Tax Settlement With Irs

Punitive damages and interest are always taxable.

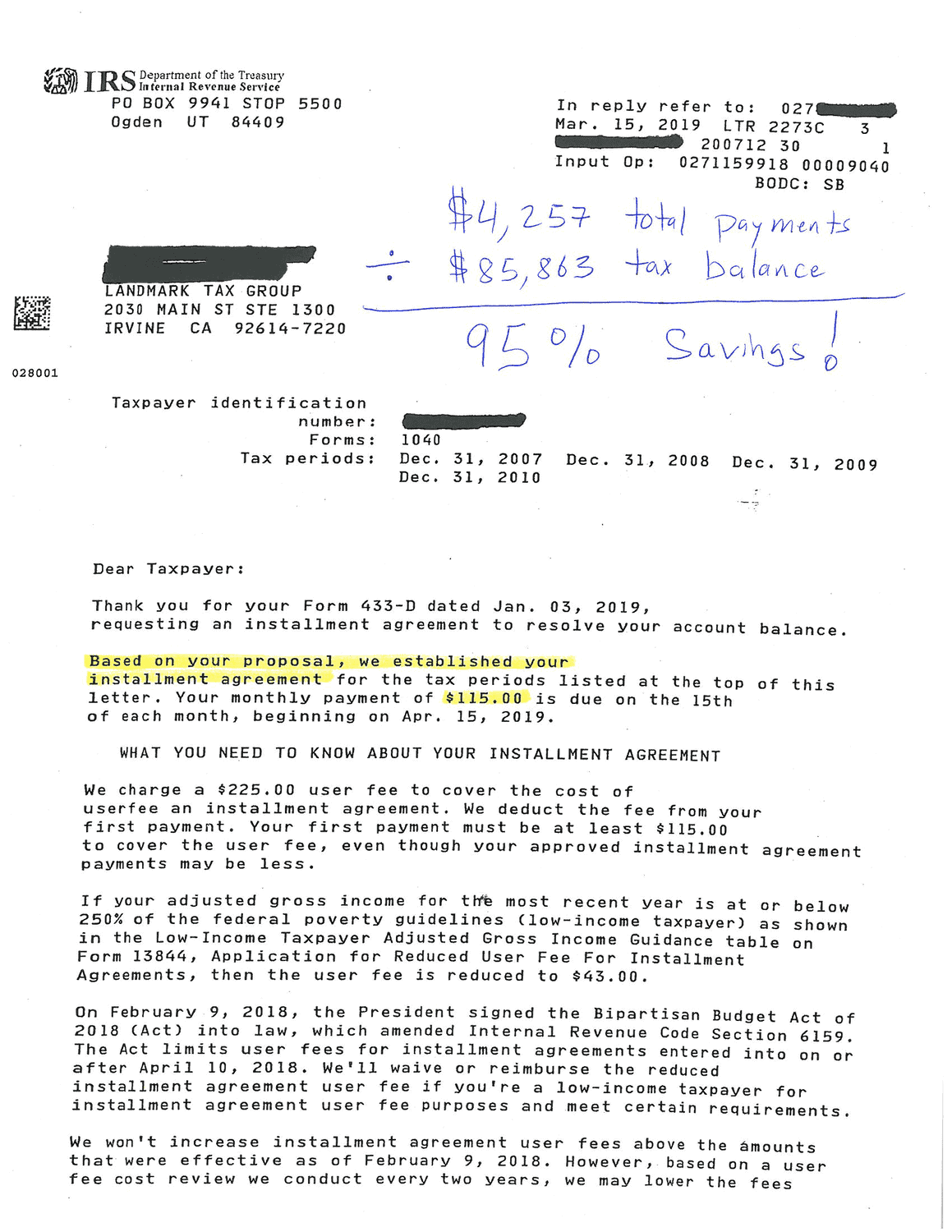

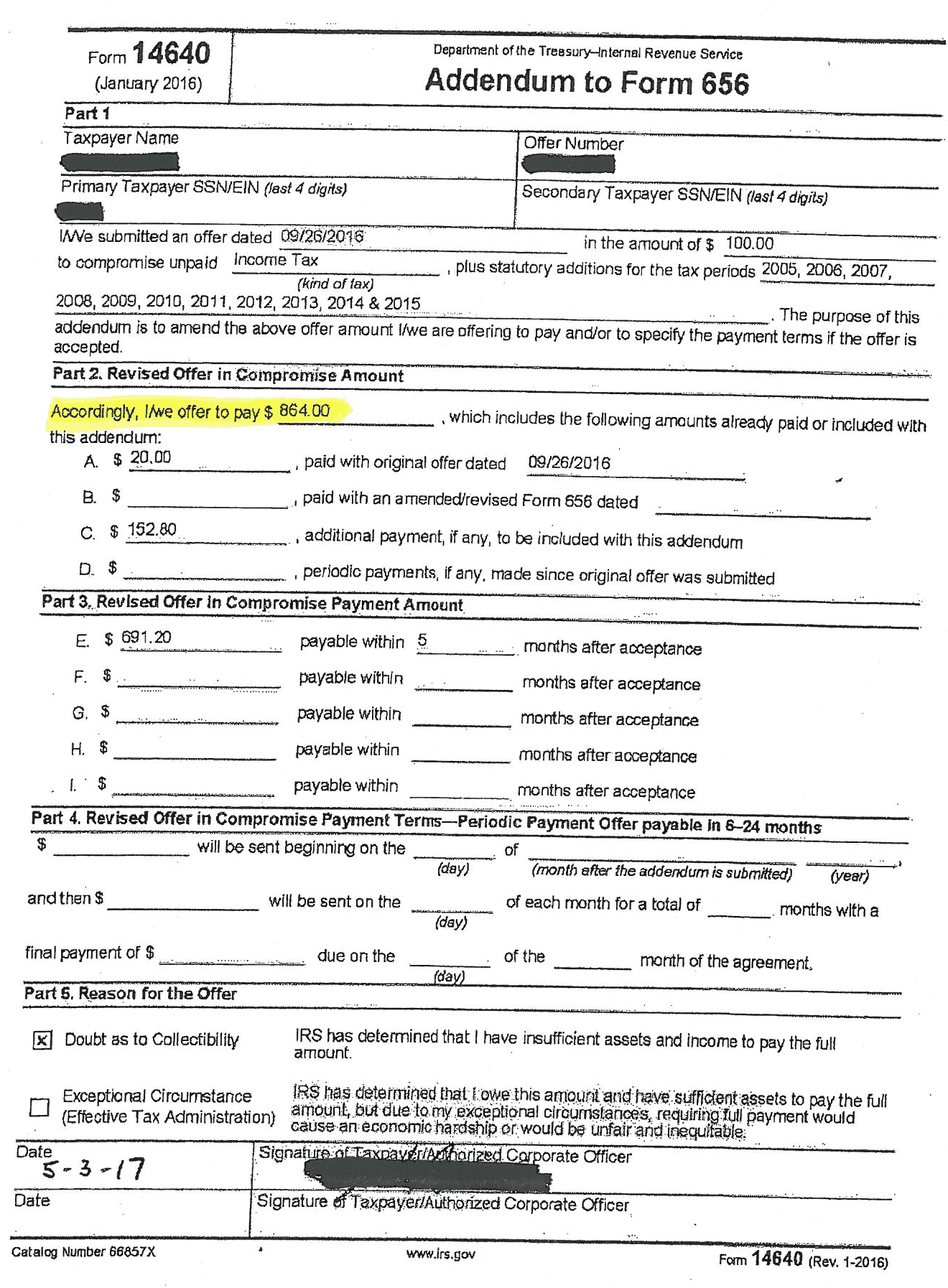

Tax settlement with irs. Get help with your tax debt today. How does a tax settlement work. The most widely published path to tax debt settlement with the irs is their offer in compromise program which allows you to request that the irs write off some of your tax debt simply because you cannot afford to pay it. If you don t have enough money to pay in full or make payments the irs may let you settle.

The application fee for offer in compromise is 205 unless you qualify for the low income certification or submit a doubt as to liability offer. This is a special agreement that some taxpayers are able make. Get reliable tax help irs tax relief irs tax debt preparation irs tax settlement back taxes help audit representation and tax problem resolution by usa tax settlement provides nationwide tax resolution services for taxpayers with irs or state tax problems. The irs also reverses penalties for qualifying taxpayers.

Tax advice early before the case settles and the settlement agreement is signed is essential. Tax settlement firms use an accepted irs procedure known as an offer in compromise in an effort to reduce their clients tax bills. Taxpayers who have a tax debt they cannot pay may have heard that they can settle their tax debt for less than the full amount owed. Irs special edition tax tip 2017 07 april 26 2017.

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. A tax settlement is when you pay less than you owe and the irs erases the rest of your tax amount owed.

/images/2019/06/10/woman-settles-tax-debt.jpg)