Small Business Unsecured Line Of Credit

Establishing or re building business credit with wells fargo.

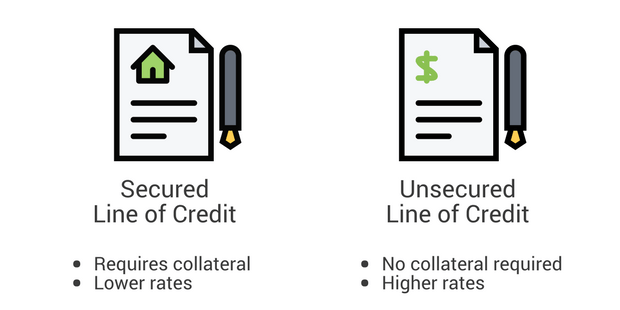

Small business unsecured line of credit. A business line of credit credit line small business is an excellent asset for a multitude of reasons and applying is quick easy and hassle free. An unsecured line of credit can be considered a non traditional business financing option because it doesn t require as much paperwork and documentation as a secured line of credit or loan. Wells fargo small business advantage line of credit backed by u s. A loan typically requires fixed monthly payments but you could repay your balance on a line of credit at a pace that works with your financial situation.

Another term for revolving line of credit is a small business line of credit. An unsecured line of credit that puts funds between 20 000 and 100 000 at your fingertips. An unsecured business line of credit can help you bridge the gap between payables and receivables temporarily fund fluctuating. Small business administration sba financing is designed to provide small businesses with access to credit featuring structures and terms that may be more flexible than conventional lending options.

Small business administration ideal for businesses in operation for less than 2 years. One commonly used option to obtain these funds is by securing a line of credit. For this reason it s a good choice for small businesses looking for ways to better manage cash flow. The typical apr for a small business line of credit from an online lender falls between 30 and 50.

Credit lines from 5 000 to 50 000. Applicants can qualify for an unsecured business line of credit of up to 100 000 with td bank. 5 year revolving line of credit no scheduled annual review. For an loc with a six month term this equates to 1 500 to 2 500 per 10 000 borrowed.

/how-a-line-of-credit-works-315642-FINAL-b923e17560394229b556ae9adec6f507.png)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)