Small Business Loan Terms And Rates

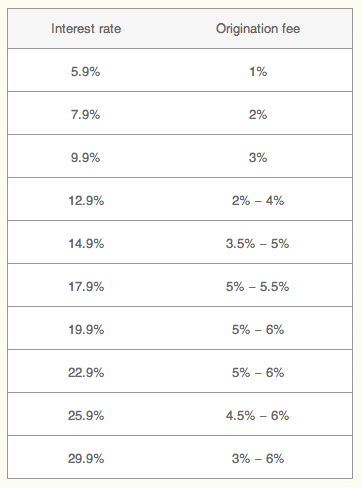

Loans from traditional lenders such as banks or credit unions can have annual percentage rates aprs ranging from 4 to 13 while alternative or online loans can have aprs ranging from 7 to over 100.

Small business loan terms and rates. Applicants can receive initial funding five days after signing loan closing documents. If you run a for profit business you are likely eligible for a 7 a business loan in the eyes of the sba. However the partner lenders are ultimately responsible for borrower eligibility. 18 month loans originated prior to 2 6 2020 have different prepayment provisions.

Consult your loan agreement for details. Businesses nonprofit organizations homeowners and renters are eligible for funding with repayment terms up to 30 years and interest rates starting at 1 75. Organisations and small to medium businesses including sole traders and the self employed may be eligible for a one off loan with a term of 5 years if they have been adversely affected by covid 19. Includes wells fargo businessloan term loan and fastflex small business loan.

1 to 5 year terms. The rate for loans above 50 000 is 7 75. No specific collateral required. This is not a guarantee of your actual term fees or.

Small business administration sba disaster loans provide businesses with affordable financing for disaster recovery. 10 000 to 100 000 loan amounts. The average interest rate for a small business loan varies depending on your qualifications as a borrower the type of loan you re applying for and which lender you select. Applications opened on 12 may 2020 and can now be submitted up to and including 31 december 2020.

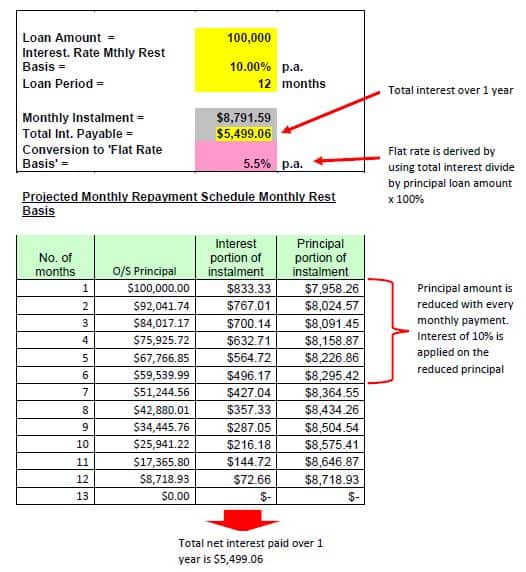

This business loan calculator is intended for demonstration purposes only. Sba 7 a loan eligibility terms. Fixed rates start at 6 25.

/ScreenShot2019-01-15at3.35.40PM-5c3e475ec9e77c00019b7191.png)