Roll Over Ira Into 401k

You could also transfer money from an ira into a 401 k sometimes called a reverse rollover but in most cases it s not a good idea.

Roll over ira into 401k. In the world of retirement account rollovers there s one type that doesn t get much love. Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution. How to do an ira rollover to a 401 k without tax penalties first you must check your eligibility. Beyond the type of ira you want to open you ll need choose a financial institution to invest with.

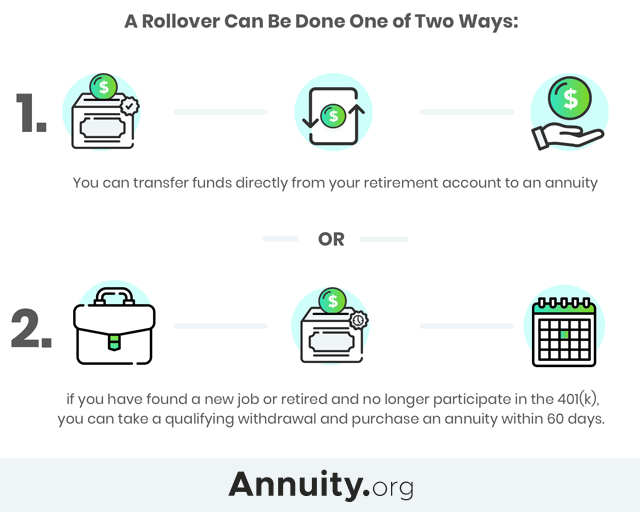

Some of the top reasons to roll over your 401 k into an ira are more investment choices better communication lower fees and the potential to open a roth account. Same goes for a roth 401 k to roth ira rollover. The ira to 401 k maneuver which allows you to roll pretax traditional ira assets into a 401 k. The taxable portion of your withdrawal that is eligible for rollover into an individual retirement account ira or another employer s retirement plan is subject to 20 mandatory federal income tax withholding unless it is directly rolled over to an ira or another employer plan.

To do a rollover from a traditional 401 k to a roth ira however is a two step process. You can rollover from a traditional 401 k into a traditional ira tax free. Deciding which ira to choose. With an ira rollover you can preserve the tax deferred status of your retirement assets without paying current taxes or early withdrawal penalties at the time of transfer.

You can only roll an ira into a 401 k if the provider is willing and able to accept the deposit. 60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days. You can t roll a roth 401 k into a traditional ira. The most common type of rollover is the 401 k rollover which lets you transfer money from a 401 k you had at a previous job into an ira or the 401 k at a new job this is the type of rollover we re going to focus on.