Take It Or Leave It Insurance Contract

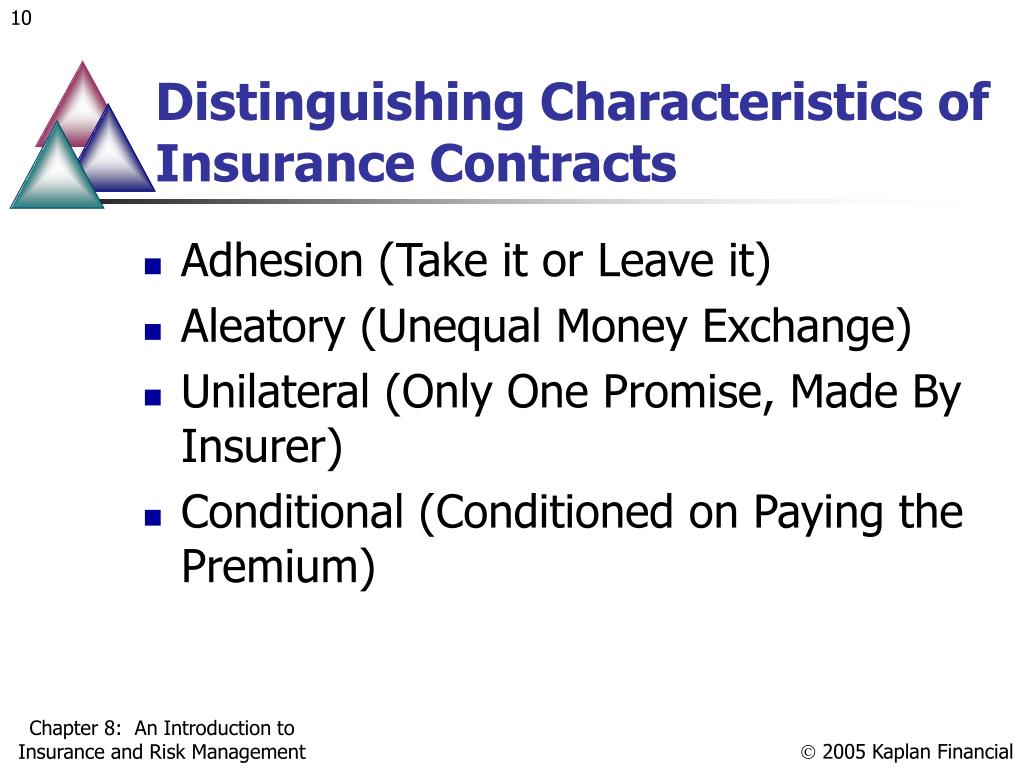

By contrast the insured makes few if any enforceable promises to the insurer.

Take it or leave it insurance contract. Which of these is not considered to be an element of an insurance contract. Boilerplate contract prepared entirely by the party with preponderant bargaining power and offered to the weaker party on in effect a take it or leave it basis. Where a term is unfair it may be altered the contract can be enforced as if the term is absent if it is possible to do so or if it is not operable without the clause the contract may be set aside. Unilateral contract a contract in which only one party makes an enforceable promise.

Most insurance policies and small business loans and some contracts of employment although legal are contracts of adhesion because they provide little or no opportunity to negotiate the terms. The party being offered the agreement either accepts or denies the agreement but they cannot make a counteroffer. In effect the applicant adheres to the terms of the contract on a take it or leave it basis when accepted. Any disambiguities will be settled in favor of the insured because the insurer draws up the contract.

Insurance contracts are contracts of adhesion. Insurance contracts are contracts of adhesion which means they are offered on a take it or leave it basis. The schedule and amount of premium payments. The insurance company draws up the contract which only becomes mutually binding when the buyer makes an offer by accepting the terms or mailing in the first payment.

This means that the contract has been prepared by one party the insurance company with no negotiation between the applicant and insurer. A standard form contract sometimes referred to as a contract of adhesion a leonine contract a take it or leave it contract or a boilerplate contract is a contract between two parties where the terms and conditions of the contract are set by one of the parties and the other party has little or no ability to negotiate more favorable terms and is thus placed in a take it or leave it position. The part of a life insurance policy guaranteed to be true is called a. Insurance policies offered on a take it or leave it basis are considered what.

Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. The receiving party does not have the option of negotiating revising or deleting any part or provision of the document. Insured s only option is whether to accept or reject. The takeaway is that although a take it or leave it contract is valid terms that unilaterally grant rights to one person may be considered unfair and unenforceable.

A take it or leave it contract is also called a contract of adhesion and it means that the agreement cannot be negotiated. The consideration clause of an insurance contract includes.

/GettyImages-1053743626-3b1327252ce94a998c9508c06fed8eea.jpg)

/GettyImages-944975896-1e117f457b9f4b72a623b9befa6a3c3e.jpg)