Selling My Annuity

Tips on selling your annuity or structured settlement.

Selling my annuity. Annuity owners invest in an annuity agreement for financial stability after retirement or as a trust to secure their families futures. Selling a portion of my. In most cases these are the different routes that we can take. What are my annuity sale options.

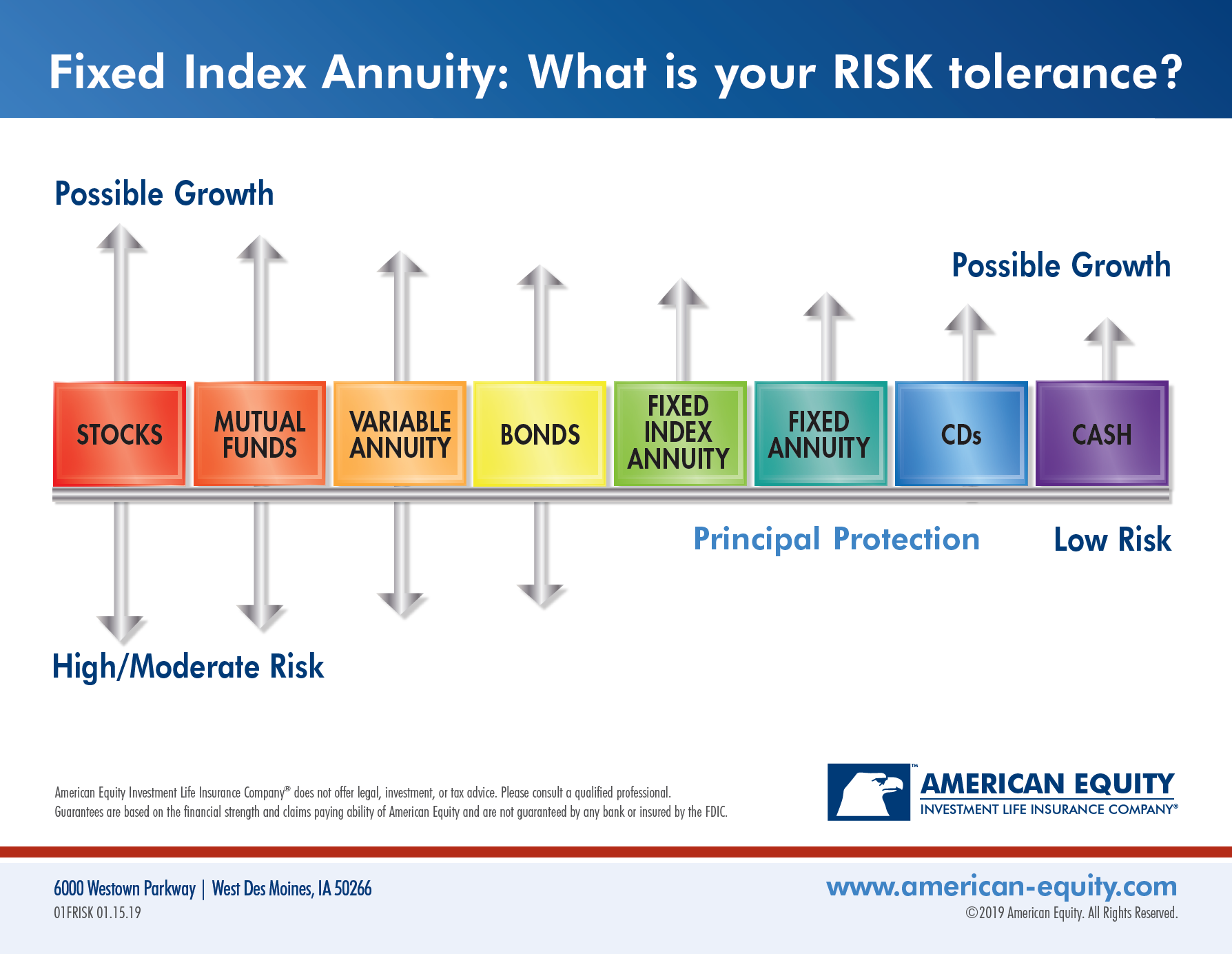

In exchange for quick turnaround on cash annuity buyers will charge a fee and sell your annuity at a discounted rate for profit. Understanding different types of annuities. When considering selling your annuity it doesn t have to be all or nothing we can buy a portion of payments a period of payments or buy your entire annuity altogether sometimes referred to as an annuity cash out. A surrender fee is when you are charged a penalty for taking out your money before the surrender period ends.

First and foremost selling your annuity does not guarantee a full payout equal to the initial value of the contract. Selling my annuity payments. Selling your annuity payment does have tax implications. Like any investment decision the decision to sell your annuity should be made after careful consideration of your situation and consultation with your financial advisors to avoid any financial mistakes.

A partial sale a sale in its entirety or lump sum sales. This sells your payments from the annuity for a set period of time. However if you find yourself in financial trouble you may consider selling your annuity. There are three ways you can sell your annuity.

Selling my annuity in the face of an investment opportunity large amounts of debt or unexpected medical expenses selling part or all of your annuity may give you the financial freedom you need. We offer free expert advice on how you can make the most of an annuity or structured settlement and how and where you can sell your payments. Yes riders can impact the amount of cash you receive when you sell your annuity. Does it influence selling my annuity.

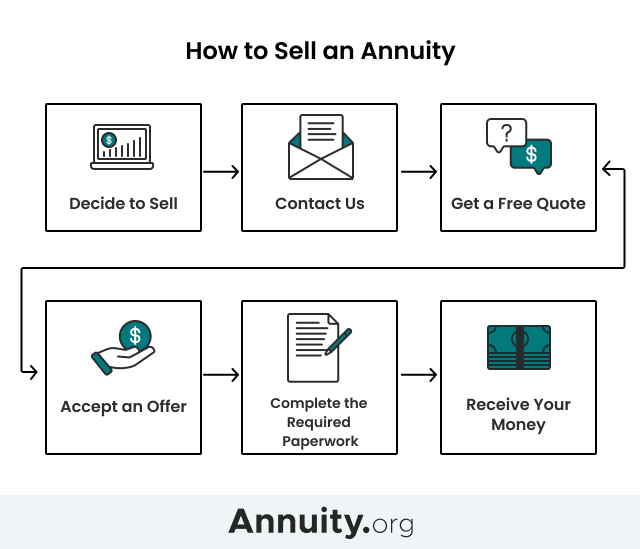

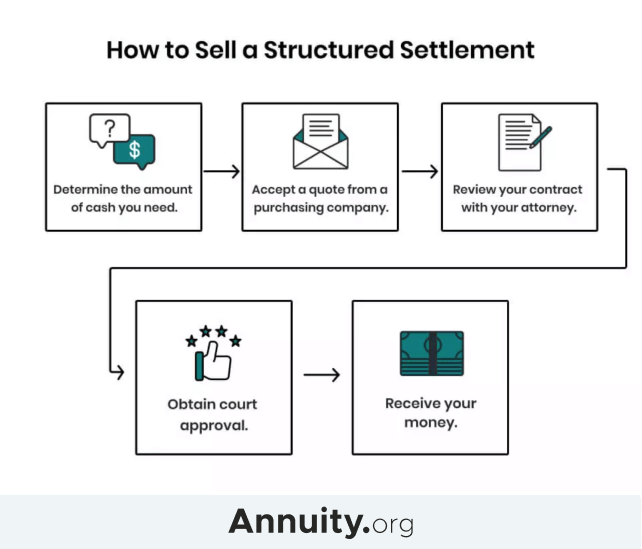

How selling your annuity for cash works. Annuities can be a great source of regular reliable income during your retirement years. A surrender period of an annuity is the time in which the investor must keep a certain amount of money if not all in the annuity account. If your financial needs have changed recently selling the rights to these payments in exchange for a lump sum payout from a company that specializes in buying annuities can give you some financial flexibility.

Sell my annuity llc will not only help determine if you should sell your structured settlement or annuity we. You can sell your annuity or structured settlement payments for cash now. Here s how they compare. For example say your annuity that covers you for life and you re 40 years old.

/annuity-1a2c27eba1cb4ecf85aca9e888096cbd.jpg)