Roth Ira Catch Up Contribution Limits 2015

No seps are funded by employer contributions only.

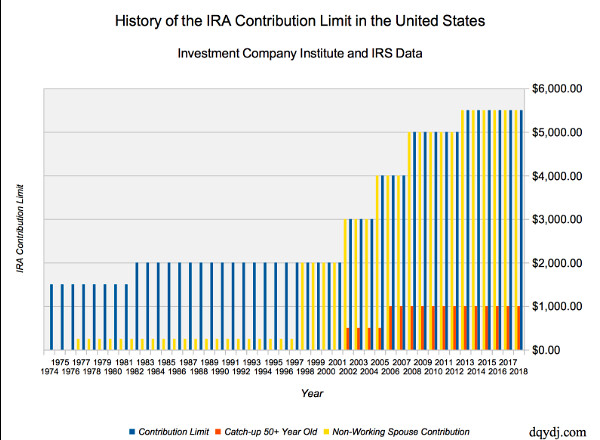

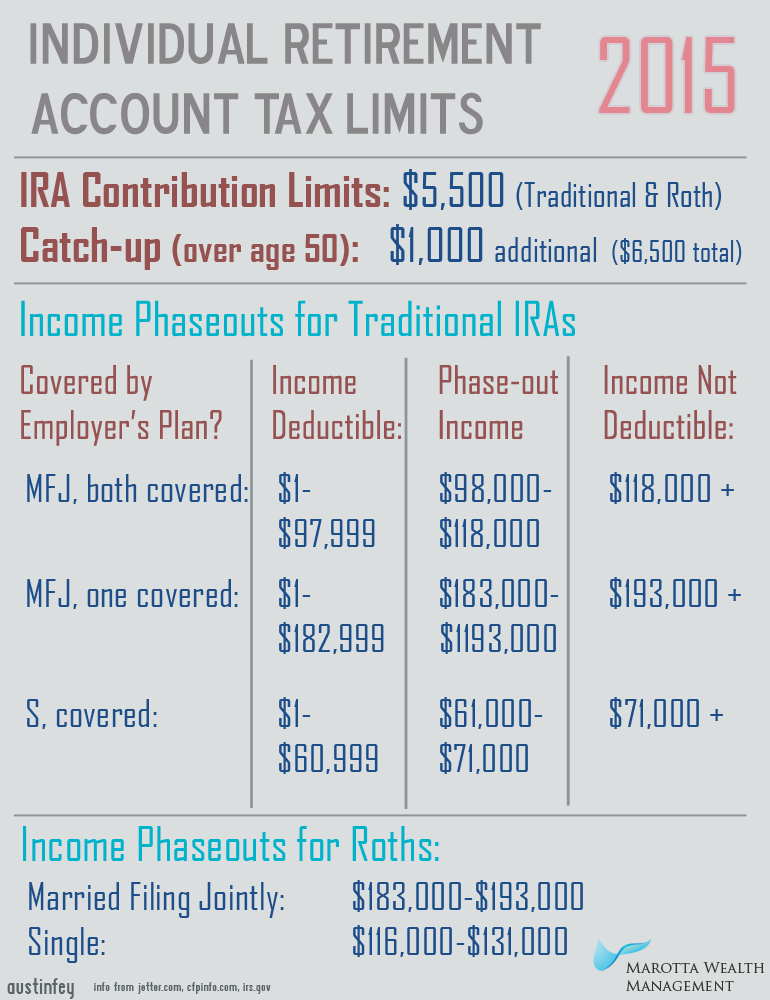

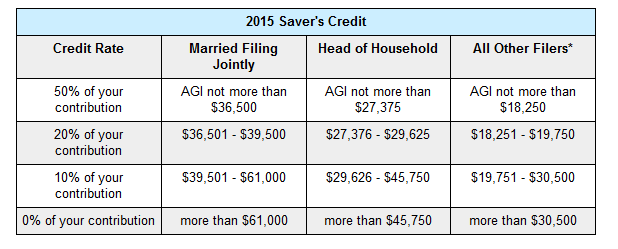

Roth ira catch up contribution limits 2015. Your ability to make a 2015 roth ira contribution as well as the limit of that contribution also depend on your income level as related to your tax filing status. Traditional and roth ira contribution limit will stay the same at 5 500 in 2015. If you have a traditional ira or roth ira and earn 124 000 or less per year 196 000 if married filing jointly you can contribute up to 6 000 to it in 2020. If you are age 50 or over the catch up contribution limit will also increase by 500 to 3 000.

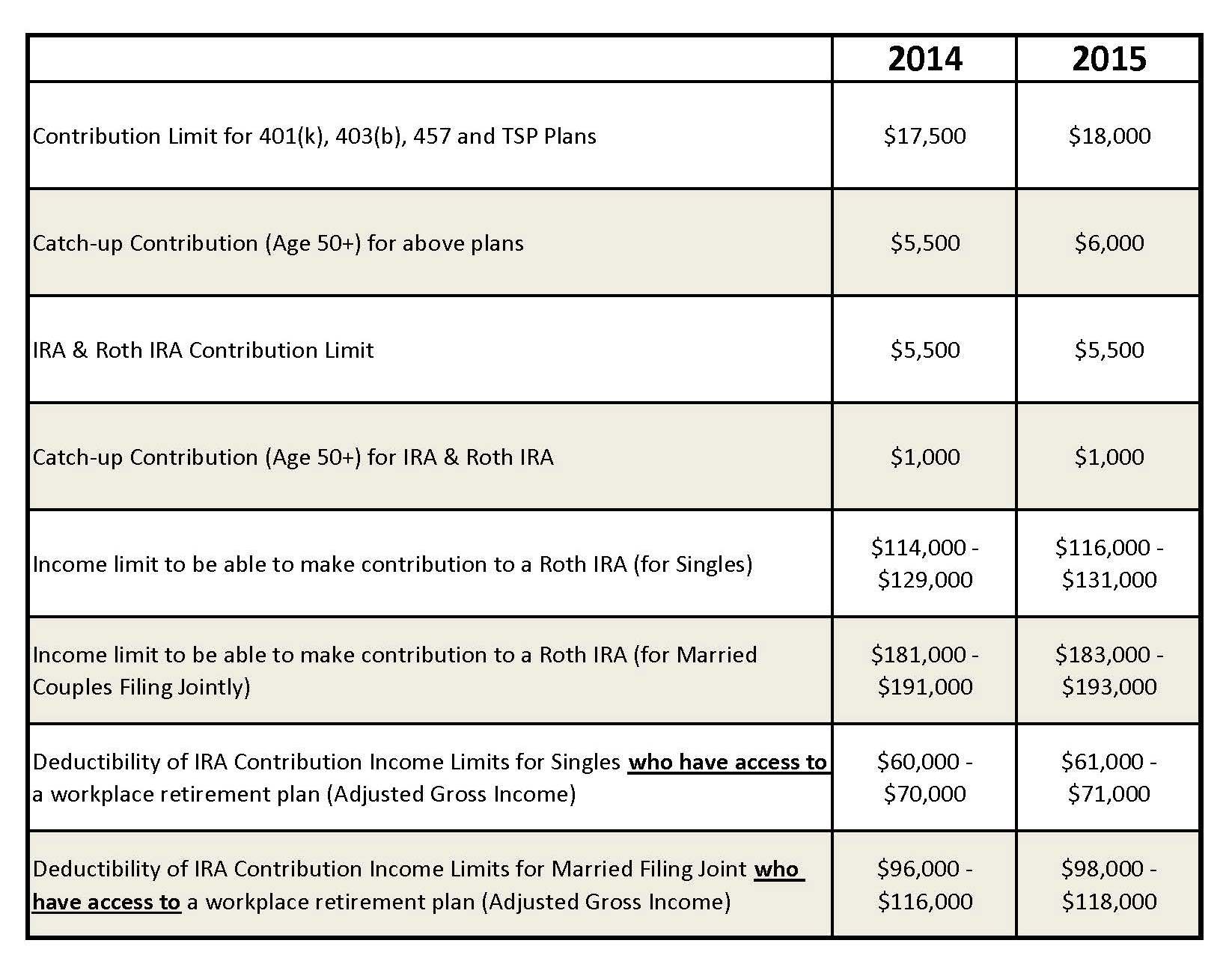

Annual 401k contribution limits which also applies to 403b 457 plans and the federal government s thrift savings plan will increase by 500 to 18 000 in 2015. They are separate from the elective deferral and annual addition limits. Catch up contributions are made on top of your regular employee contributions. Salary reduction contributions in a simple ira plan are not treated as catch up contributions until they exceed 13 500 in 2020 13 000 in 2015 2019.

Her total traditional ira and roth ira contributions cannot exceed 6 000 for 2019 and may be made in addition to her sep contributions. Can i make catch up contributions to my sep. 403 b plan catch up amounts employees with at least 15 years of service may be eligible to make additional contributions to a 403 b plan in addition to the regular catch up for participants who are age 50 or over. Ira contribution limits the ira contribution limits are the same for both the 2014 and 2015 tax years.

The catch up contribution for those over 50 will also increase by 500 to 6 000. Catch up contribution limits for traditional and roth iras. To be eligible to make these special contributions you must be on track to meet the irs elective deferral limit. If you are age 50 or older you can add catch up contributions of 1 000 more or up to 7 000 in total.

2015 roth ira income limits. Because your maximum 2015 roth ira contribution limit phases out as your income rises above the threshold for making the maximum contribution. 5 500 plus an extra 1 000 catch up contribution for those age 50 or older. Catch up contributions for simple iras increase to 3 000 from 2 500 in 2015.

The age 50 catch up limit is fixed by law at 1 000. Deductible ira income limit. If you have a sep ira you may contribute up to 53 000 or 25 of up to 265 000 in gross income in 2015. Traditional and roth ira contribution limit.

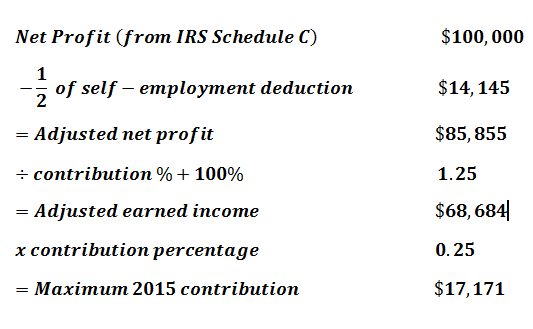

For the the are self employed the total employer plus employee contributions to all defined contribution plans by the same employer will go up by.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/heaps-of-coins-of-euro-with-green-natural-plants-it-they-are-born--illuminated-by-the-light-of-the-sun-691426912-5ab43358a9d4f900375661dc.jpg)