Rolling Over Ira Into 401k

The taxable portion of your withdrawal that is eligible for rollover into an individual retirement account ira or another employer s retirement plan is subject to 20 mandatory federal income tax withholding unless it is directly rolled over to an ira or another employer plan.

Rolling over ira into 401k. You can also roll over a 401 k into. Below are seven reasons why. You can t roll a roth 401 k into a traditional ira. For most people rolling over a 401 k or the 403 b cousin for those in the public or nonprofit sector into an ira is the best choice.

How to do an ira rollover to a 401 k without tax penalties first you must check your eligibility. A 401 k rollover is a way to move money from a workplace retirement plan to an individual retirement account typically when you switch jobs or retire. It seems like everybody and their brother is interested in rolling money out of your 401 k says daniel galli a. To do a rollover from a traditional 401 k to a roth ira however is a two step process.

Deciding which ira to choose. You can only roll an ira into a 401 k if the provider is willing and able to accept the deposit. You could also transfer money from an ira into a 401 k sometimes called a reverse rollover but in most cases it s not a good idea. The most common type of rollover is the 401 k rollover which lets you transfer money from a 401 k you had at a previous job into an ira or the 401 k at a new job this is the type of rollover we re going to focus on.

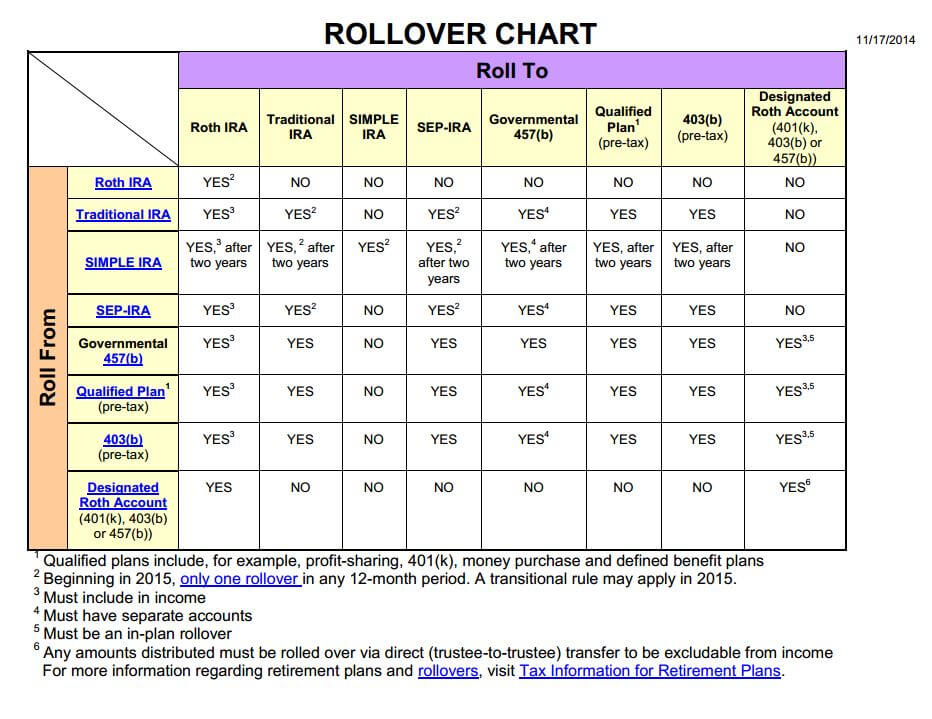

Roll to roth ira traditional ira simple ira sep ira governmental 457 b qualified plan1 pre tax 403 b pre tax designated roth account 401 k. Same goes for a roth 401 k to roth ira rollover. As with a 401 k rollover the easiest way to roll a traditional ira into a 401 k is to request a direct transfer which moves the money from your ira into your 401 k without it ever touching. Don t let anyone steamroll you into rolling over your 401 k to an ira.