Set Up Payroll For Small Business

Apr 21 2020 by megan totka in small business operations 3 296.

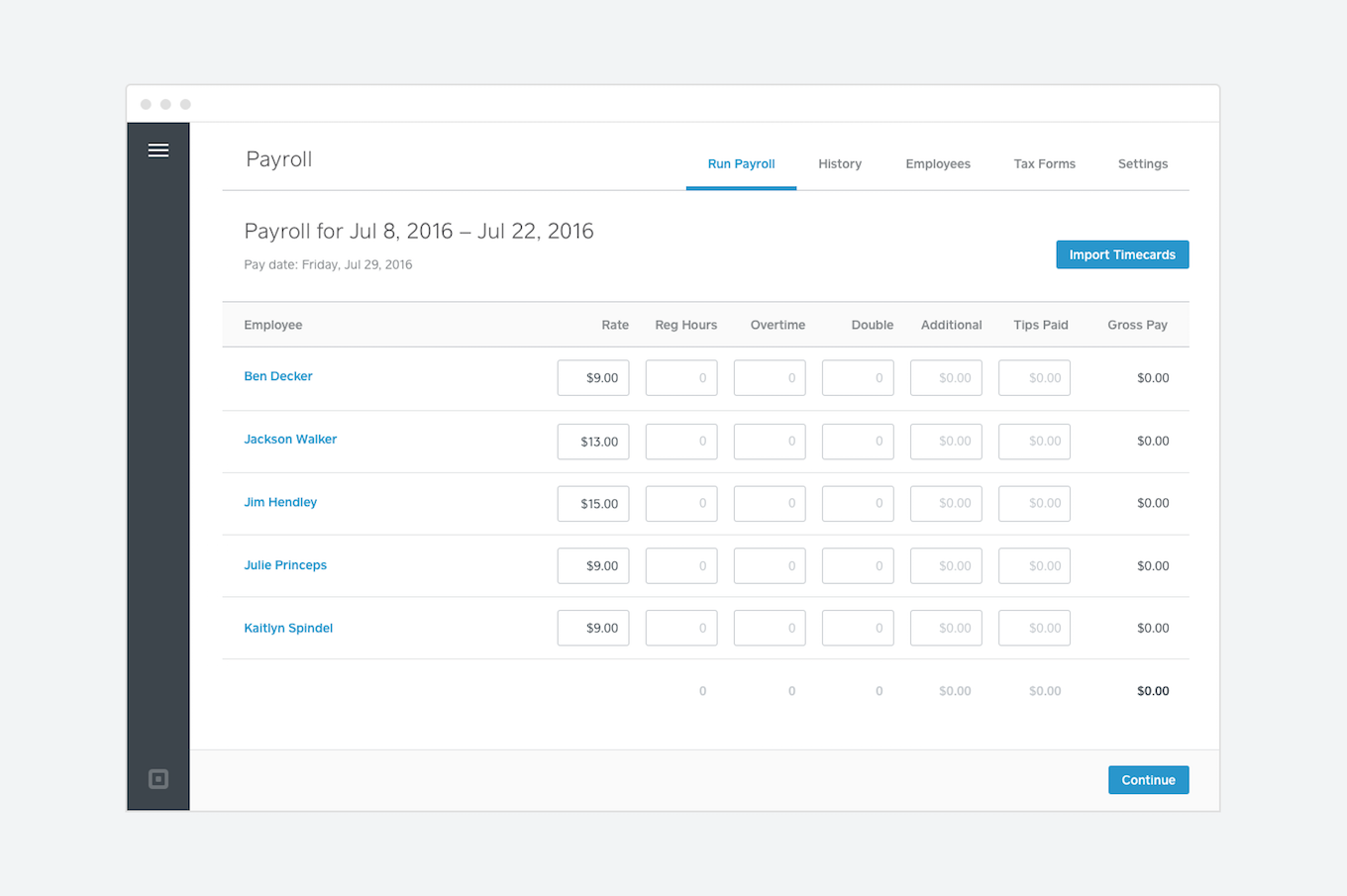

Set up payroll for small business. You can choose when and how often to pay your employees. With stp you report employees payroll information such as salaries and wages pay as you go payg withholding and super to us each time you pay them through stp enabled software. Once you ve gathered all the information about your employees it s time to set up payroll. 8 important steps to set up your small business payroll solution published.

Steps to set up payroll for your small business. How to set up payroll for a small business. Set a payroll schedule. Payroll is the largest expense for a lot of small businesses.

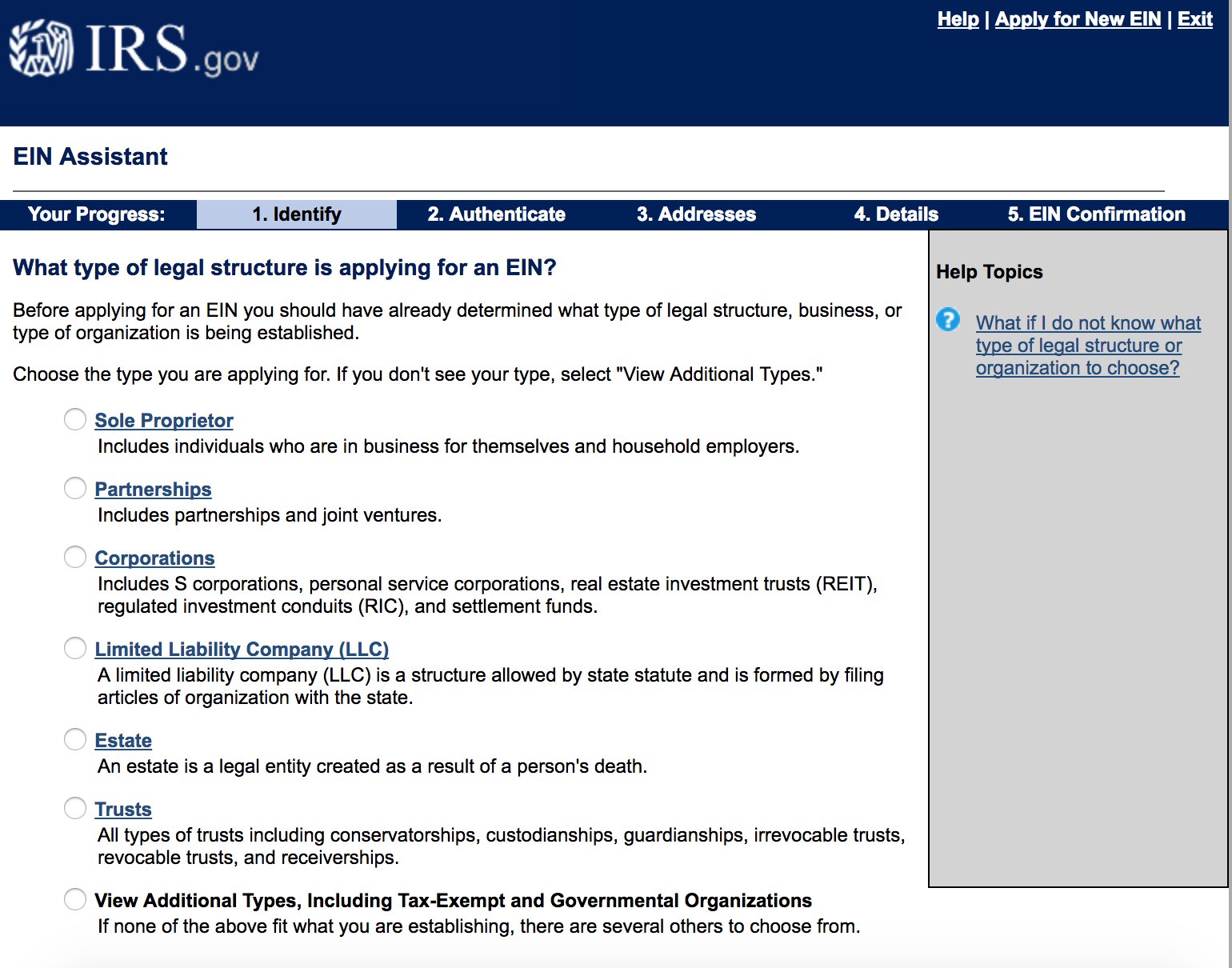

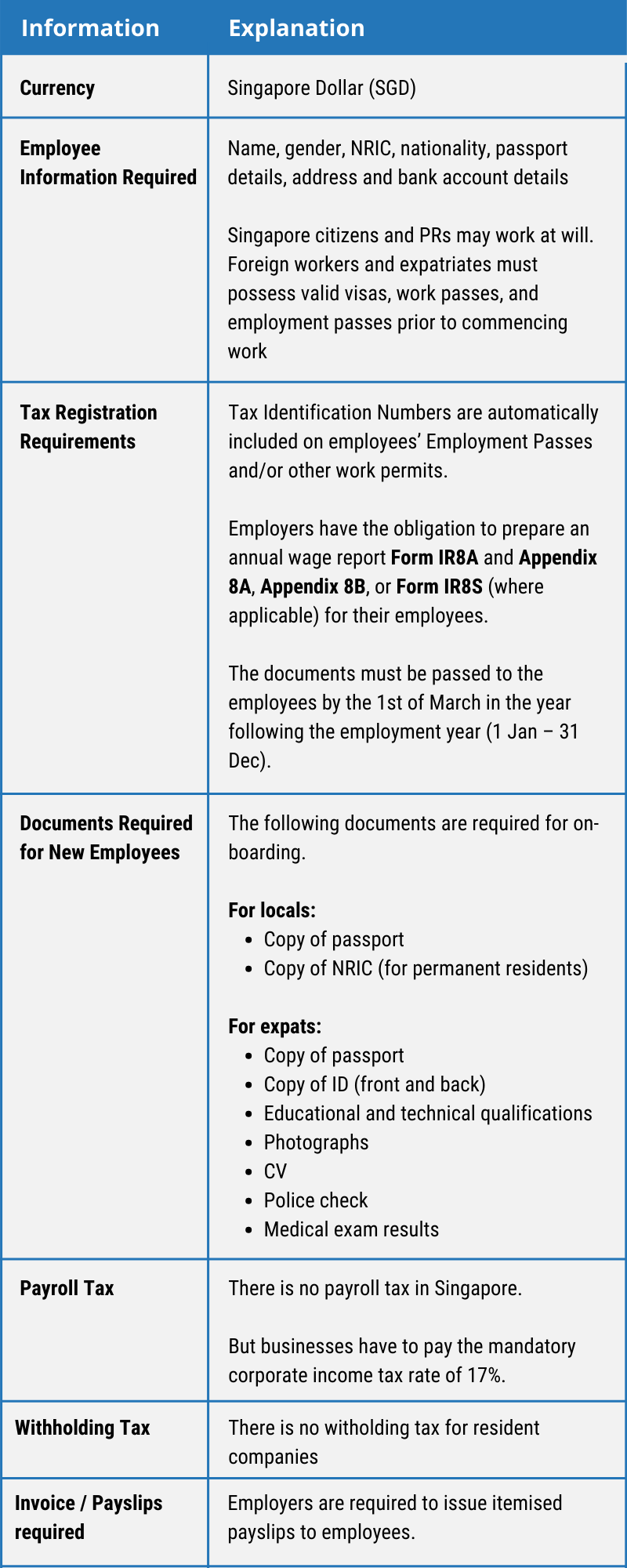

You must establish your business before you can hire and pay employees. Will running payroll cause cash flow problems. Setting up payroll if you decide to run payroll yourself you need to complete certain tasks to pay your employees for the first time. Find out if the employment arrangement between the worker and the payer is an employer employee or business relationship.

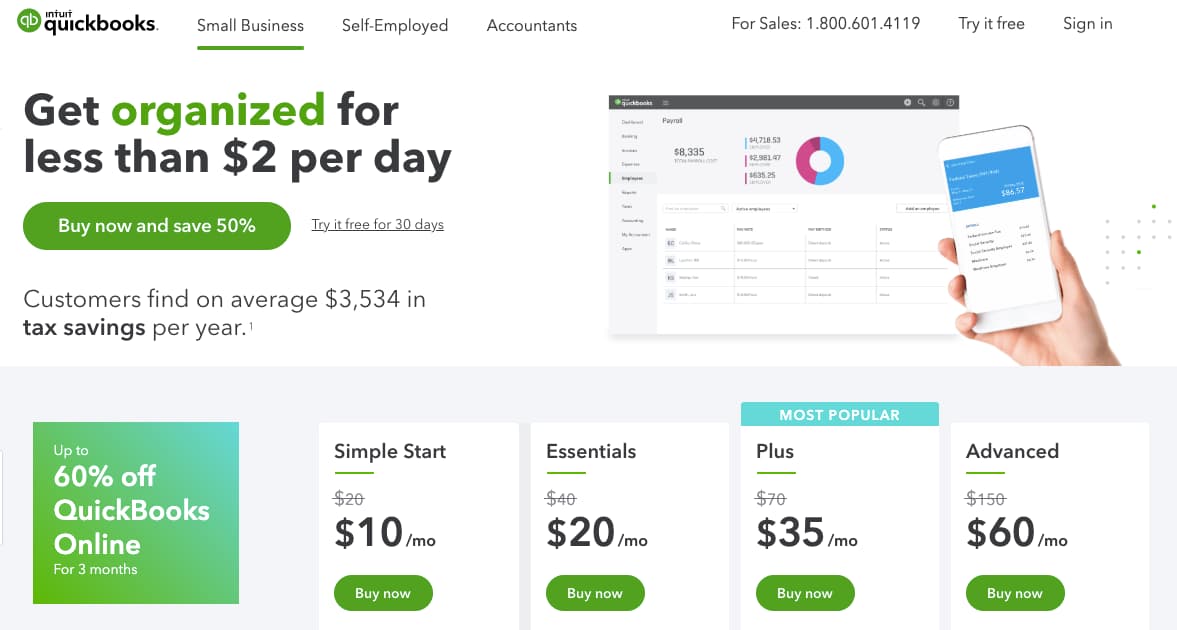

This includes setting up your business to legally run payroll and making some decisions about pay frequency pay rates and processes you want to establish like due dates for employee time cards. What do your employees need. Everything you need to know about creating a business invoice. Most small business customers who use quickbooks pay their employees weekly.

You have to learn how to set up payroll get employee information run payroll and pay and file taxes. Don t worry if the diy method is not for you payroll services make it easier for small business owners to pay their employees and get back to their core business functions. Employees are usually paid several days after a pay period ends to allow time to calculate hours and withholdings. Employing a caregiver baby sitter or domestic worker find out if you are considered to be the employer of that person.

Is there a period of time when it s more convenient for you to run it. Before your employees pass go and collect 200 set up your schedule in a way you re comfortable with. Most payroll services calculate employee pay and taxes automatically and send your payroll taxes and filings to the irs and your state s tax department s for you. Single touch payroll stp is a new way of reporting tax and superannuation information to us.

If you re about to run payroll for the first time you might be overwhelmed. There are so many new terms and processes to learn. Below are the steps involved with setting up and maintaining payroll for your employees. Jul 19 2016 last updated.