Rollover 401k Into Ira

Just be sure to check your 401 k balance when you leave your job and decide on a course of action.

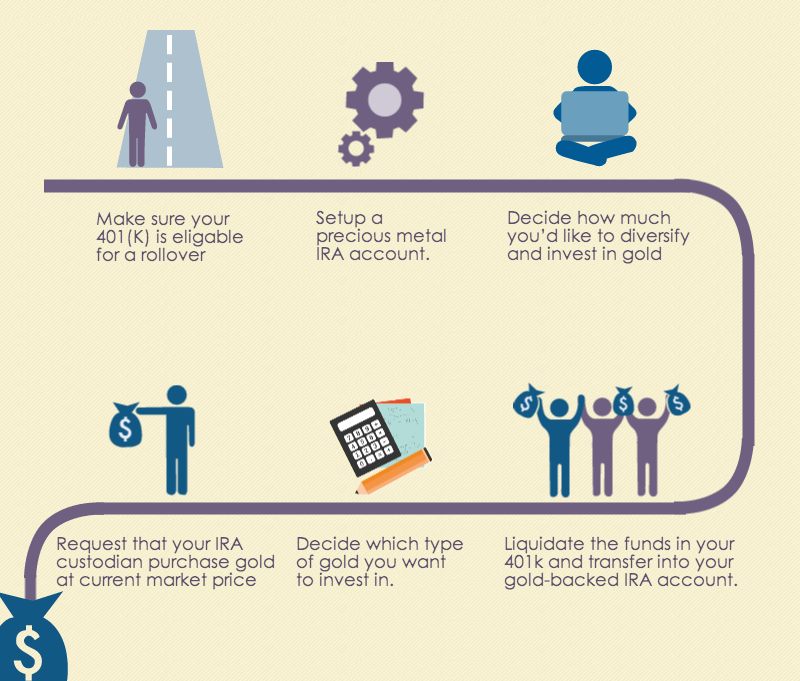

Rollover 401k into ira. Beyond the type of ira you want to open you ll need choose a financial institution to invest with. There are no opening closing or annual fees for fidelity s traditional roth sep simple and rollover iras. Same goes for a roth 401 k to roth ira rollover. A 401 k rollover is a way to move money from a workplace retirement plan to an individual retirement account typically when you switch jobs or retire.

In fact if yours is one of the increasingly common roth 401 k s a roth ira is the preferred rollover option. As with a 401 k rollover the easiest way to roll a traditional ira into a 401 k is to request a direct transfer which moves the money from your ira into your 401 k without it ever touching. That means you move a regular 401 k into a traditional ira and a roth 401 k into a roth ira. You can t roll a roth 401 k into a traditional ira.

You can rollover from a traditional 401 k into a traditional ira tax free. Why choose a rollover ira. An ira rollover opens up the possibility of a roth account.