Reverse Mortgage Faqs

Below are some frequently asked questions about reverse mortgages.

Reverse mortgage faqs. Each reverse mortgage borrower must undergo a financial assessment. A reverse mortgage loan helps provide greater financial security to well over 250 000 seniors in the u s. Reverse mortgage faqs what is a reverse mortgage loan. Below is a list of frequently asked questions we hear from our customers on a day to day basis.

1 with this type of loan you maintain the title to your home. Most but not all reverse mortgages today are federally insured through the federal housing administration s home equity conversion mortgage hecm program. Reverse mortgage loan interest rates are comparable to home equity loan rates. This is excerpted from u s.

To learn more about reverse mortgages read through the following commonly asked. A reverse mortgage loan is generally not repaid until the homeowner passes away or permanently moves out of the home for 12 consecutive months. Department of housing and urban development. Here at south river mortgage we want you to know exactly what a reverse mortgage is and why you should or should not consider obtaining a reverse mortgage.

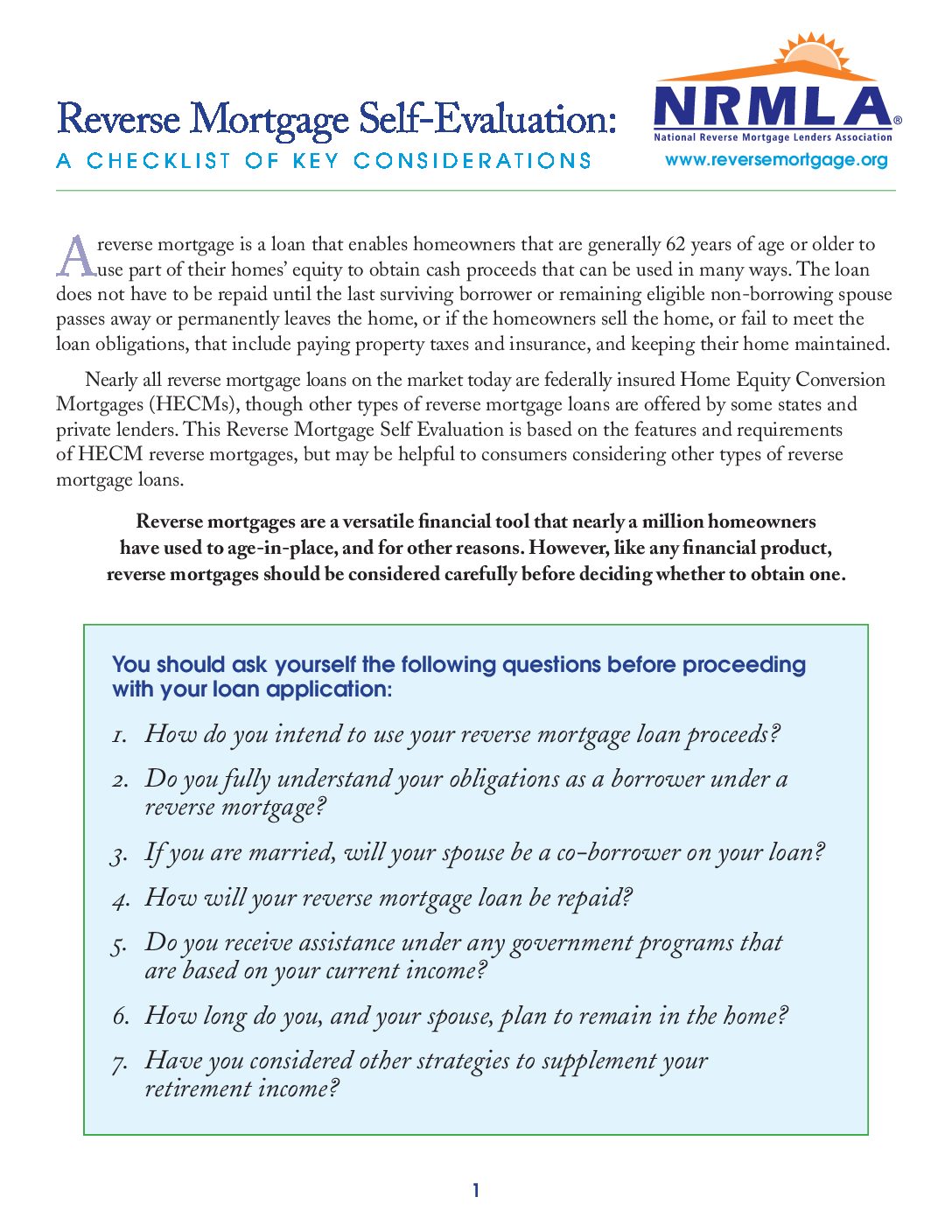

A reverse mortgage is a loan that enables homeowners and homebuyers age 62 or older to convert some of their home equity into cash or a line of credit. Reverse mortgage frequently asked questions kevin guttman 2020 07 08t13 49 50 06 00. The loan typically becomes due when the last borrower s permanently leave the home or the borrower s fail to meet the loan obligations 1. A reverse mortgage counseling certificate is the certificate that you receive once you have attended a counseling session conducted by a certified reverse mortgage counselor.

Reverse mortgage faqs these frequently asked questions are arranged in the order in which they occur during the loan origination process. Find out why today s savvy financial service professionals utilize reverse mortgages to help retirement aged clients improve their financial futures. Reverse mortgages are a widely unknown topic and have many myths surrounding them. This is conducted by the lenders and is done for the purposes of assessing whether or not the potential borrower can afford to maintain living expenses and keep current with the payment of all homeowners insurance property taxes and other fees over the loan period.

The home equity conversion mortgage hecm is fha s reverse mortgage program which enables you to withdraw some of the equity in your home. Some loans also let homeowners finance a new home purchase. A reverse mortgage is a loan that allows you to access a portion of your home equity without having to make monthly mortgage payments.