which the lender pays you. If you ve thought about taking a reverse mortgage be aware that new rules might make it harder for you to qualify are reverse mortgages helpful or hazardous. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

This is sometimes called equity release. The money you get usually is tax free.