Reverse Mortgage Financing

A reverse mortgage financial assessment is a review of the borrower s credit history employment history debts and income during the reverse mortgage application process.

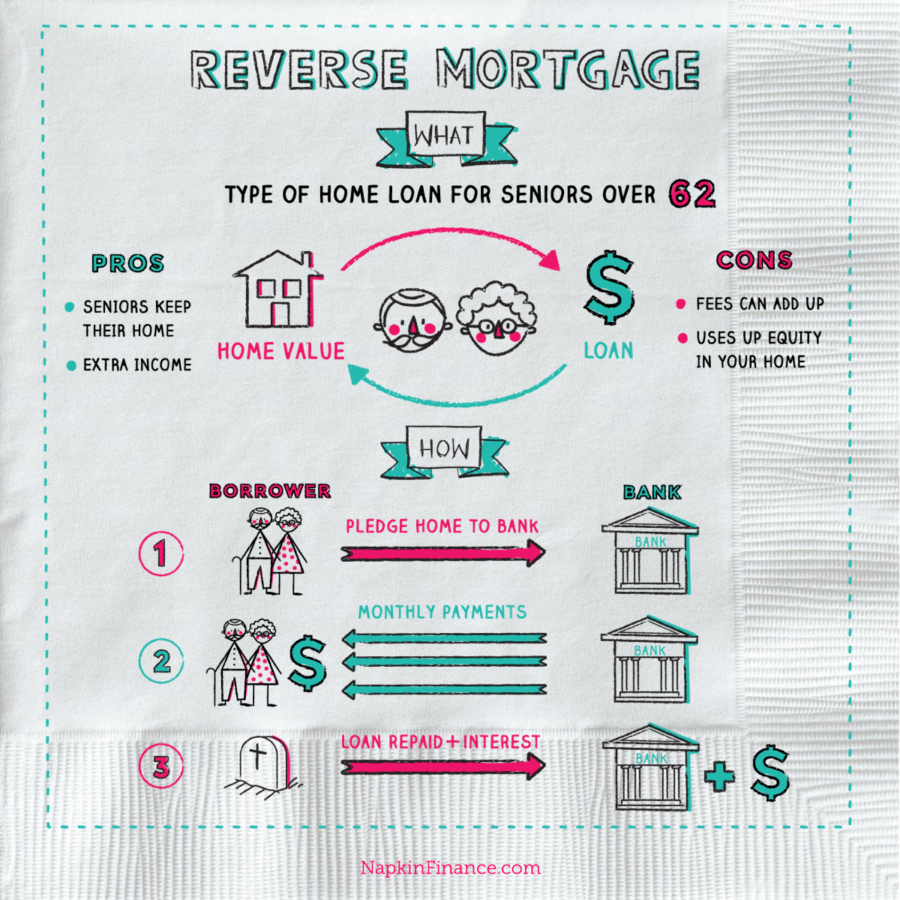

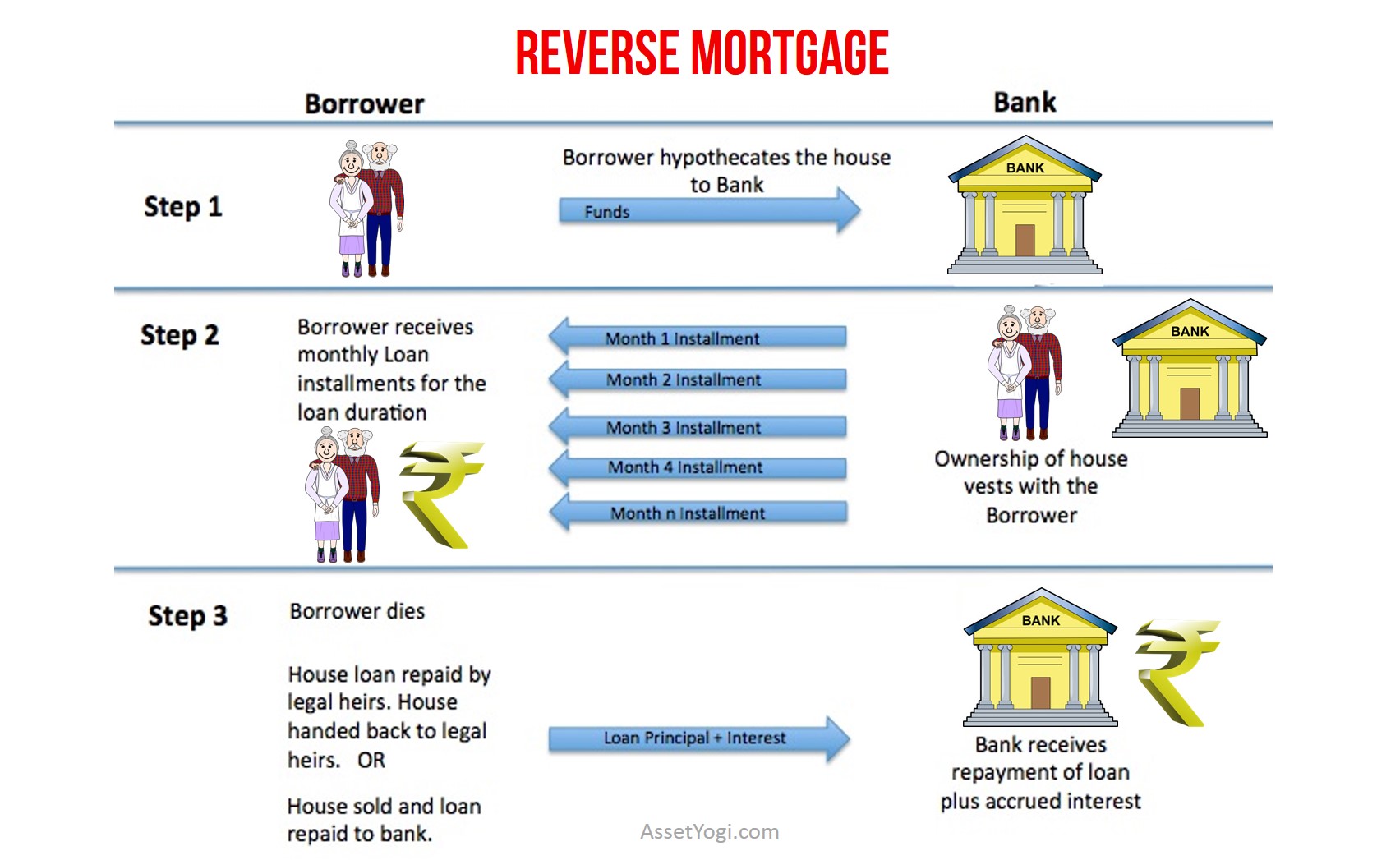

Reverse mortgage financing. A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. A reverse mortgage is a loan that allows you to get money from your home equity without having to sell your home. Modified tenure payment plan. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

You don t have to repay the loan until you sell your house move or die. A reverse mortgage is a loan based on the paid up current value or equity in your home. Some reverse mortgages mostly hecms offer fixed rates but they tend to require you to take your loan as a lump sum at closing. What to look for in a reverse mortgage price.

You may be able to borrow up to a certain percentage of the current value of your home. Since 2004 we have helped more than 17 000 kiwis enjoy a more comfortable retirement on their terms. When we rated reverse mortgages in early 2017 the interest rates on offer for reverse mortgages ranged from 6 19 to 6 37 with an average rate of 6 25. Instead the loan is repaid after the borrower moves out or dies.

Reverse mortgages enjoy financial flexibility independence and a lifestyle you love heartland is new zealand s leading reverse mortgage provider. Borrowers are still responsible for property taxes and homeowner s insurance. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. This is sometimes called equity release.

A way to receive reverse mortgage proceeds in which the borrower gets access to a line of credit as well as equal monthly payments for as long as he or she lives in. Variable rate loans tend to give you more options on how you get your money through the reverse mortgage. The average fees in 2017 were as follows. A reverse mortgage is a type of loan that s reserved for seniors age 62 and older and does not require monthly mortgage payments.

Most reverse mortgages have variable rates which are tied to a financial index and change with the market.