Schwab Intelligent Portfolio Vs Wealthfront

/wealthfront-vs-charles-schwab-intelligent-portfolios-dc8b708347dc461fb7dd0970a48de0c3.jpg)

Charles schwab intelligent portfolio vs wealthfront.

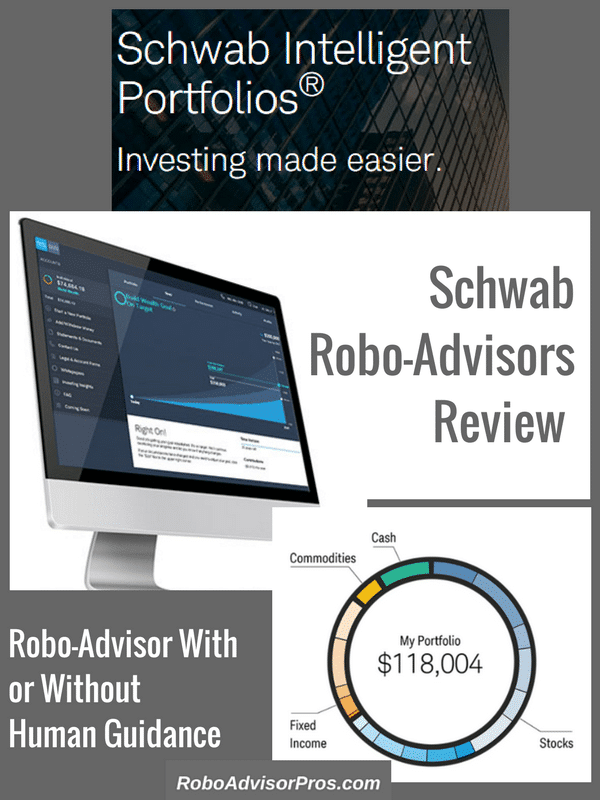

Schwab intelligent portfolio vs wealthfront. How does it compare to wealthfront. Wealthfront vs charles schwab intelligent portfolios for online robo investing 2020. Users are also insured for 500 000 by the sipc and all cash held with schwab is insured for up to 250 000 by the fdic. Schwab intelligent portfolios also has a good reputation and the same level of account security as wealthfront.

Read our comparison chart below. Charles schwab intelligent portfolios 0 0 management fee will attract younger investors although the relatively high 5 000 minimum may prove a barrier for some. Charles schwab intelligent portfolio is a robo advisor offering more diversified portfolios with completely free management. Schwab is a massive u s.

As of the end of 2018 schwab intelligent portfolios held 33 4 billion in assets and ranked among the biggest in the industry. Charles schwab intelligent portfolio charges no service fees rebalance fees or commissions. Wealthfront was the highest scoring robo advisor we reviewed in 2019 so it is no surprise that it has the edge over schwab intelligent portfolios in the key areas of goal planning account set up.

:max_bytes(150000):strip_icc()/wealthfront_productcard-5c74508fc9e77c000136a5cb.jpg)

:max_bytes(150000):strip_icc()/charles-schwab-intelligent-portfolios-vs-Etrade-core-portfolios-fc534558828e425b9418c5bafecc82ae.png)