Student Loans Refinancing

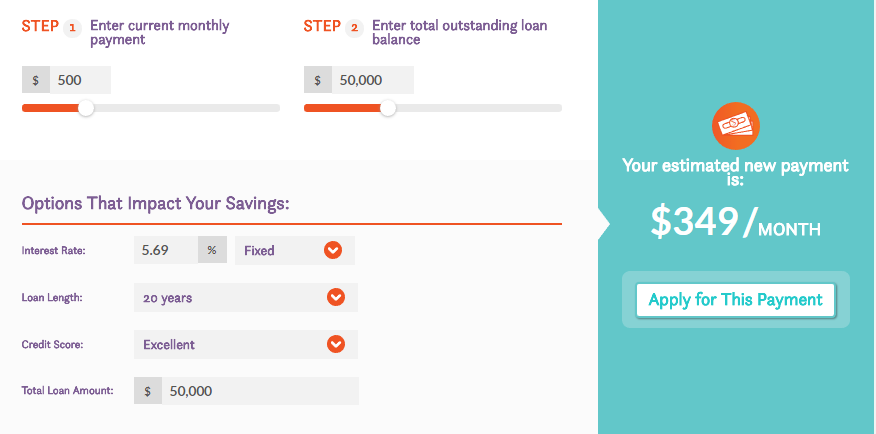

Just add in your current student loan information and we ll calculate your estimated savings both monthly and over the lifetime of your loan.

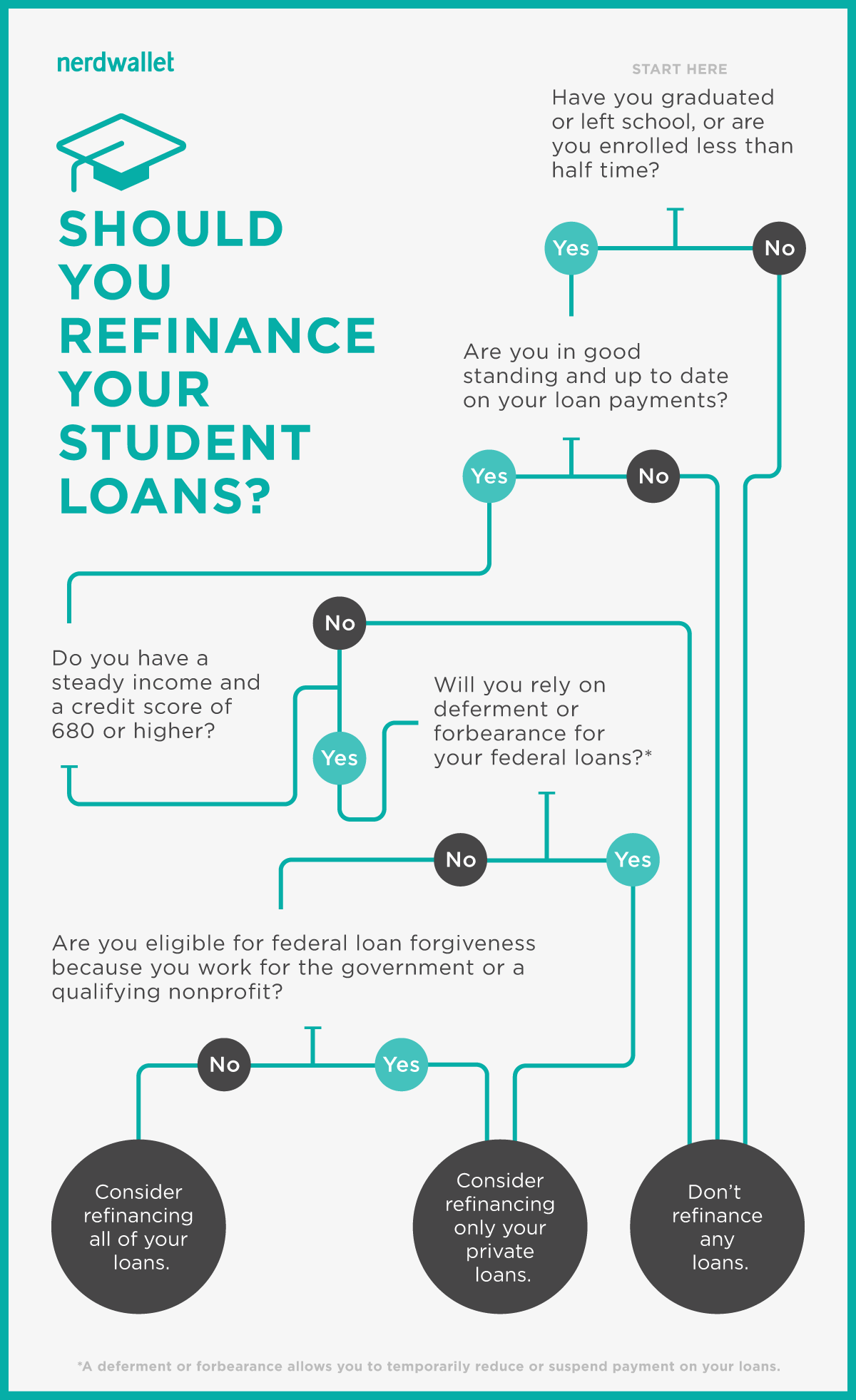

Student loans refinancing. Student loan refinancing allows qualified borrowers to adjust the interest rate and repayment terms on their private and federal student loans by taking out a new loan that pays off some or all of their existing education debt. Our calculator shows how much you can save on your student loans by refinancing with sofi. Refinancing student loans doesn t make sense if student loan consolidation is a better choice. Student loan refinancing has several advantages including a lower interest rate single monthly payment fixed or variable interest rate flexible 5 20 year loan repayment term one student loan.

Credit scores at least in the. Here s how it works. To qualify you ll need. For starters student loan consolidation which is included in the student loan refinance process simplifies the management of your monthly payments into a single loan.

A private consolidation loan is a private student loan that combines and refinances multiple education loans into one new loan with a new interest rate repayment term and monthly payment amount. Student loan refinancing allows you to consolidate both your private and federal loans including parent plus loans select a repayment term that makes sense for you and often get a lower interest rate. Consolidation does nothing for your interest rate but it does make your loans easier to manage says travis hornsby founder of student loan planner a consulting firm that helps borrowers manage student loans. Student loan refinancing can mean big savings in the right circumstances.

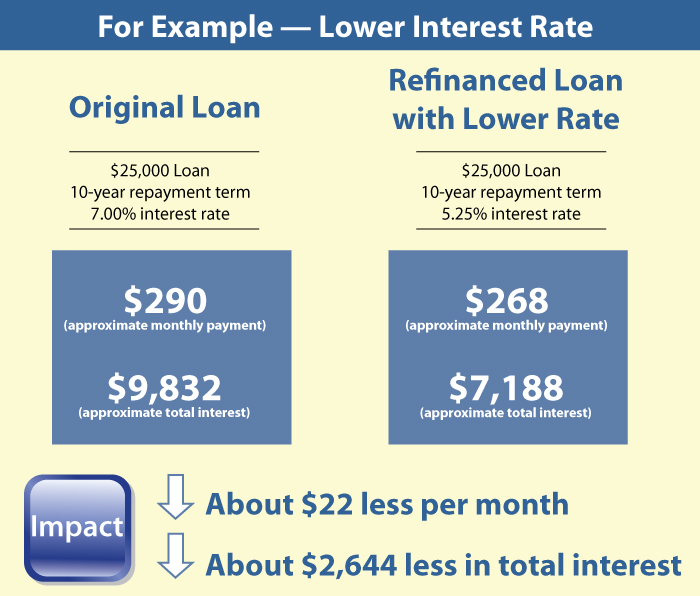

Interest rates on variable rate loans are capped at either 8 95 or 9 95 depending on term of loan. Student loan refinancing saves borrowers money by replacing existing education debt with a new lower cost loan through a private lender. Refinancing your student loans only makes financial sense if the loan you apply for has a lower interest rate than the current interest rate of your student loans. You can refinance student loans through many private lenders.

A new private company typically a bank credit union or online lender pays off the student. This could result in a lower interest rate and or a lower monthly payment.