Small Business Loan Interest

Terms and loan security.

Small business loan interest. Pay interest only on the amount you owe. A simple loan to help you manage or grow your business. The average interest rate for a small business loan varies depending on your qualifications as a borrower the type of loan you re applying for and which lender you select. Get flexibility in how you repay your loan.

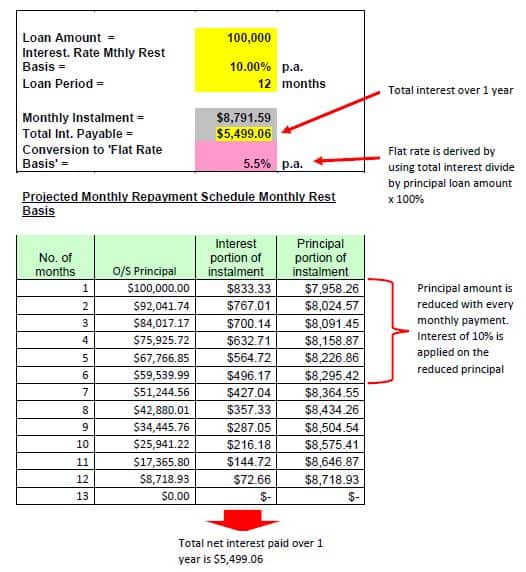

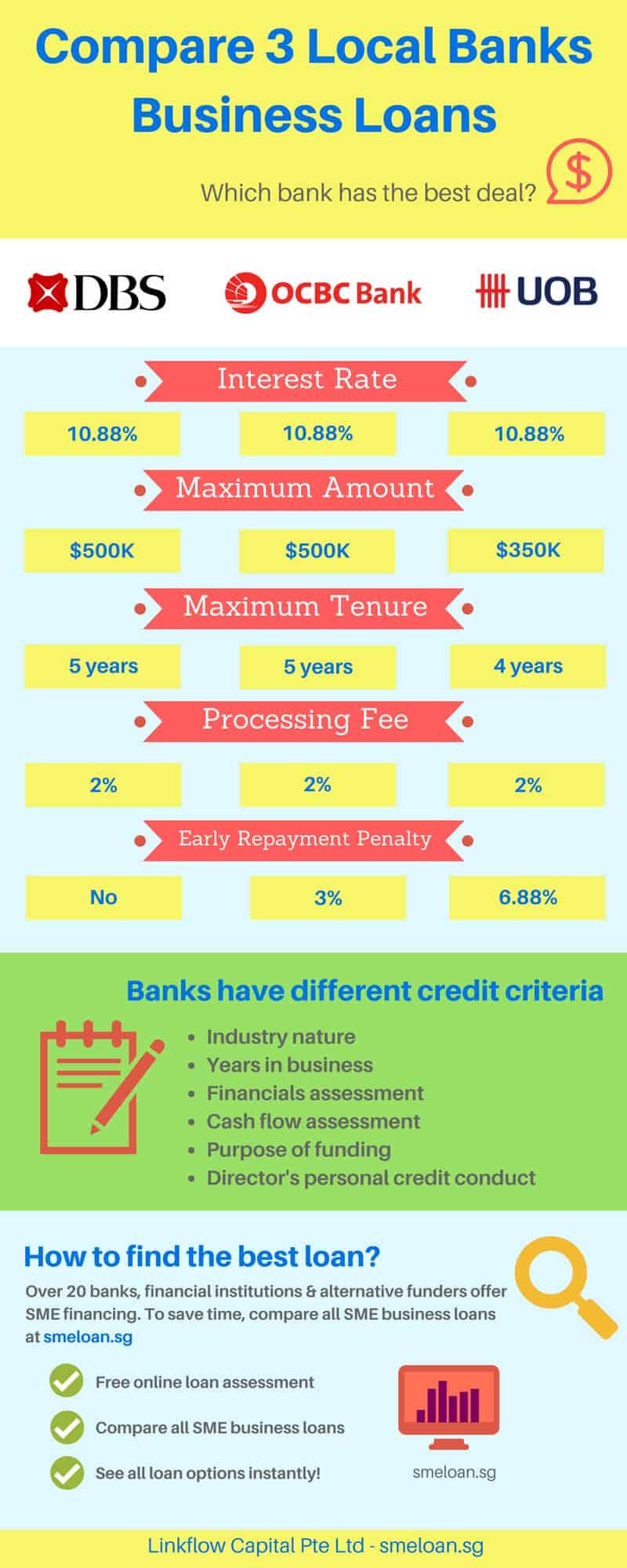

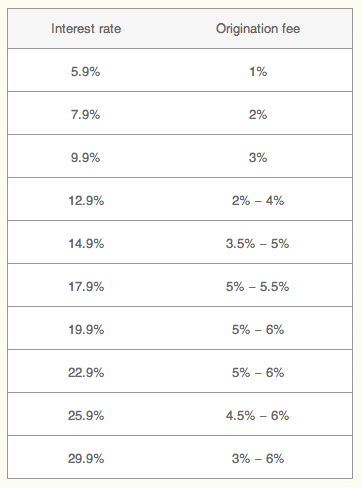

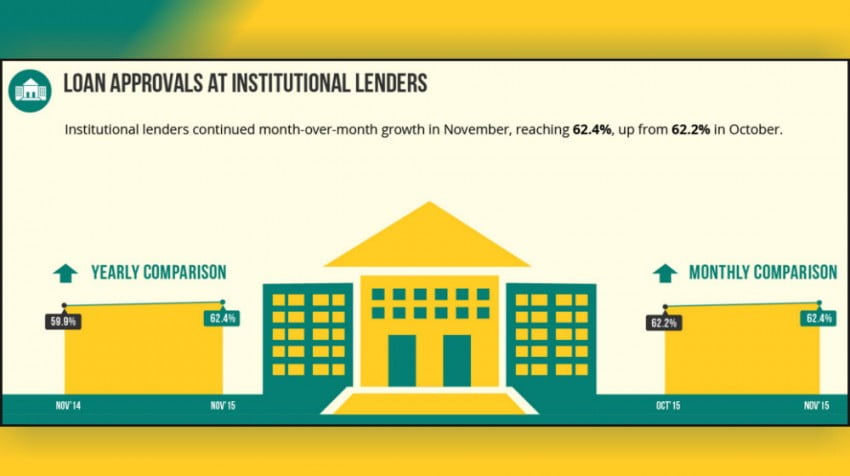

It can be secured or unsecured with flexible repayment options. Keep track of your business loan balance and financials online and at tax time export details of interest paid to your accounting software. Our small business loan interest rate calculator can show you the rates you might pay and check your eligibility for lending up to 25 000. Loans from traditional lenders such as banks or credit unions can have annual percentage rates aprs ranging from 4 to 13 while alternative or online loans can have aprs ranging from 7 to over 100.

The small business cashflow loan scheme has been extended until the end of 2020. Flexible security options 2 include. The term of your business loan will vary depending on security offered you may swap if your situation changes. This could include repurposing the small business cashflow loan scheme setting up a small business growth fund establishing a micro finance company for small businesses or expanding the mandate of the venture investment fund.

Small business guidance loan resources. A small business loan 1 can help you purchase business assets or finance expansion plans. Organisations and small to medium businesses including sole traders and the self employed may be eligible for a one off loan with a term of 5 years if they have been adversely affected by covid 19. Get an interest free loan of up to 40 000 to help cover operating costs where your business s revenues have been reduced due to the economic impacts of covid 19.

Business assets business real estate. Fixed or floating interest rates are available for small business loans. Applications opened on 12 may 2020 and can now be submitted up to and including 31 december 2020. Under the small business cashflow loan scheme businesses can get a loan of 10 000.

Canada emergency business account. You can now also check the rates you re likely to pay for lending up to 50 000. Borrow from 10 000 for business purposes. Make extra repayments and access them with redraw.

Here s what you get. Depending on the type of sba loan they can be used for various purposes including business start up or acquisition working capital real estate franchise financing debt refinancing or improvements and. Contact your primary financial institution for information. Small businesses are encouraged to do their part to keep their employees customers and themselves healthy.