Should I Get A Personal Loan To Consolidate Debt

How to consolidate debt with a personal loan.

Should i get a personal loan to consolidate debt. Taking out a personal loan to pay off high interest credit card debt may sound like an easy and simple solution but it shouldn t be done lightly. Combining multiple types of debt such as credit card and store card balances loans overdrafts and payday loans. See if you prequalify get started cons of debt consolidation with a personal loan. If you re deep in debt and struggling to find a way out you may be considering a debt consolidation loan as a solution to your problem.

Use the money from the loan to pay off your debt then pay back the loan in installments over a set term. There are some potential disadvantages to consider before you decide to use a personal loan to consolidate your debt. If you qualify for a loan at a favorable rate your new lender should charge you much less in interest than many of the debts you re trying to pay back. When you re using a personal loan to consolidate debts a longer term gets you lower monthly payments but you ll have a higher interest rate.

As a financial planner this is a question i am asked frequently. Using a personal loan to consolidate debt has several advantages including. In the last decade personal loans have become much more common for small projects big but not huge purchases and for debt consolidation. To get the best personal loan for debt consolidation you should get quotes from several different personal loan lenders.

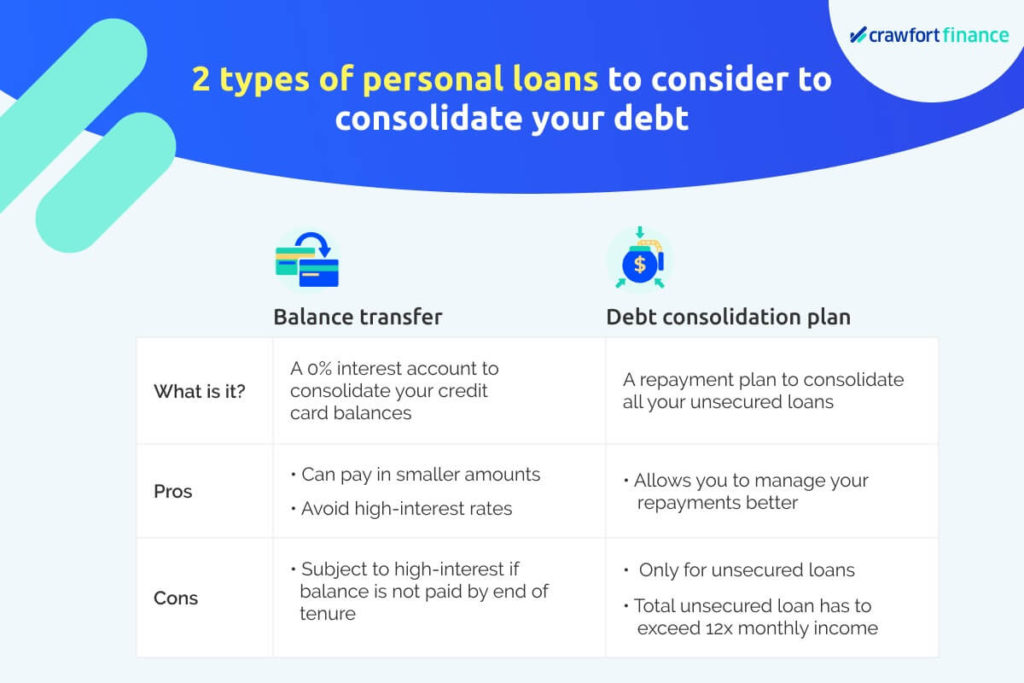

Is it smart to get a personal loan to consolidate debt. Lowering your interest rate. Consolidating debt with a personal loan when people mention debt consolidation they are usually referring to one of two different methods. By consolidating multiple debts and outstanding balances into a new loan product you can rid yourself of the need to make several payments each month simplify your life and even lower your monthly out of pocket expense.

Consolidating your debt with a personal loan could help your credit scores if it leads to a lower credit utilization rate and more on time payments. Get a fixed rate debt consolidation loan. You also want to know about the fees and expenses. Compare interest rates repayment terms and qualifying requirements to.

Two additional ways to consolidate debt are.