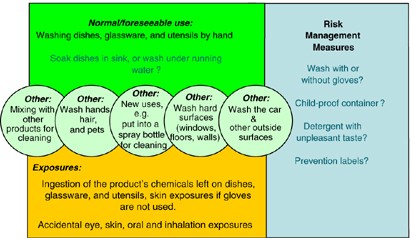

Risk Management Measures

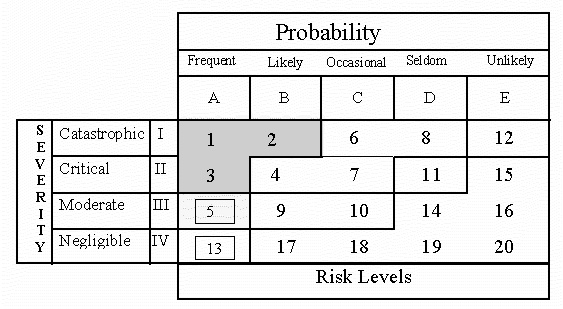

The ways of controlling risks are ranked from the highest level of protection and reliability to the lowest.

Risk management measures. Controlling risks using the hierarchy of control measures. The market has a beta of 1 and it can be used to gauge the risk. Risk management measures and metrics. It is best practice for process owners throughout organizations to complete over half of the rmm standards so that these metrics can be automatically aggregated into a single report suitable for presenting to the board.

Risk management measures and metrics publication. Risk management measures fundamental risk management policies. Risk measures are statistical measures that are historical predictors of investment risk and volatility and they are also major components in modern portfolio theory mpt. As applied to corporate finance risk management is the technique for measuring monitoring and controlling the financial or operational risk on a firm s balance sheet a traditional measure is the value at risk var but there also other measures like profit at risk par or margin at risk.

This ranking is known as the hierarchy of control. Risk assessment means the process of evaluating the probability and consequences of injury or illness arising from exposure to an identified hazard and determining the appropriate measures for risk control. With the deregulation and internationalization of the financial sector and the diversification of financial services and businesses the risks to which banks are exposed are becoming more complex and diverse heightening the importance of risk management. Risk management has been under a lot of scrutiny in the past decade largely due to the increasing regulatory requirements that are becoming key to managing investments.

The board of directors and management are responsible for managing business financial and environmental risks as well as the related insurance coverage. Risk management measures are aimed at securing cramo group s long term competitiveness. The workplace safety and health risk management regulations state that employers self employed persons and principals including contractors and sub contractors are responsible for identifying safety and health hazards at workplaces and taking measures to eliminate or reduce the risks. The rmm uses the metrics referenced above to produce the data needed to measure the effectiveness of your risk management program.

Beta measures the amount of systematic risk an individual security or an industrial sector has relative to the whole stock market. Management of business risks.