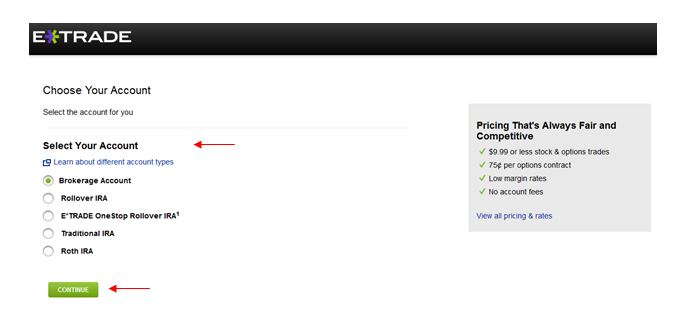

Rollover Ira Brokerage Account

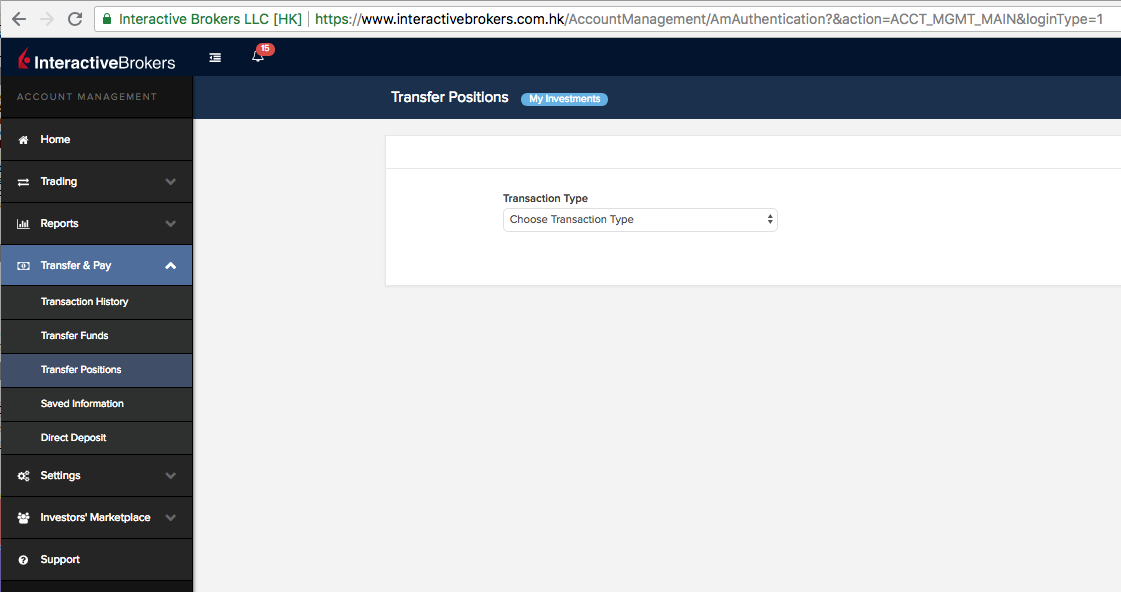

This can occur through a direct transfer or by a check.

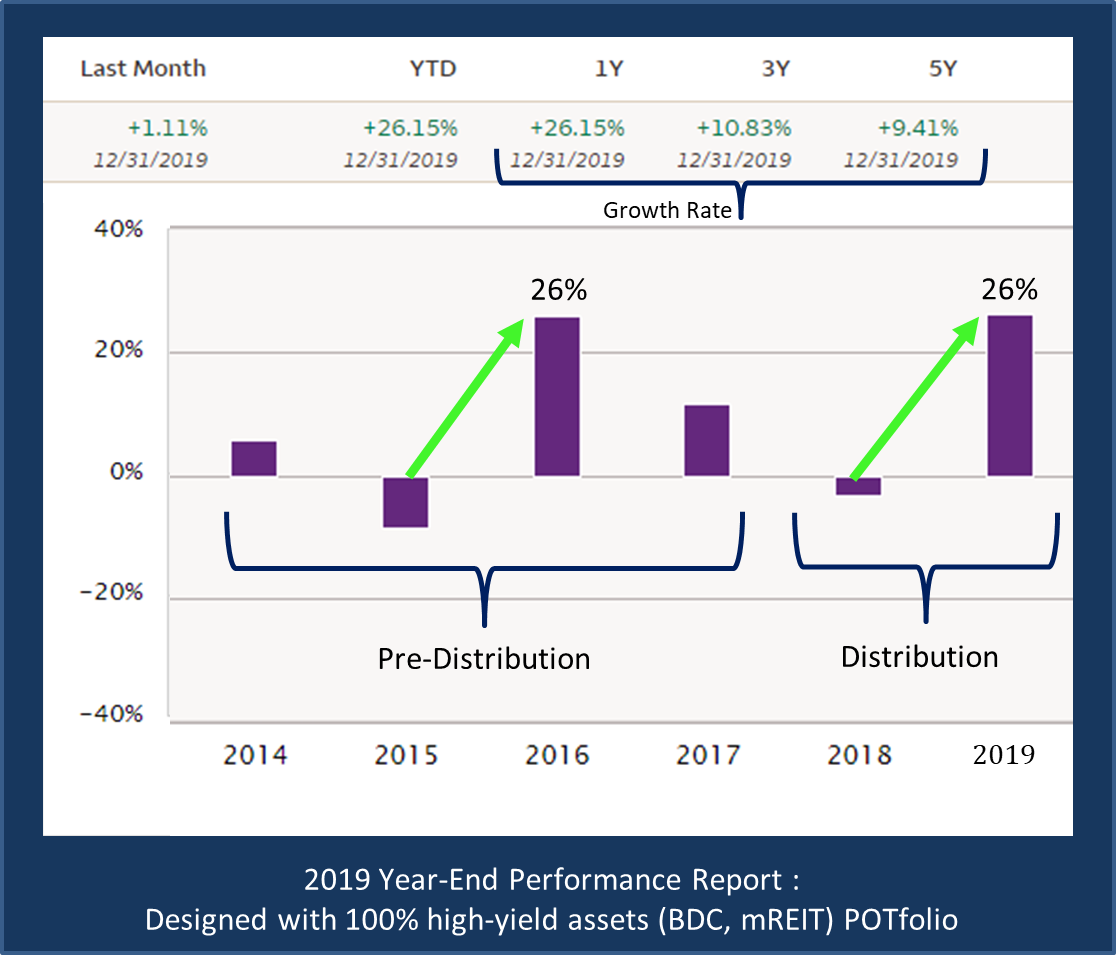

Rollover ira brokerage account. As a result an ira brokerage account must be a cash account not a margin account. When choosing a brokerage to house an existing rollover or new ira account it is important to consider the account s costs available investments and other key features. There s a 10 federal penalty tax on withdrawals of contributions and earnings before age 59. Importantly the one ira rollover per year rule doesn t apply to rollovers from a tax deferred ira account to a roth account.

There are some exceptions to the 10 penalty so be sure to check the irs website. It typically takes just 15. An individual retirement account or ira is one of the best places to save for retirement the tax benefits can give your savings a nice lift. Based on the features most important to the typical retirement investor we compared the 19 different brokers to find the best ira accounts available today.

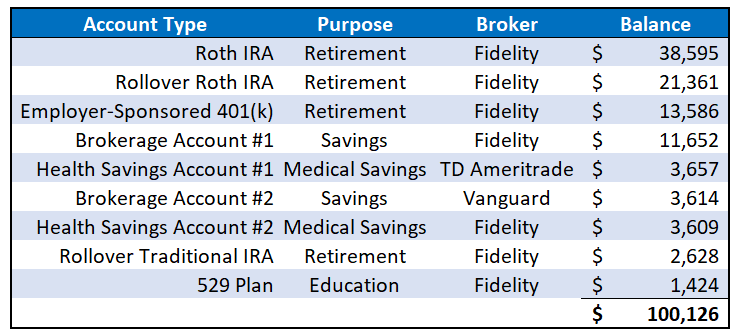

There s a 10 federal penalty tax on withdrawals of earnings before age 59. An individual retirement account rollover is a transfer of funds from a retirement account into a traditional ira or a roth ira. Some stock trading strategies require the leverage provided by a margin account to generate acceptable profits. These factors include but are not limited to investment options in each type of account fees and expenses available services potential withdrawal penalties protection from creditors and legal judgments required minimum distributions and tax consequences of rolling over employer stock to an ira.

Simply stated a rollover ira is an account that acts just like a regular brokerage account in all regards except that it is funded by transferring or rolling over money from a previous employer s retirement plan it is subject to the same restrictions for instance you can t make a withdrawal unless you pay your full tax rate plus a 10 penalty but for the most part it is far. These calculations show that moving the company stock to an ira might cost only 125 or so more in tax than moving it to a brokerage account and then benefiting from the nua advantages. To an ira at a separate brokerage account won t protect you.

/GettyImages-1017300682-3086d9bb0cc942df8fc62401a5286372.jpg)