Spac Financing

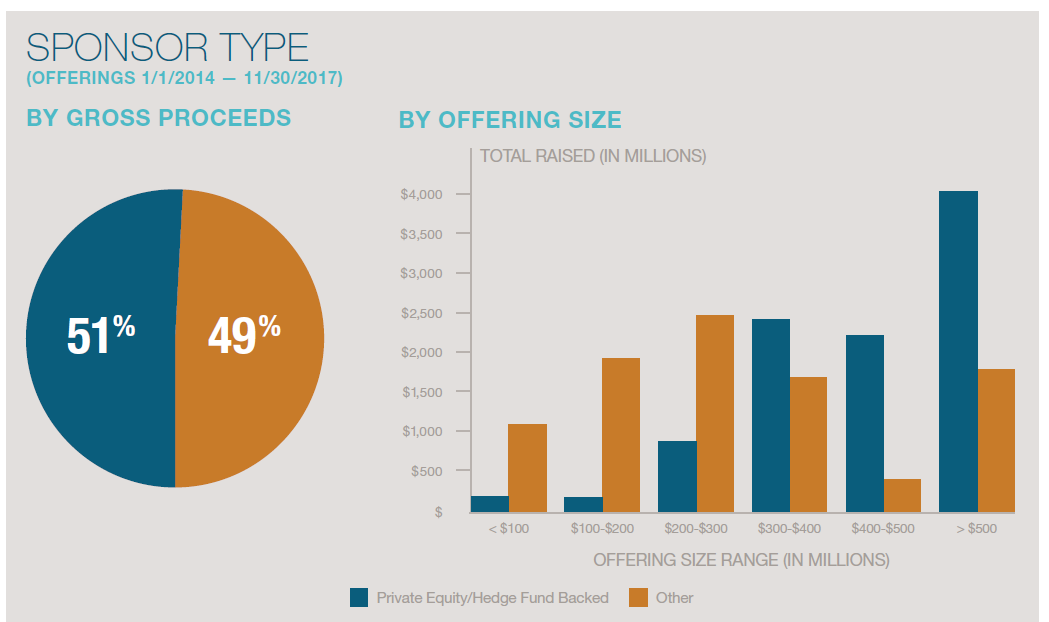

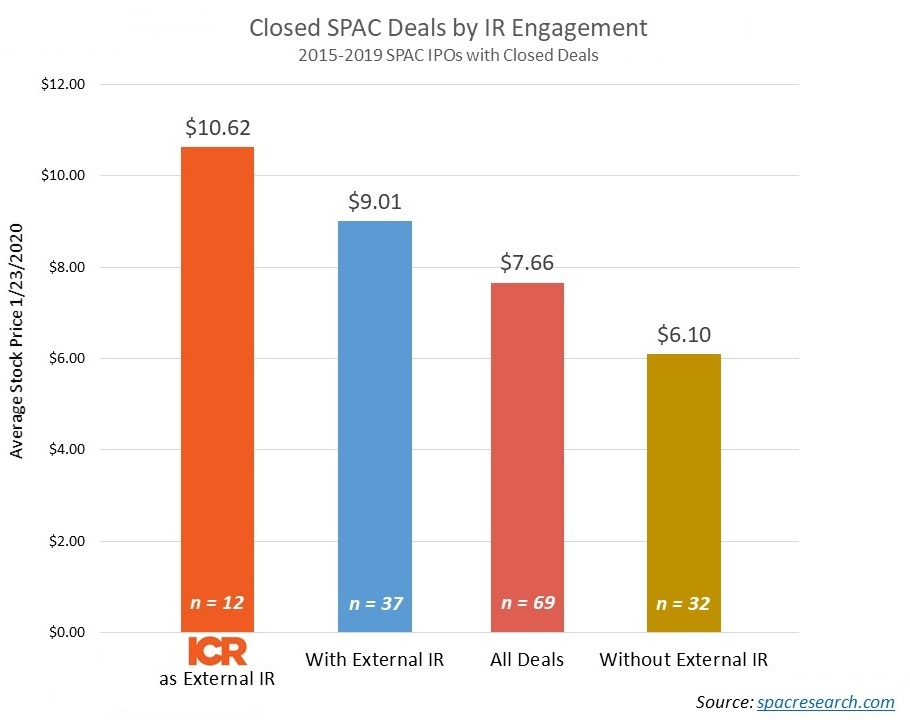

Spacs bring together experienced management teams often comprising industry veterans private equity sponsors or other financing experts who can leverage their expertise to raise capital to acquire then operate a new public company.

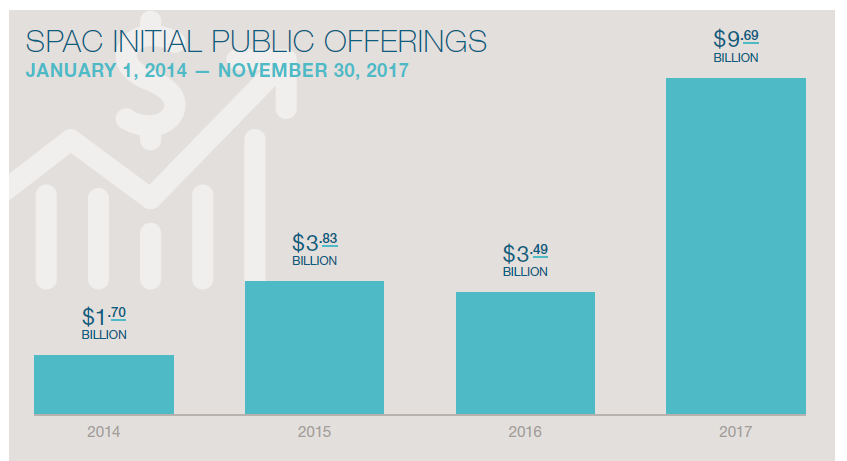

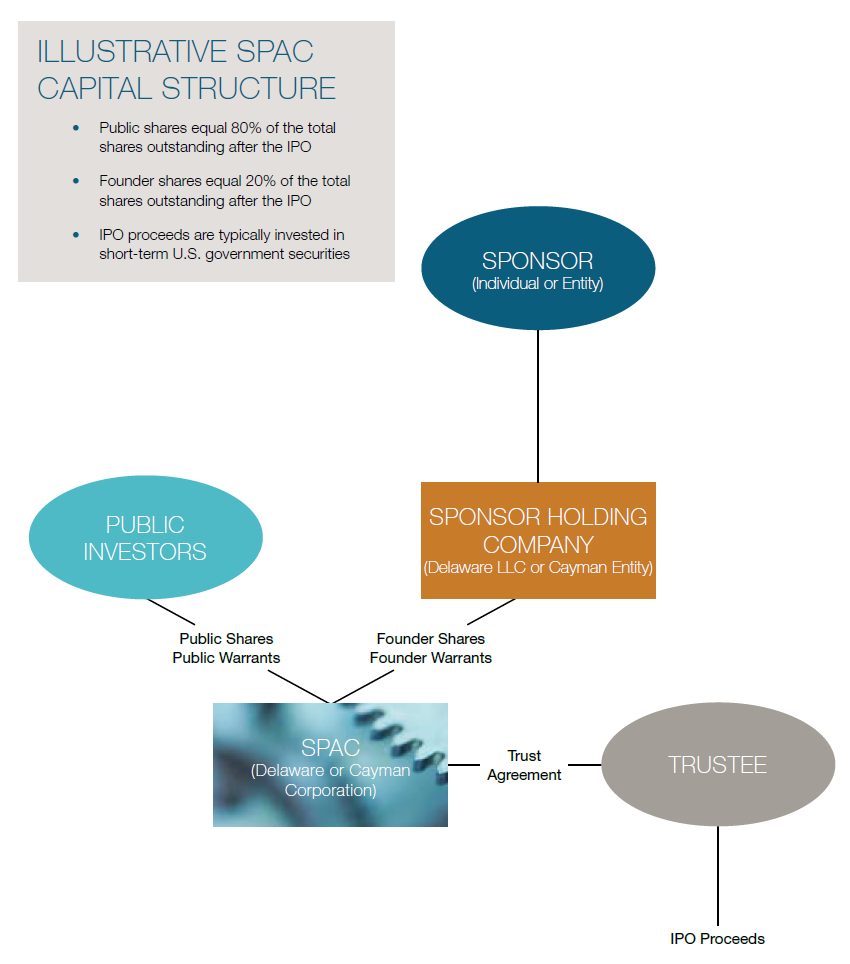

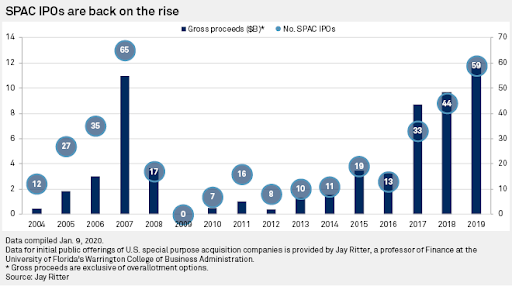

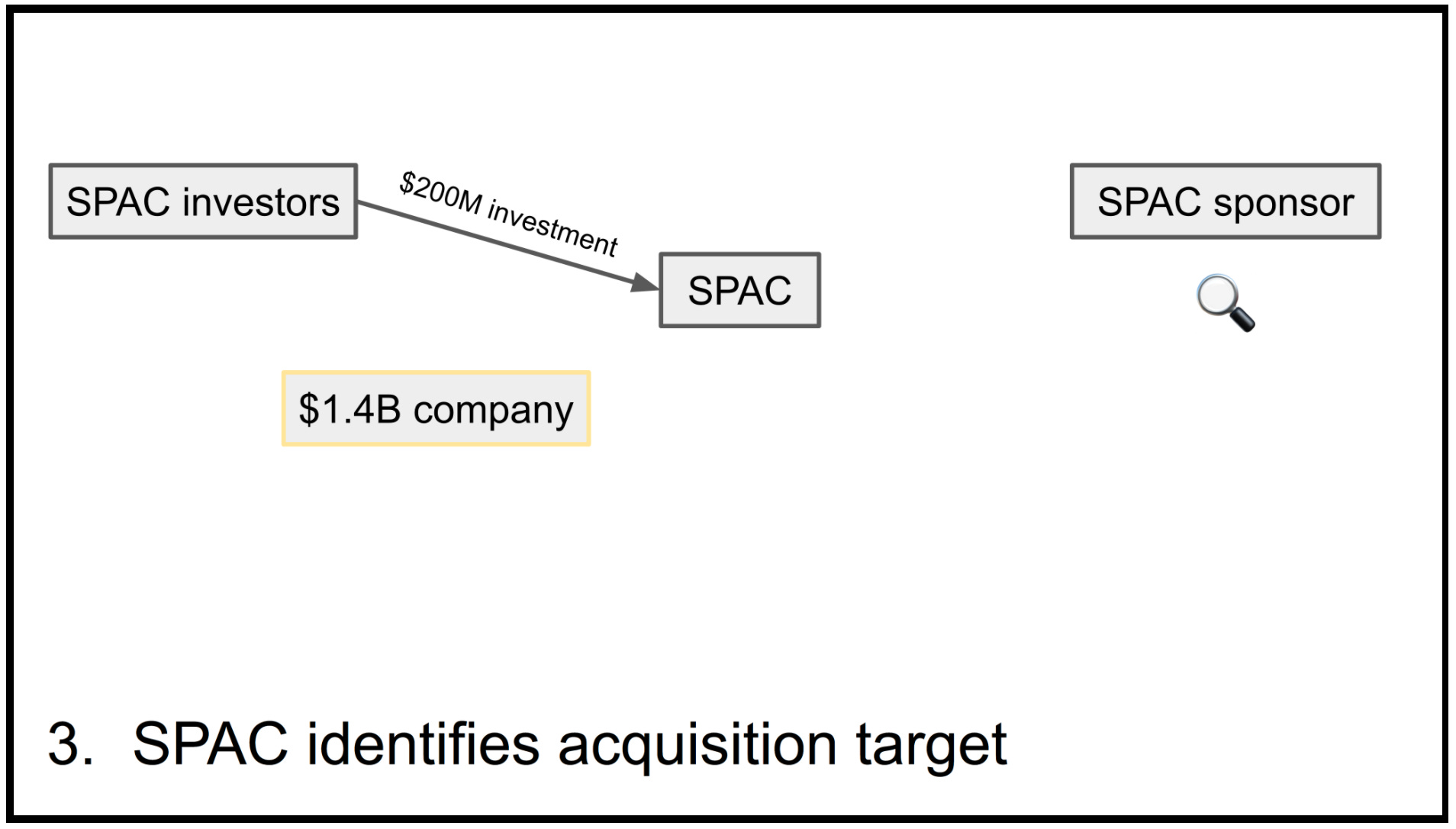

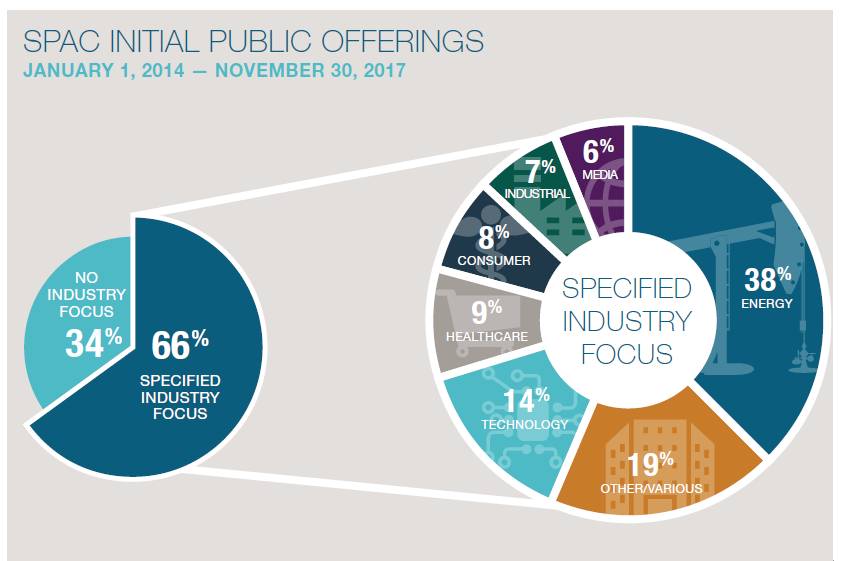

Spac financing. The spac issues an ipo and collects investments in exchange for common shares in itself. A special purpose acquisition company spac is a corporation formed for the sole purpose of raising investment capital through an initial public offering ipo initial public offering ipo an initial public offering ipo is the first sale of stocks issued by a company to the public. Sometimes at the outset it may have identified the industry in which it wishes to. The sponsor then finds a private business for the spac to acquire with the proceeds.

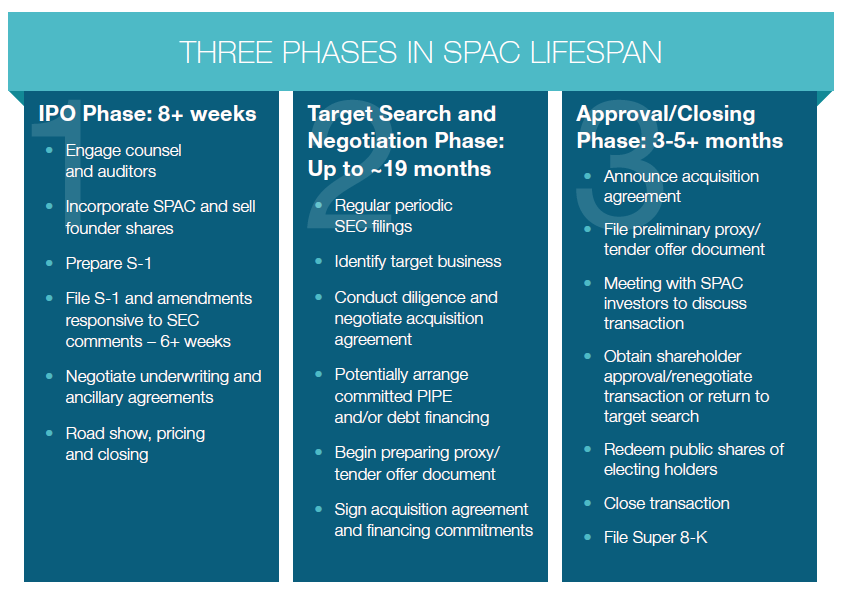

A special purpose acquisition company spac is a publicly traded company created for the purpose of acquiring or merging with an existing company. It then uses the capital it raises to identify and then purchase a target company. Within 24 months or less a spac will find an attractive company to acquire and once that transaction is completed a new publicly traded company is formed. What is a special purpose acquisition company spac.

The spac is listed on the stock exchange via an ipo. More from finance economics. A special purpose acquisition company spac sometimes called blank check company is a shell company that has no operations but plans to go public with the intention of acquiring or merging with a company utilising the proceeds of the spac s initial public offering ipo.