Roll 401k

Learn more about how a 401k rollover works with our easy to follow infographic.

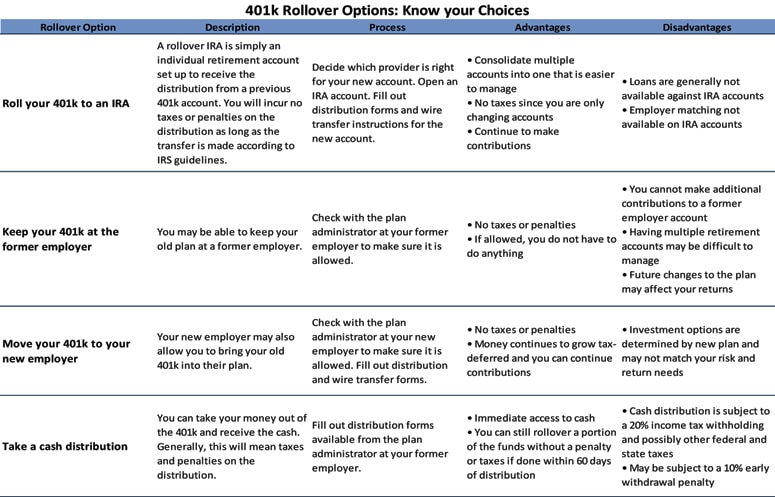

Roll 401k. After you leave your job there are several options for your 401 k. A rollover ira allows individuals to move their employer sponsored retirement accounts without incurring tax penalties and remain invested tax deferred. Roll it over into your new employer s 401 k plan. You can rollover from a traditional 401 k into a traditional ira tax free.

60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days. Compare 401 k rollover options. Same goes for a roth 401 k to roth ira rollover. Beyond the type of ira you want to open you ll need choose a financial institution to invest with.

You may be able to leave your account where it is. You could also transfer money from an ira into a 401 k sometimes called a reverse rollover but in most cases it s not a good idea. This approach will require you to file some paperwork but you ll have all your 401 k money in one place. Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution.

Get help deciding if you should roll over your old 401 k to an ira. This guide will help you understand rollover options and rules and if rolling over your 401k into an ira is appropriate for you. This choice can make sense if you. The most common type of rollover is the 401 k rollover which lets you transfer money from a 401 k you had at a previous job into an ira or the 401 k at a new job this is the type of rollover we re going to focus on.

You can t roll a roth 401 k into a traditional ira. Transferring tax advantages fees and more. A rollover ira is an individual retirement account often used by those who have changed jobs or retired. The irs gives you 60 days from the date you receive an ira or retirement plan.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)