Roll Over Ira To Roth

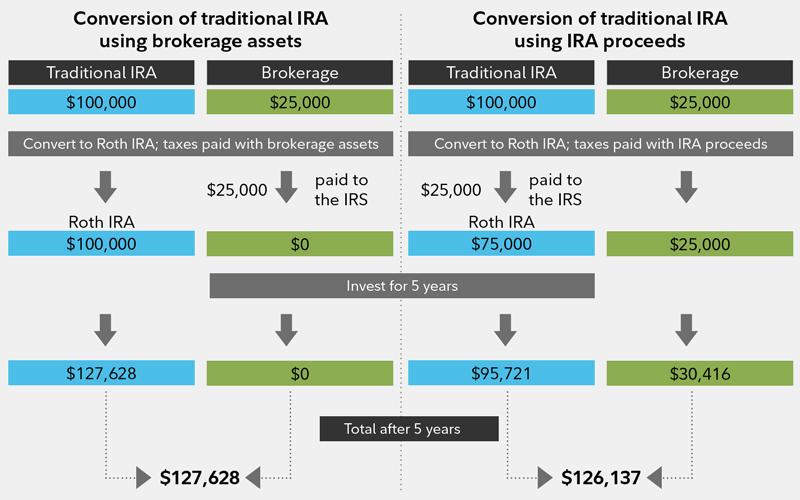

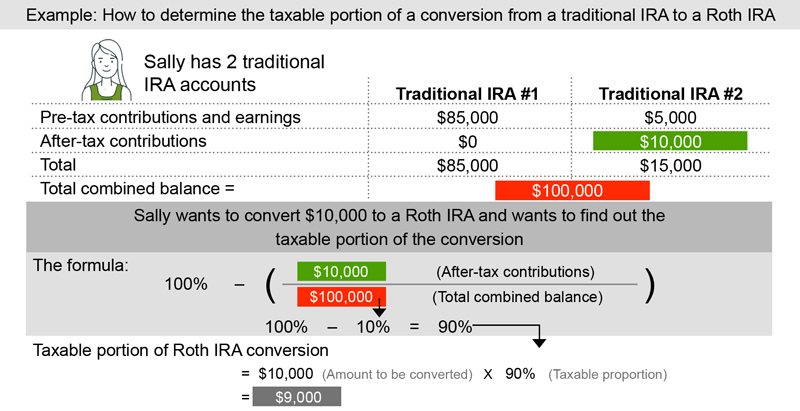

If she decides to convert the entire ira to a roth she would only have to pay taxes on the earnings portion.

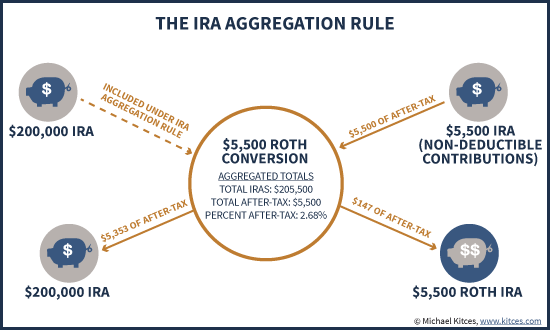

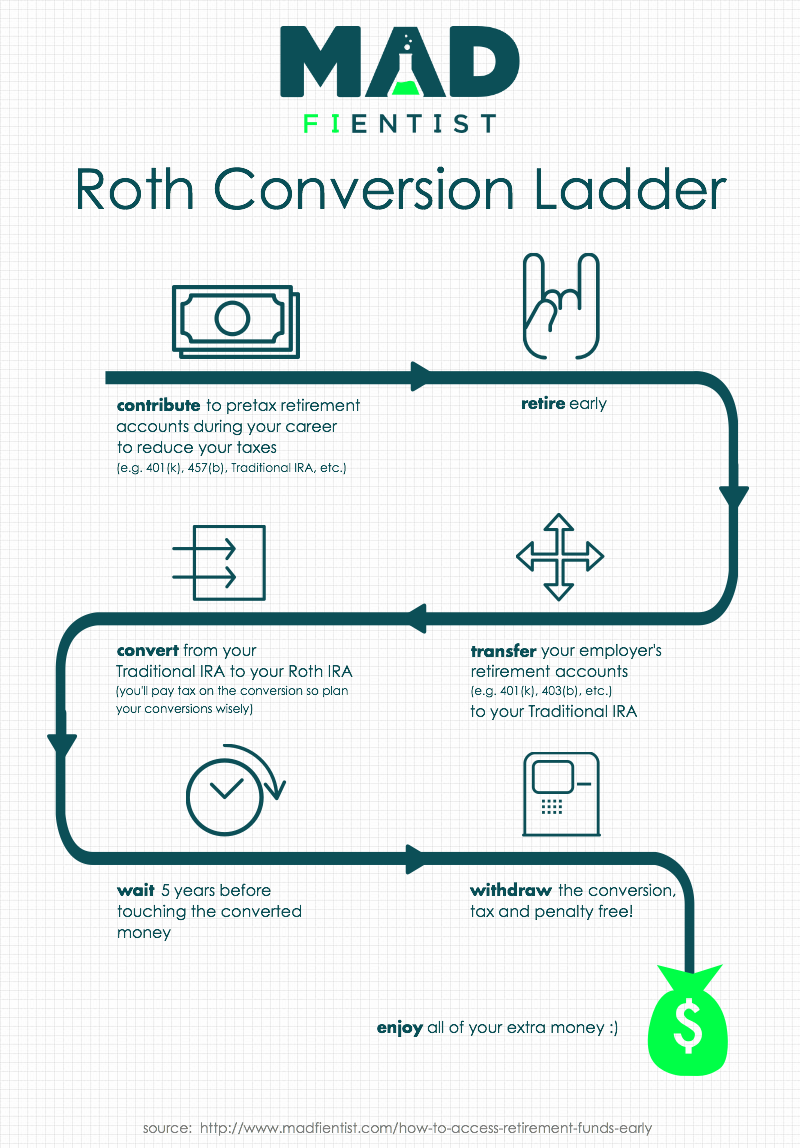

Roll over ira to roth. Contributions into roth iras are not tax deductible while contributions into rollover traditional iras are tax deductible. You ll owe taxes on the amount of pretax assets you roll over. If you and your spouse are not covered by a plan at work there are no income limits on deductibility. If you qualify you can do an eligible rollover distribution from your old 401 k directly to a roth ira.

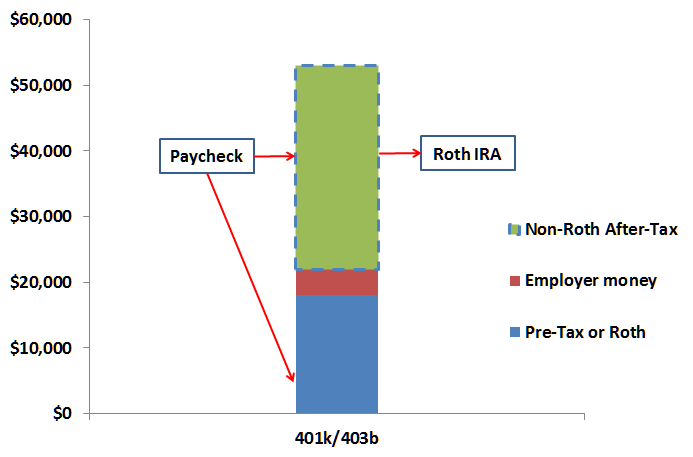

Have held the account for at least 5 years and. Because of that financial advisors generally recommend that the rollover is. A rollover ira is a traditional ira that is created to receive funds from a qualified retirement plan such as 401 k and 403 b. The ira is composed of 90 000 in non deductible contributions and 10 000 in earnings.

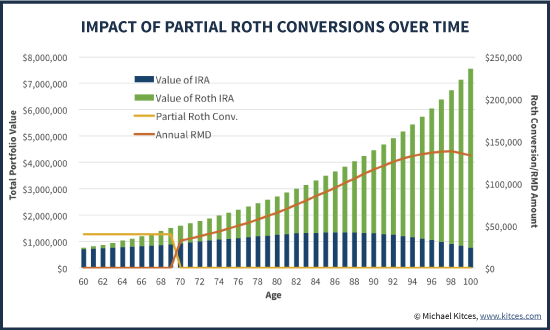

In addition you can get a tax free distribution after 5 years from a roth ira of up to 10 000 to buy your first home. For 2010 there are no income limits or restrictions on rolling over a traditional ira into a roth ira as long as you pay taxes on the contribution. Withdrawals from a roth ira or designated roth account including earnings will be tax free if you. Age 59 or older.

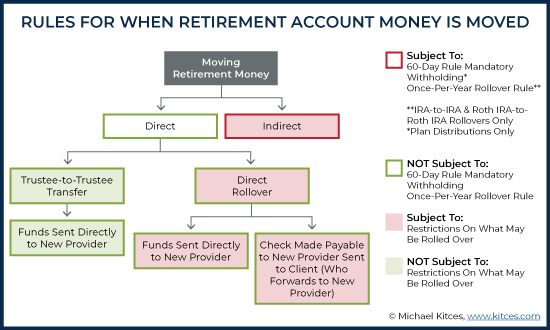

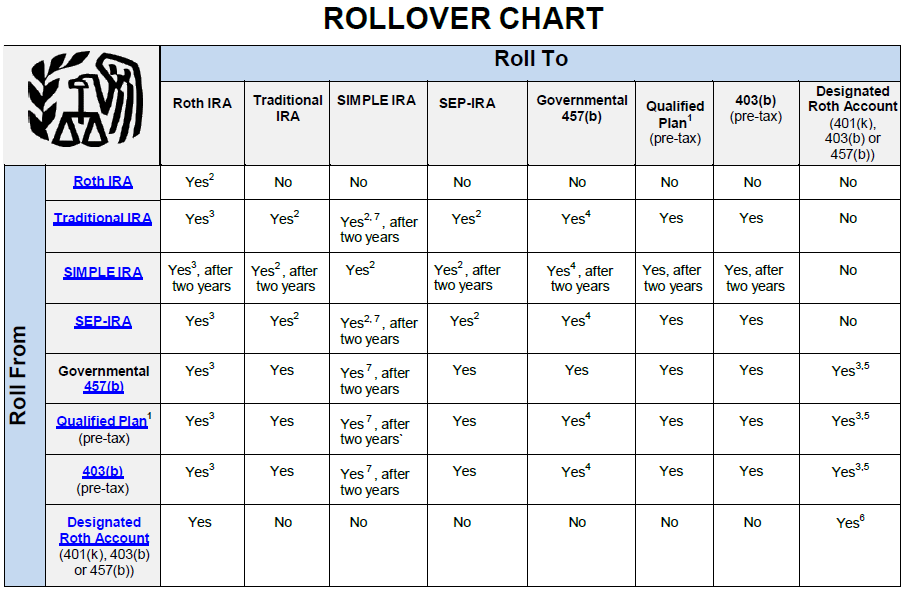

Similarly you can rollover a traditional 401 k into a traditional ira without paying taxes or a roth ira with paying taxes but it would not make sense to rollover a roth 401 k into a traditional ira. You can roll over your ira into a qualified retirement plan for example a 401 k plan assuming the retirement plan has language allowing it to accept this type of rollover. An rmd cannot be rolled over to a roth via a conversion. The main difference between a rollover ira and roth ira is in how they are taxed.

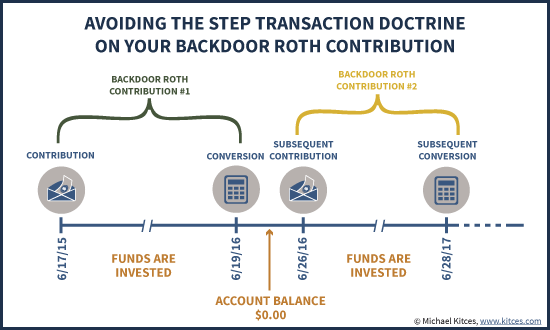

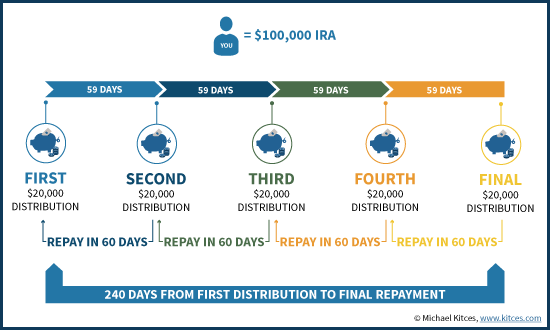

You can get around roth ira income limits by doing a rollover. Rmds are always subject to tax. Technically a roth conversion is also a rollover and occurs when a distribution is made from a traditional account under an eligible retirement plan and rolled over to a roth account. Roth iras can only be rolled over to another roth ira.

You must have earned income to make a roth contribution. A roth ira rollover or conversion shifts money from a traditional ira or 401 k into a roth. When you roll over money from a traditional ira to its roth counterpart the amount moved is taxed as ordinary income. Only money you take above the rmd amount can be.

:max_bytes(150000):strip_icc()/roth-ira-vs-traditional-ira-written-in-the-notepad--1090754116-525e8e6001494031bda19fa01ad1cf2f.jpg)