Student Loan Refinance Mn

Minnesota has a low interest student loan program called self loans.

Student loan refinance mn. Student loan credit. Finance your college at the lowest cost. Loans are offered by commonbond lending llc nmls 1175900 nmls consumer access. The self loan is a student loan administered by the minnesota office of higher education and is unique to minnesota.

A2 commonbond student loan refinance. Here s how it works. The self refi is a student loan refinancing program administered by the minnesota office of higher education a state agency. The state agency responsible for helping students plan and pay for college is called the minnesota office of higher education mohe and mohe also administers the student loan program which is called the self loan.

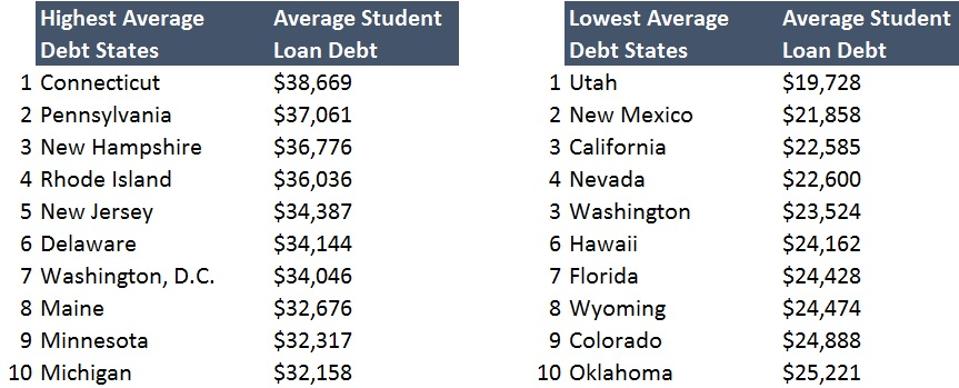

How to refinance student loans in minnesota. The self program is not funded by the state or federal government. Unlike consolidation you could potentially score a lower overall interest rate depending on your or your cosigner s credit score and debt to income ratio dti. Minnesota s student loan refinance program has helped nearly 1 000 minnesotans reduce their loan payments and save money since january 2016 said lt.

Both of these changes are geared toward making refinancing student loans more accessible to minnesotans. The self loan is a long term low interest student loan. Offered terms are subject to change and state law restriction. Minnesota student loan refinance program overview self refi is made possible by the minnesota office of higher education which is a state agency that provides students with financial aid opportunities and acts as the state s clearinghouse for a variety of post secondary based data research and analysis.

With the self loan you know before you apply what your interest rate is. Because the self loan is administered by the minnesota office of higher education a state agency the interest rates may be lower than private loans and some federal loans. Student loan refinancing can mean big savings in the right circumstances. As you might already know student loan refinancing like consolidation allows you to group your current loans into one new loan.

Minnesota is one of the few states whose student loan program survived the recession. For married couples each spouse may qualify for this credit. The debt to income ratio is increased to 50 with a co signer. The program is available to minnesota residents who completed a postsecondary course of study and meet the credit criteria.

Minnesota student loan programs. Minnesota residents who make payments on their own postsecondary education loans may qualify for a nonrefundable credit.