Stock Insurance Companies

A stock insurance company is a publicly traded firm that works within the insurance industry.

Stock insurance companies. Allstate progressive berkshire hathaway which owns geico and a. The company issues shares which can be purchased by the public to help raise capital for the company. A well run insurance company can prosper thanks to a strong core business and not have to worry about the interest it earns to prop up profits. One of the most important things to understand before buying any stock is how the company makes its money.

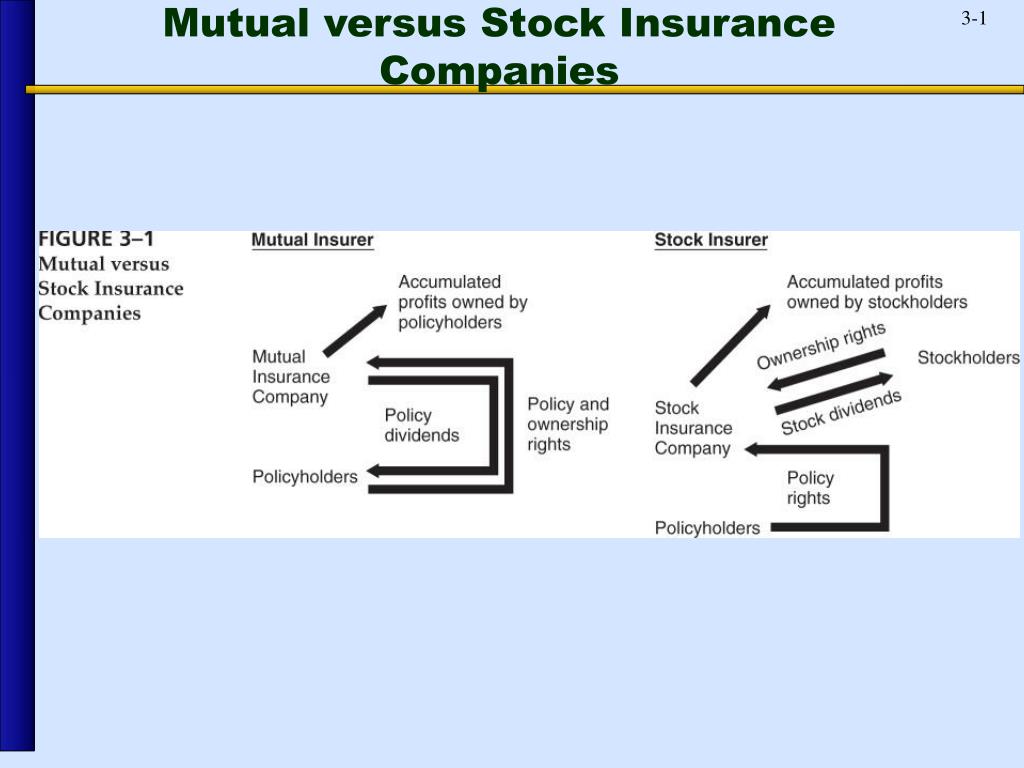

This sounds simple but it s frequently. Best of all well run insurance stocks are income. In a mutual company policyholders are co owners of the firm and enjoy dividend income based on. A stock insurer distributes profits to shareholders in the form of dividends.

Top insurance company 3. Every day thestreet ratings produces a list of the top rated stocks we consider these 10 insurance stocks to be the best picks in the insurance industry. A stock insurance company is owned by its shareholders. This enables the stock insurance company to utilize the additional capital to enlarge the firm in a manner superior to a mutual insurance company.

Insurance companies are most often organized as either a stock company or a mutual company. The main difference between a stock insurer and a mutual insurer is the form of ownership. Some of the largest property and casualty insurance companies listed on stock exchanges where investors can buy shares are. If buying back stock offers a better return it isn t afraid to pull back on growth and aggressively.

In addition the company provides life accident and health insurance products. The company delicately balances the trade off of writing more insurance or buying back stock. Stock insurance company definition is an insurance company with capital contributed by stockholders who control its operations and reap any profits or sustain any losses which may result therefrom and with policies that are ordinarily nonparticipating and always nonassessable. It may be privately held or publicly traded.

/thinkstockphotos_493208894-5bfc2b9746e0fb0051bde2b8.jpg)