Tax Settlement Program

File back taxes the irs only accepts settlement offers if you have filed all your required tax returns if you have unfiled returns make sure to file those returns before applying.

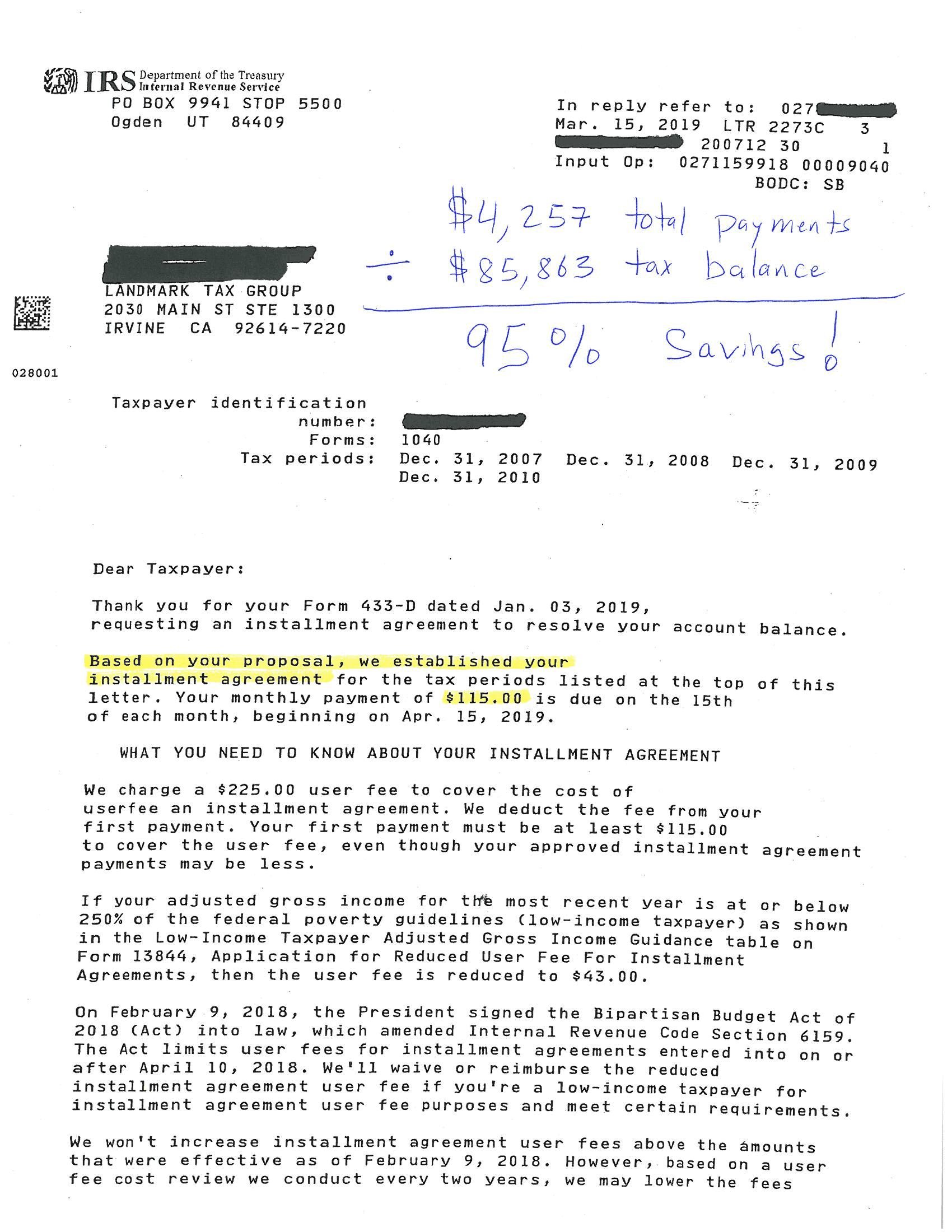

Tax settlement program. Patrick mansfield u s. Requires making a lump sum or short term payment plan to pay off the irs at a reduced dollar amount. Irs tax settlement program article by. How to settle taxes owed.

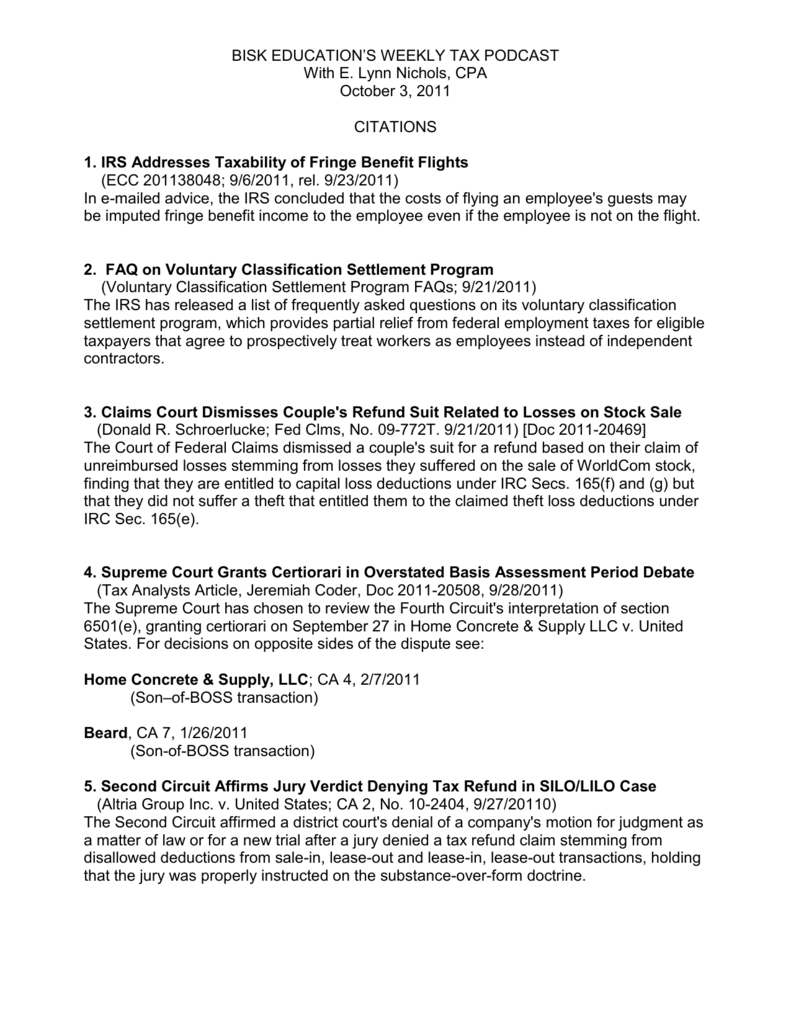

You also must be up to date on your current tax obligations. Also with the exception of the childhood lead poisoning prevention fee and the occupational lead poisoning prevention fee disputes involving the hazardous substances tax law are administered by the department of toxic substances control. The settlement program does not presently apply to disputes involving jet fuel tax motor vehicle fuel tax or the fire prevention fee. This is one irs debt settlement strategy that i would insist requires the help of an outside agency either from a tax settlement expert or an attorney with tax related experience.

These are the basic steps you need to follow if you want to settle taxes owed. Tag archive for tax settlement program. The remainder of what you owed before is now canceled debt. Written by nina olson posted in irs ovdp tax amnesty taxconnections.

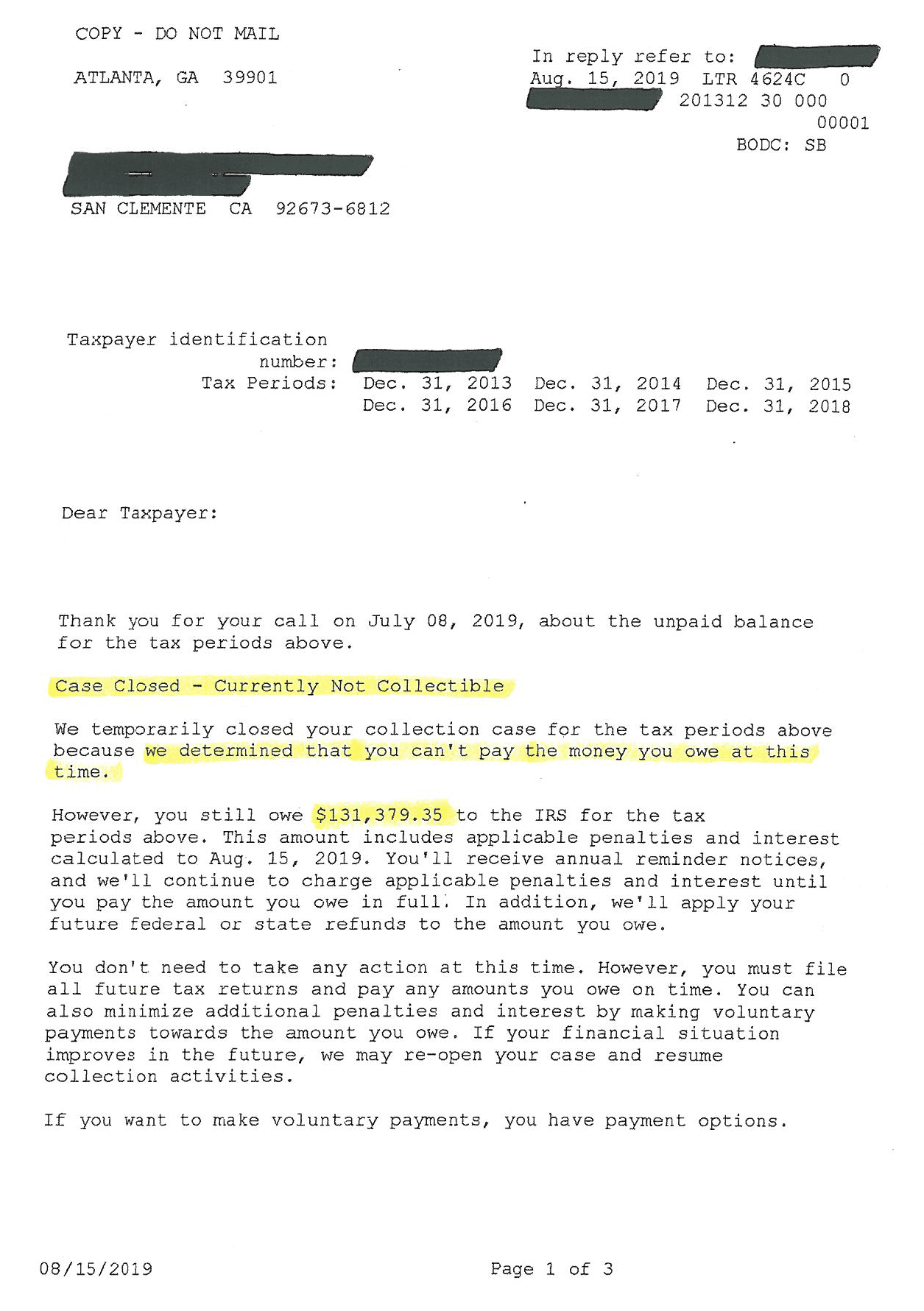

A program where you can settle your tax debts for less than what you owe. A tax settlement will typically involve a reduced balance and can involve completely removing an individual s tax liability if the case calls for such a move. 23 mar 2018. Gov connect an offer in compromise oic is a longstanding program that was put in place by the irs aimed towards helping individuals eliminate tax debt burdens that are too large for them to pay back.

Notification effective april 27 2020. A taxpayer s financial situation is the main deciding factor to determine their specific path toward tax debt freedom. If you owe the irs more than you can afford to pay this could be the plan for you. The application fee for offer in compromise is 205 unless you qualify for the low income certification or submit a doubt as to liability offer.

When you settle your debt you are agreeing to pay less than you owe. But when a lender cancels the debt the irs treats the amount of canceled debt as if it is. You simply do not want to enter bankruptcy court without an expert on your side because the irs knows how to handle these cases and it s going to take some fancy legal wrangling to win in a court of law.