Reverse Mortgage Calculator Fha

Loans insured by the fha feature low down payments and costs for fha mortgage insurance are built into the mortgage payment.

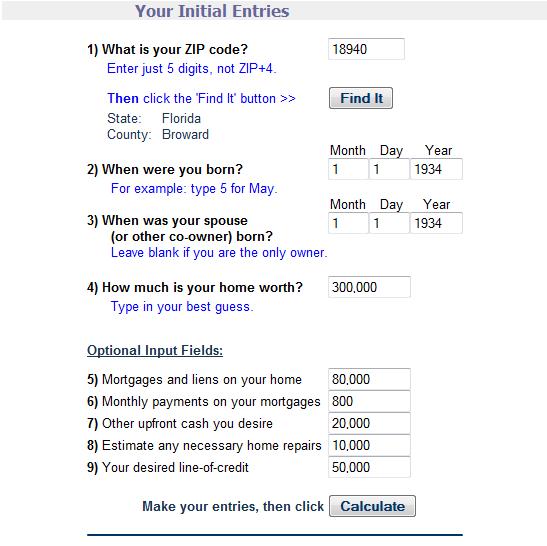

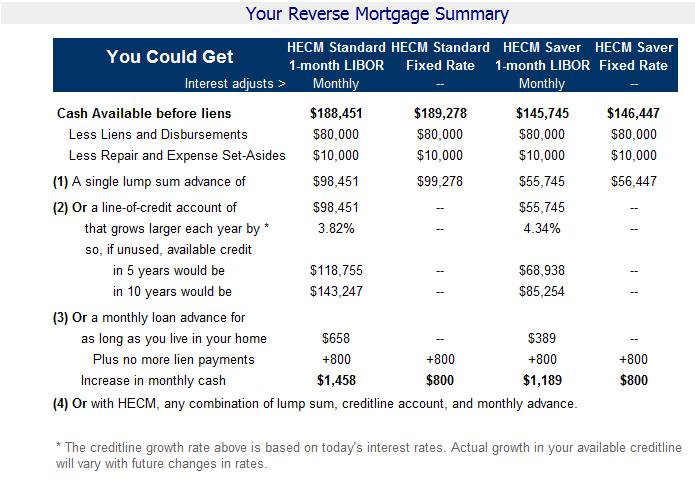

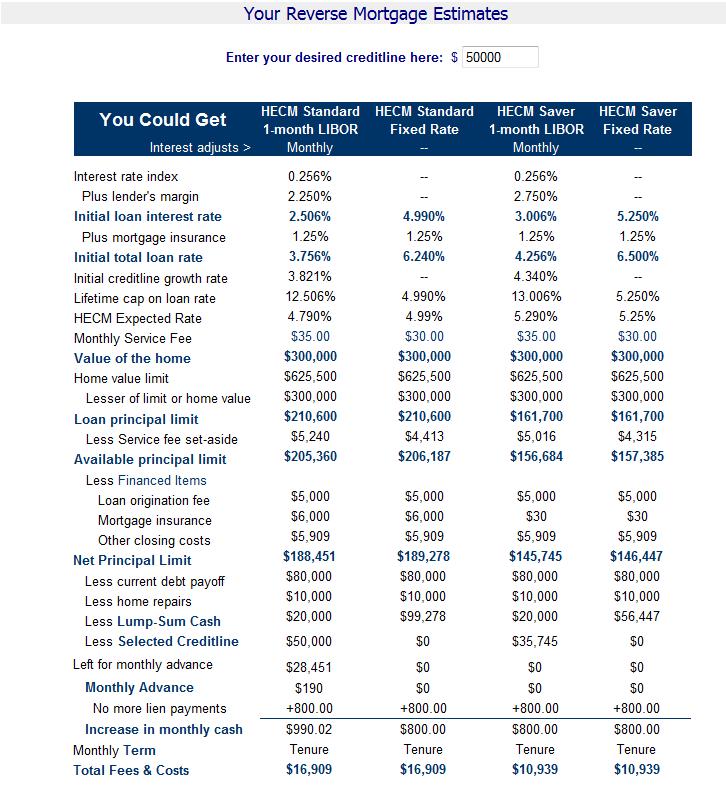

Reverse mortgage calculator fha. Reverse mortgages are increasing in popularity with seniors who have equity in their homes and want to supplement their income. An fha reverse mortgage is designed for homeowners age 62 and older. Use our free reverse mortgage calculator to determine how. That depends on your age home value the number of years you plan to occupy the property current interest rates and your loan costs.

A reverse mortgage which is a loan that allows homeowners to borrow money against their home s equity can give senior homeowners the income they need to maintain their lifestyle pay off debt cover home improvement expenses or meet other financial goals. Do you want to estimate what your remaining equity balance will be a few years out from today. If you are seeking a reverse mortgage keep in mind that the hecm is just one type of reverse mortgage. The only reverse mortgage insured by the u s.

This federal housing administration fha mortgage insurance premium mip calculator accurately displays the cost of mortgage insurance for an fha backed loan. Several additional lenders however have said they will be offering private reverse mortgage products in 2014. You can use this calculator to get an approximate estimate of the amount of money that you may be eligible for from a reverse mortgage. Fha mortgage insurance protects the lender s investment should a homeowner default on the mortgage.

The main reason for this is simple. Reverse mortgage payment calculator. Currently borrowers with very high home values can access at least one non fha reverse mortgage option. Reverse mortgage calculator learn how much equity you can unlock from your home how much can you borrow with a reverse mortgage.

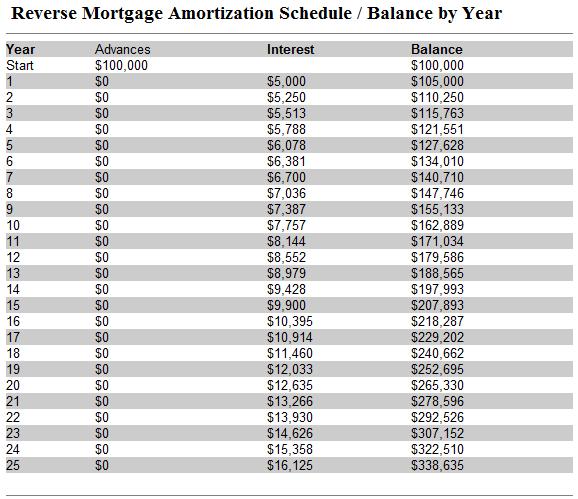

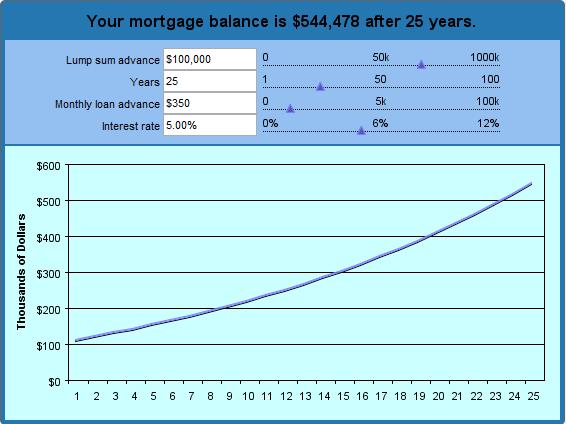

Federal government is called a home equity conversion mortgage hecm and is only available through an fha approved lender. This tool is designed to show you how compounding interest can make the outstanding balance of a reverse mortgage rapidly grow over a period of time. Please note that this is just an estimate and you will need to speak to a lender to find out exactly how much you are eligible to receive. Thinking about borrowing a reverse mortgage.

I have created a calculator that allows users to get a sense of the principal limit available with an hecm reverse mortgage on their home using the most popular one month variable rate option.