Reverse Mortgage Fees

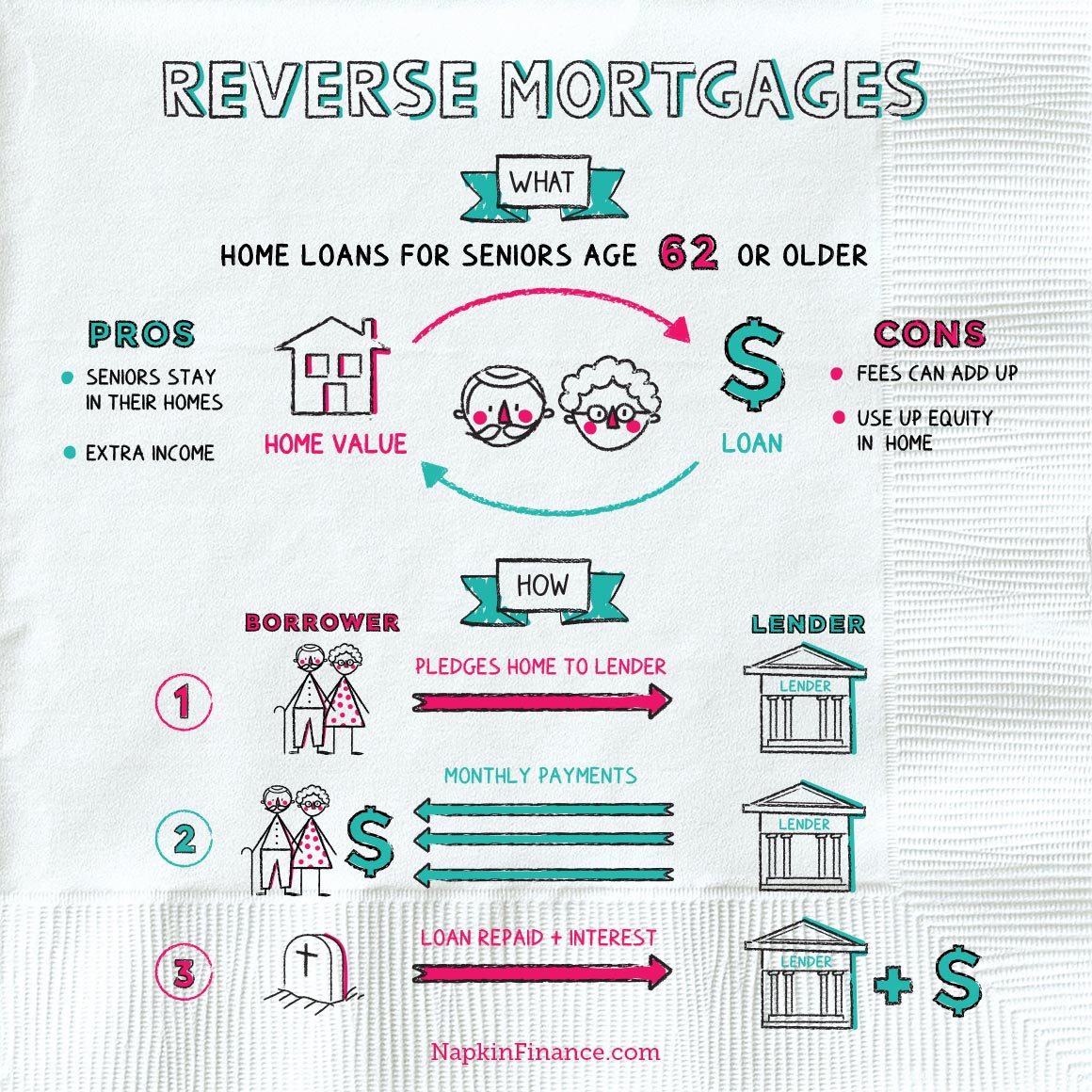

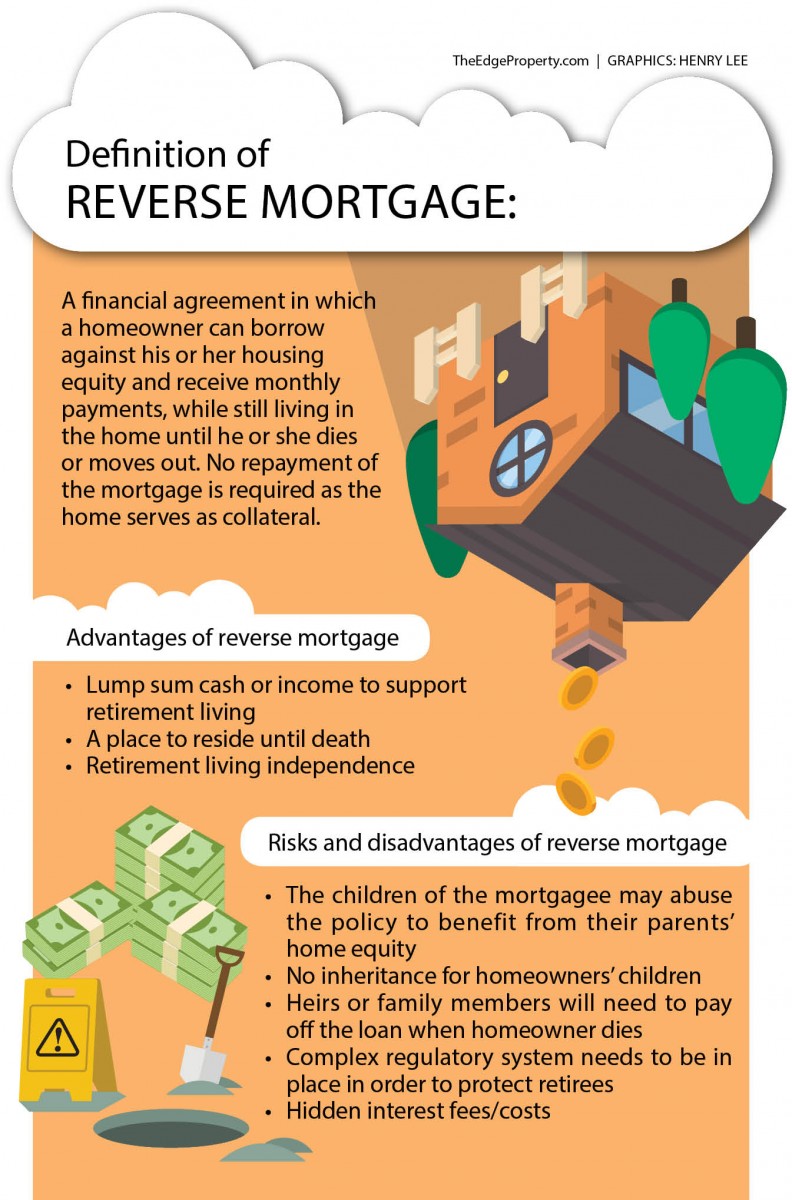

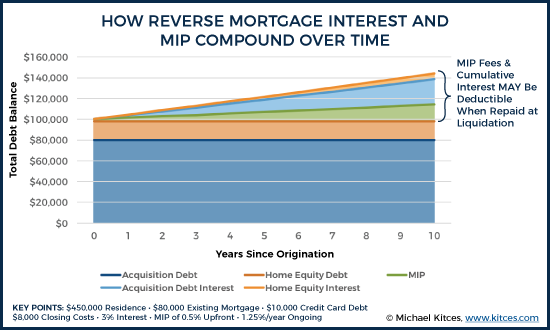

Unlike traditional mortgage loans the amount you owe on a reverse mortgage loan will grow over time.

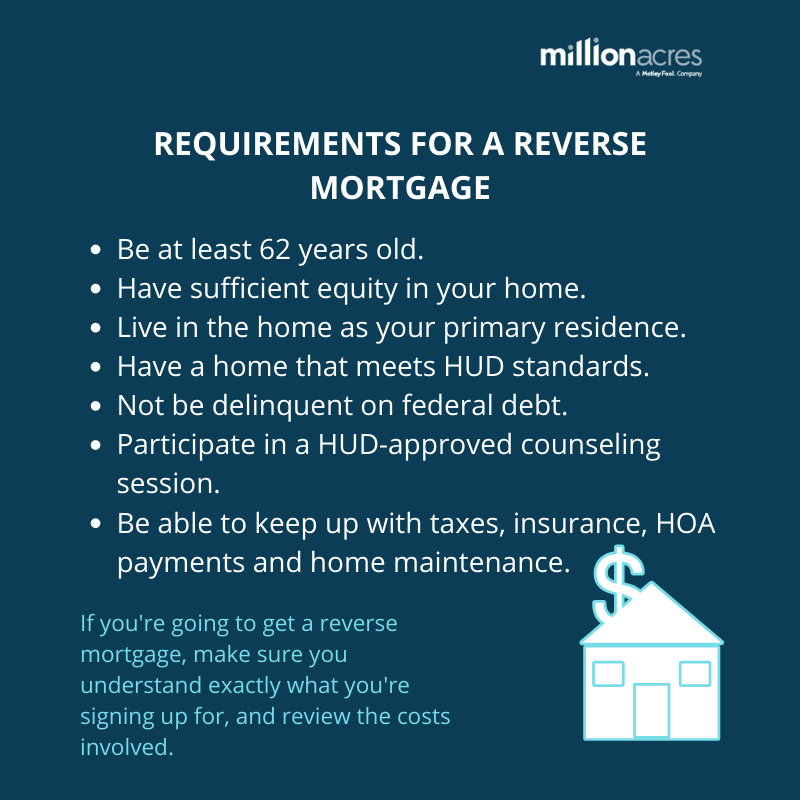

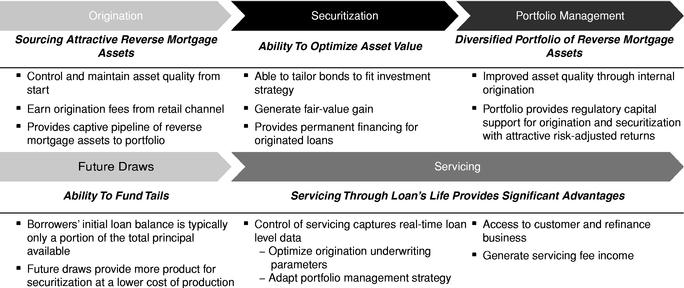

Reverse mortgage fees. The origination fee is what the reverse mortgage lender earns on the loan. Lenders can charge a monthly servicing fee of up to 30 if your reverse mortgage loan has an interest rate that adjusts annually and no more than 35 monthly if the interest. Borrowers taking out a hecm reverse mortgage loan must receive counseling from a hud approved reverse. These include origination fees interest payments mortgage insurance and closing costs.

Appraisal fees vary throughout the country but the average price is 450 according to nrmla national reverse mortgage lenders association. The origination fee covers a lender s operating expenses associated with originating the reverse mortgage. Reverse mortgage fees an explanation for each fee follows below origination fee. There are typically one time costs like origination fees which are capped at 6 000.

A maximum of a 6 000 origination fee. Hecm origination fees are capped at 6 000. Again there s a lot of information to digest here so let s consider a reverse mortgage example or two. With a reverse mortgage loan you will owe the money you borrowed as well as interest and fees.

2 of the first 200 000 of the property s value and 1 of the amount over 200 000. If the appraiser determines that repairs need to be made to the home they will need to make a second visit to verify the repairs. Appraisers typically charge 100 150 for the follow up visit. The origination fee is the upfront fee charged by the reverse mortgage lender to initiate the loan.

The entire amount of the origination fee may be financed as part of the mortgage. The fha uses a formula to determine what the lender can charge. A lender can charge the greater of 2 500 or 2 of the first 200 000 of your home s value plus 1 of the amount over 200 000. Home valued at 100 000 since the home value is less than 125 000 the lender can charge any amount up to 2 500.

2 of the first 200 000 of the property s value and 1 of the amount over 200 000 a maximum of a 6 000 origination fee.