Tax Lien Attorney

A lawyer can help you navigate the legal system while avoiding costly mistakes or procedural errors.

Tax lien attorney. An attorney can often resolve your particular legal issue faster and better than trying to do it alone. There are options for handling your tax debt beyond sending a massive lump sum payment to the irs. Rely on tax liens attorneys. Tax lien attorneys will first and foremost offer you a detailed understanding of the tax lien process.

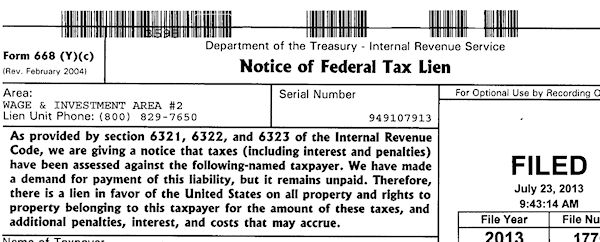

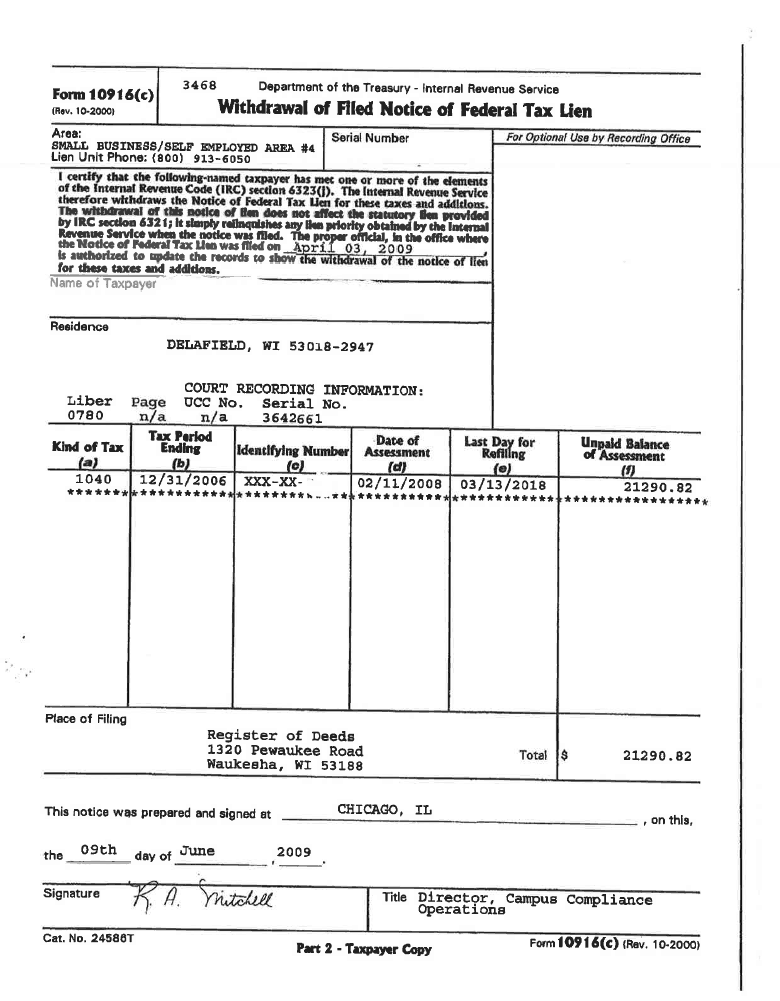

The reason is simple and can be useful for a tax attorney if for have a tax lien. A tax lien is a type of claim by the internal revenue service irs against a debtor s property or funds for failure to pay income taxes if a person does not pay their taxes then the irs may seek to recover the money owed in taxes by placing a lien on the person s home car bank accounts wages or other property. Tax liens attorneys in nj friendly caring bankruptcy and debt management lawyers can help you protect your home from foreclosure when a new jersey property owner is delinquent on the taxes owed on a home a tax lien may be imposed on that property to secure the payment of taxes. Have you recently received a notice and demand for payment of unpaid taxes from the irs.

How an attorney can help. A lien simply protects the government s interest in your property. What are tax liens. Tax attorneys are experts on all issues pertaining to federal and applicable state taxes.

An experienced tax attorney in new york can help you handle tax collection efforts and avoid the significant irs tax lien help in new york read more. These individuals are familiar and trained to deal with agents of the irs. Irs tax liens tax levies attorney. A levy on the other hand is the tool used to actually take your property from you.

In fact a tax lien is probably one of the final last ditch actions the irs undertakes to collect taxes. Find a cleveland tax lien attorney in your area. On august 31 2020 attorney general james and a group of 57 elected officials urged the delay of the city s annual tax and water lien sale. In a letter attorney general james and other elected officials called for the removal of more than 4 700 class 1 properties or residential buildings with three or fewer units from the tax lien sale scheduled for september 4 2020.

Any tax lien the irs issues comes with countless pages of paperwork and the irs must define a just cause which can be challenged by a competent.