Sell Settlement

Should you decide to sell your lawsuit settlement you are not required to sell all payments at once.

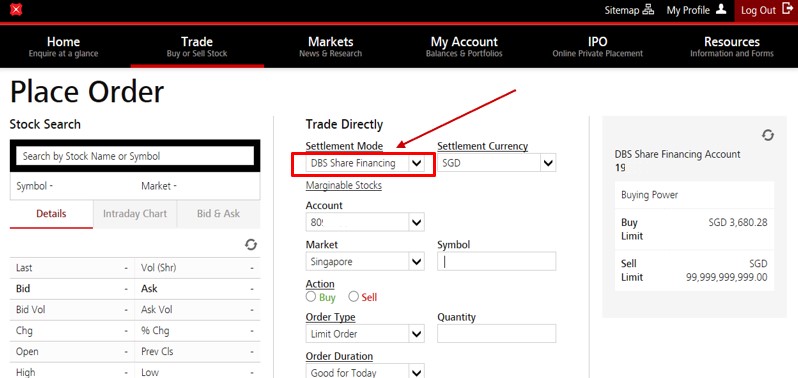

Sell settlement. Some of the data you input into a life settlement calculator will determine whether you qualify to sell your life insurance policy to a third party for cash. Many people decide to sell only a portion of their payments. For non giro clients sales proceeds will be paid on settlement date. If you have selected the trade you have sold to be settled in foreign currency all sales proceeds will be kept in trust in your online trading account according to the settlement currency that you have chosen.

In the securities industry the trade settlement period refers to the time between the trade date month day and year that an order is executed in the market and the settlement date when a trade. Each state does have its own regulations to oversee the process so refer to those legal nuances before getting started. Also check your settlement agreement for anti sale or anti assignment language although some companies may still be able to help you. You must then inform your trading representative on the same day trade day so that the contract can be manually amended to cpf.

When does settlement occur. For most stock trades settlement occurs two business days after the day the order executes. Amendment not done on trade day will result in short selling. Yes it is completely legal to sell a structured settlement in most cases.

The vast majority of people who sell structured settlement payments sell only a portion of those payments. If you wish to sell your holdings of such counters currently in your cpfis account. Or you could decide to sell six months worth of payments. The sell order should be placed with payment type cash.

Another way to remember this is through the abbreviation t 2 or trade date plus two days. You must be at least age 65 to make a traditional life settlement and some life settlement companies including harbor life require you to either be age 70 or older or have a severe medical condition. By doing this they will resume receive payments in the future. Settlement marks the official transfer of securities to the buyer s account and cash to the seller s account.

For example you might receive 5 000 a month and decide to sell 1 000 of each payment for the next two years. There are options which can be adjusted to meet your financial needs.