Roll Over Roth Ira

In such cases inherited accounts can not be rolled over in your roth ira.

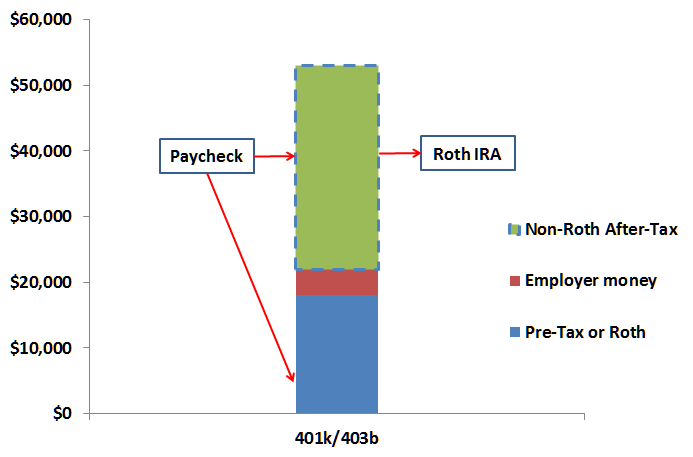

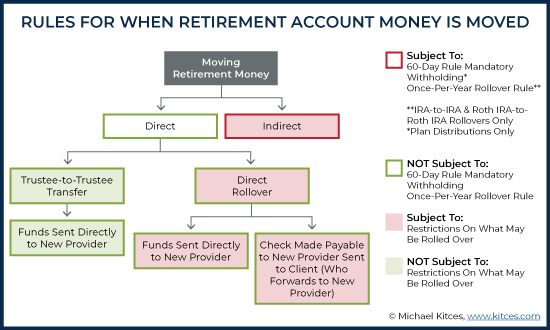

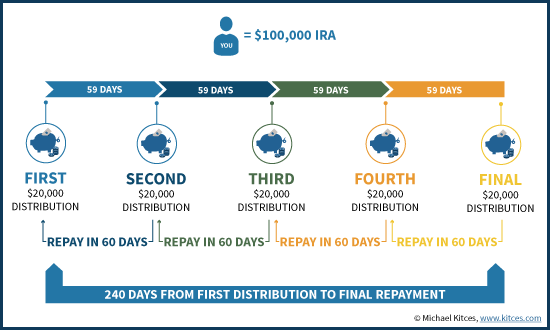

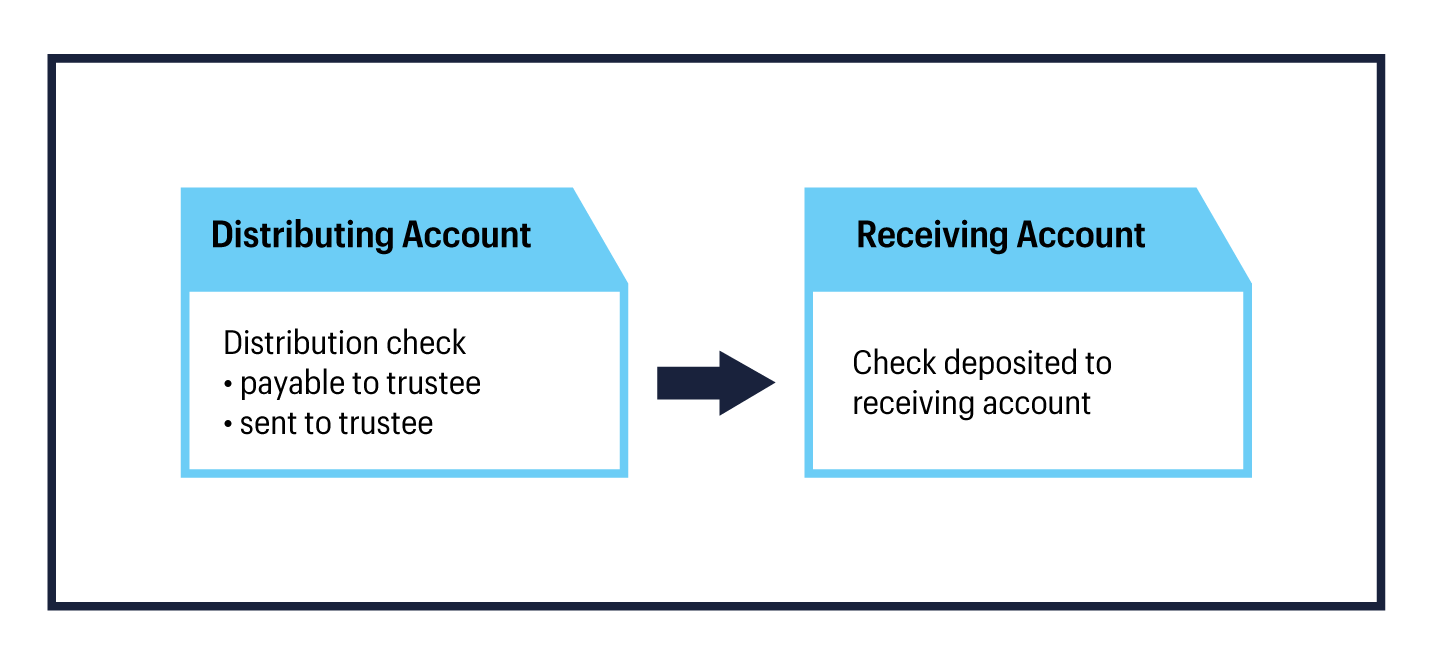

Roll over roth ira. If you choose the 60 day rollover option to move your roth ira money you first must ask for a distribution payable to you from your current roth ira custodian. You contact your employer s 401 k provider and request a rollover lowell said. Rolling over a roth 401 k to a roth ira can make sense in the right circumstances but you need to be aware of the rules. Rolling a roth 401 k into a roth ira isn t that different from completing a normal rollover from a 401 k to an ira says dave lowell a certified financial planner cfp based in the salt lake city area.

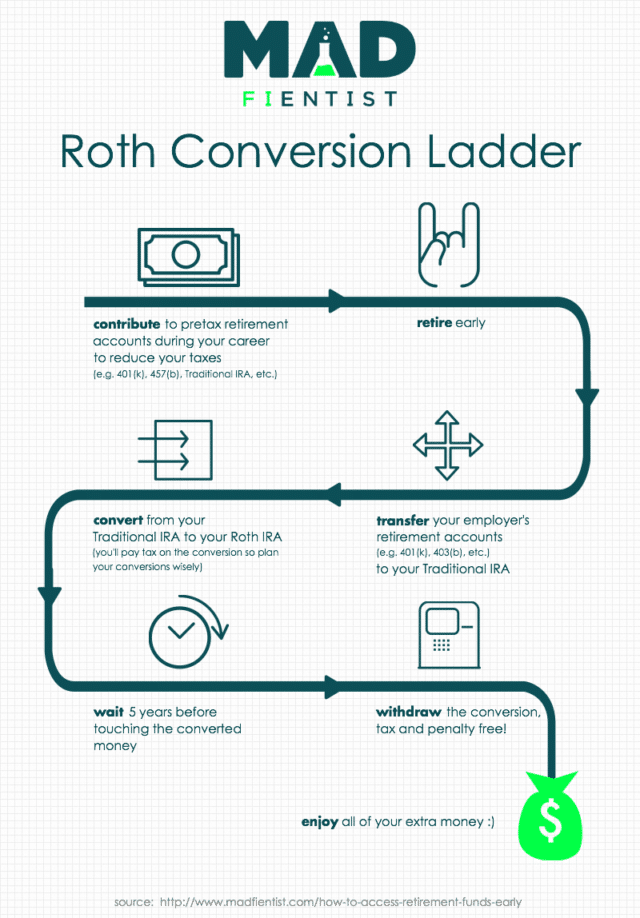

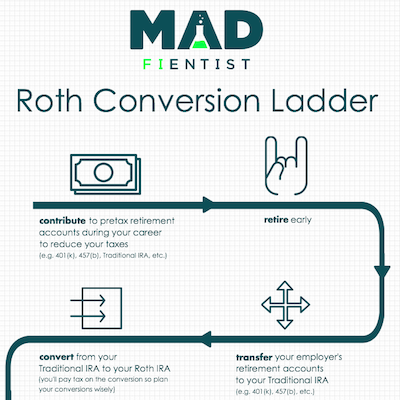

Roth iras can only be rolled over to another roth ira. There are a number of different types of ira including traditional ira rollover ira and roth ira. A roth 401 k can be rolled over to a new or existing roth ira or roth 401 k. A roth ira rollover transfers money from a traditional ira into a roth.

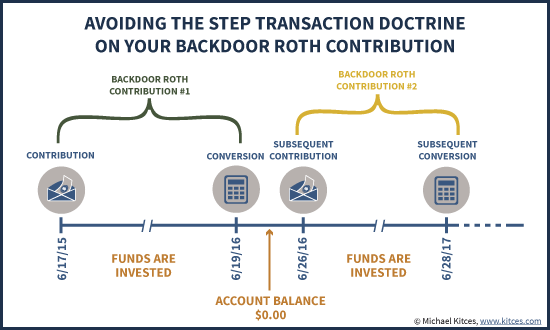

When you rollover funds from a roth 401 k to a roth ira it s the age of the roth ira that sets the clock for the 5 year rule. You can roll over eligible rollover distributions from these plans to a roth ira or to a designated roth account in the same plan if the plan allows rollovers to designated roth accounts. How to roll over a roth 401 k to a roth ira. You can roll over your ira into a qualified retirement plan for example a 401 k plan assuming the retirement plan has language allowing it to accept this type of rollover.

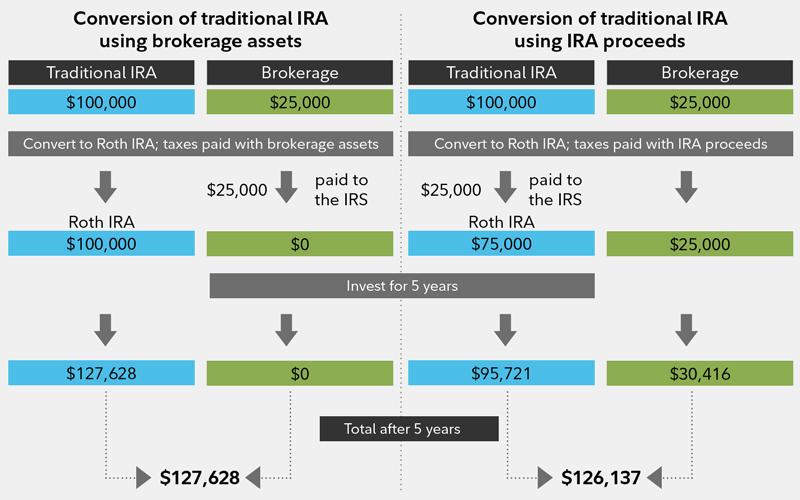

Roth ira rollover eligibility rules. Rollover ira vs roth ira ira stands for individual retirement accounts which are special investment accounts that are designed specifically for individuals who wish to build a retirement fund and manage their investment portfolio. You may want to note the differences between roth iras and designated roth accounts before you decide which type of account to choose. As a rule a transfer to a roth ira is most desirable since it facilitates a wider range of investment options.

Before you can perform a rollover you need to make sure you re eligible. After you receive the distribution you have 60 days from the date you receive the funds to redeposit rollover them to another roth ira. There are lots of good reasons to make the switch but watch out for the taxes.