Sell Your Annuities

However if you find yourself in financial trouble you may consider selling your annuity.

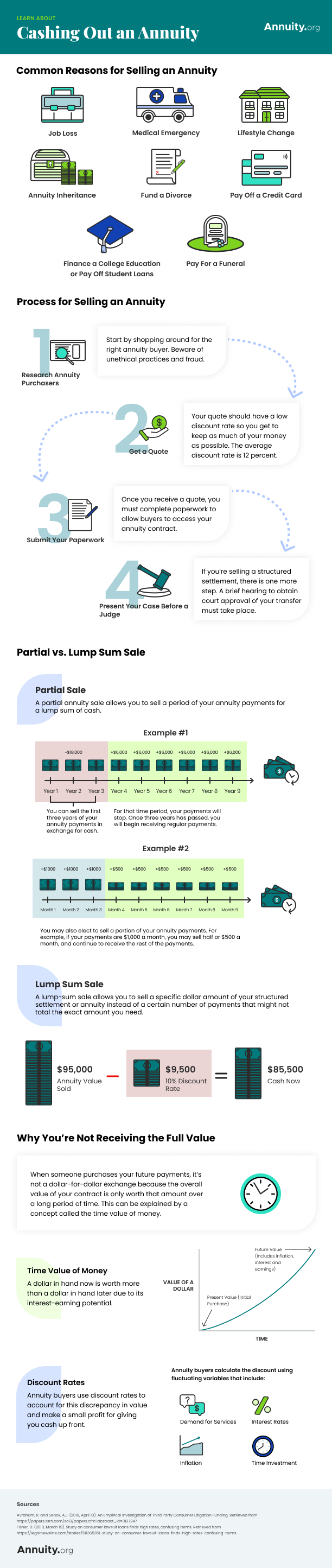

Sell your annuities. Single premium immediate annuities spias longevity annuities also called deferred income annuities or dias fixed rate annuities also called multi year guarantee annuities or mygas qualified longevity. Selling an annuity is a legal process. Just as it sounds this option is for those looking for the maximum sum of money. With this option you are choosing to sell your annuity or structured settlement in its entirety ending any chance of periodic income payments in the future.

First and foremost selling your annuity does not guarantee a full payout equal to the initial value of the contract. Secondly you ll need to research companies that buy annuities for cash. Understanding different types of annuities. Selling your annuity payment does have tax implications.

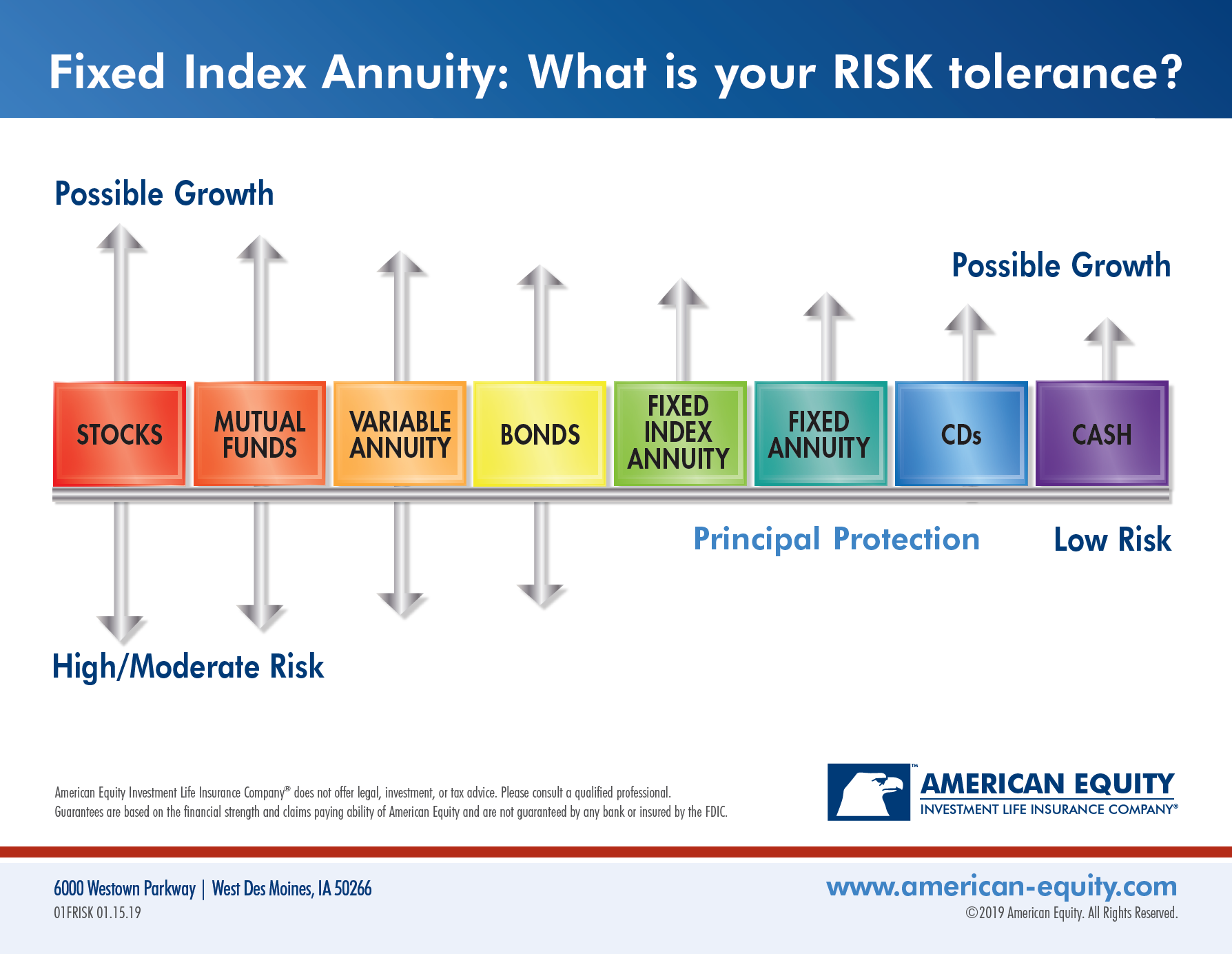

Therefore there are certain steps you need to take to do it correctly. Like any investment decision the decision to sell your annuity should be made after careful consideration of your situation and consultation with your financial advisors to avoid any financial mistakes. For an agent to sell fixed annuities they only need a life insurance license issued by their state of residence fixed annuities are primarily represented by five different products. We offer free expert advice on how you can make the most of an annuity or structured settlement and how and where you can sell your payments.

Annuities can be a great source of regular reliable income during your retirement years. Selling annuity payments could be the solution for an array of financial woes. Similarly if you have not contributed to other more tax advantaged retirement accounts such as a 401 k 403 b roth ira etc or plan on receiving the money before age 59. 2 you can sell a portion of your scheduled annuity payments which involves selling part of each regular payment you receive this is also known as a partial buyout while you keep the balance.

Once you ve determined that selling your annuity payments is the right step for you there are a variety of things you can do with your lump sum. In exchange for quick turnaround on cash annuity buyers will charge a fee and sell your annuity at a discounted rate for profit. Selling your annuities may not be appropriate anymore when you have not established an emergency fund to cover living expenses for at least three to six months. Tips on selling your annuity or structured settlement.

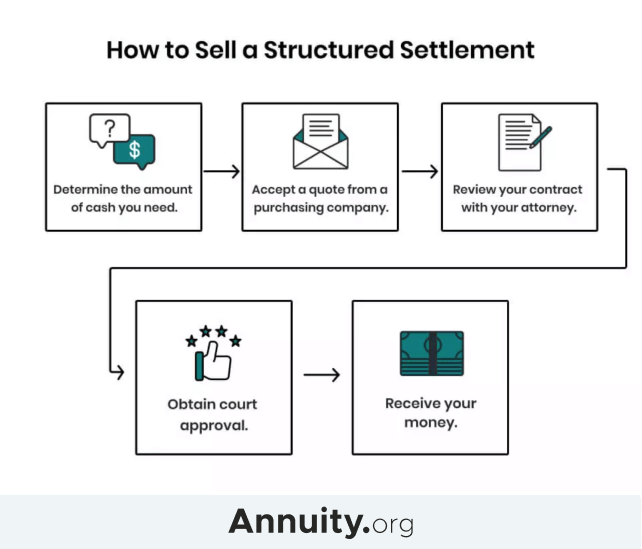

Below we take you through our step by step process of getting cash for your. We are happy to provide you with a full buyout option and will guarantee the highest value. Whether that includes buying a new house paying for a new car paying for college tuition or even balancing medical expenses cashing out a portion of your annuity could be the solution to avoiding unnecessary debt. How to sell your annuity.

3 you can sell all of your annuity payments in exchange for a lump sum amount.