Should I Transfer 401k To Ira

Another option is to roll 401 k accounts from former employers into your current employer s plan assuming.

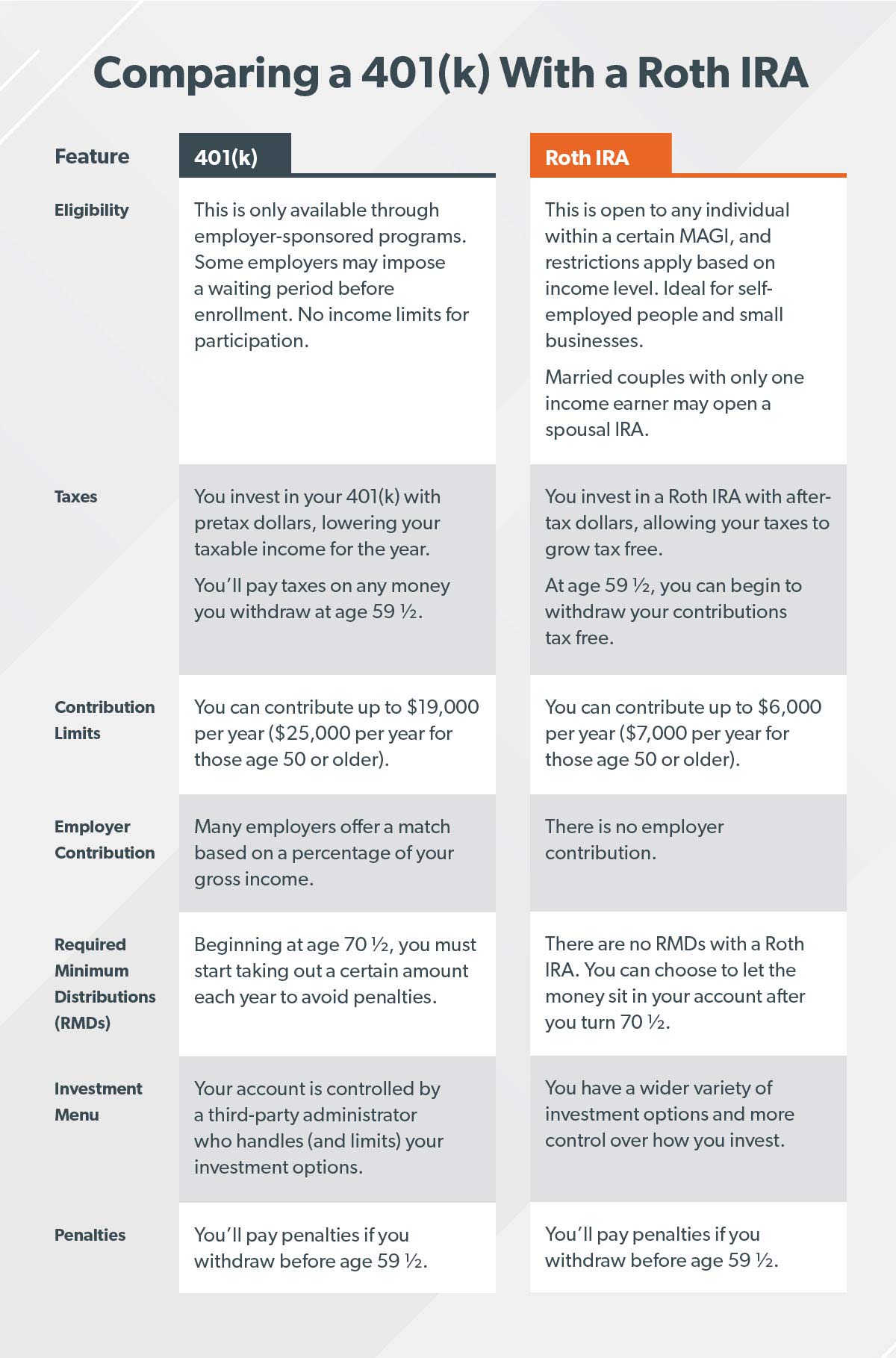

Should i transfer 401k to ira. More eligible rollover distribution. An ira rollover is a transfer of funds from a retirement account into a traditional ira or a roth ira via direct transfer or by check. Rolling over your 401 k to an ira i e. However when you leave your job or retire you may want to transfer your 401 k plan to a traditional ira to maintain the tax deferred status of the account or to consolidate your retirement accounts.

An ira rollover is a transfer of funds from a retirement account into a traditional ira or a roth ira via direct transfer or by check. As with a 401 k rollover the easiest way to roll a traditional ira into a 401 k is to request a direct transfer which moves the money from your ira into your 401 k without it ever touching. Having everything in one account makes it easy to update and change beneficiaries manage investments and take withdrawals. 401 k s 403 b s sep accounts simple accounts keoghs individual 401 k s and some 457 plans can all be transferred into one ira account.

Traditional ira structure. If you retire at age 55 and roll over your 401 k to an ira you ll have to wait 4 1 2 years longer to withdraw your funds without a penalty. Employers provide 401 k plans so their employees have a tax deferred retirement savings plan. You can withdraw money from an ira at any time without penalty after age 59 but withdrawing money from a past employer s 401 k plan will require jumping through a few more hoops.

In that case it can make sense to consolidate all of your old 401 k plans in an ira. More sneaking in the backdoor roth ira.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)