Term Life Insurance As An Investment

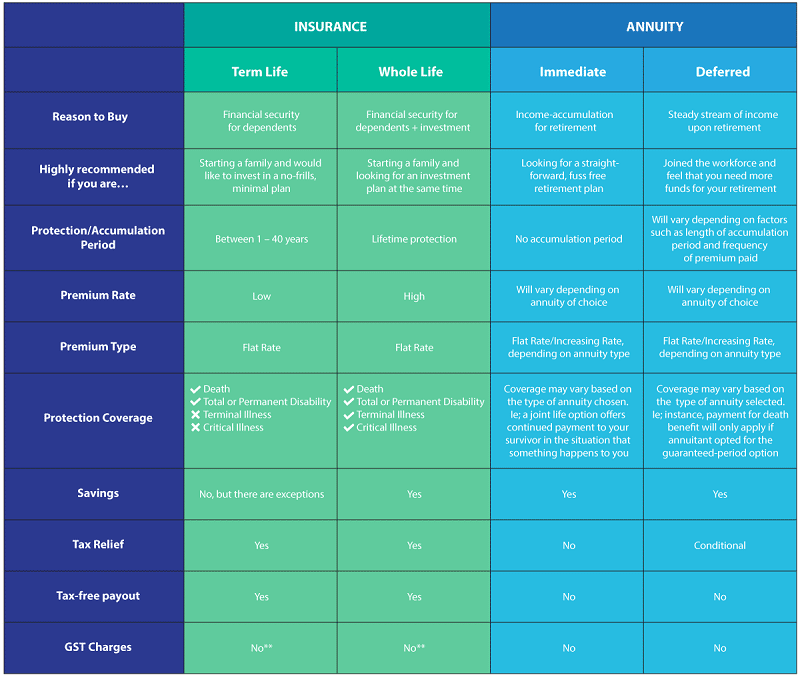

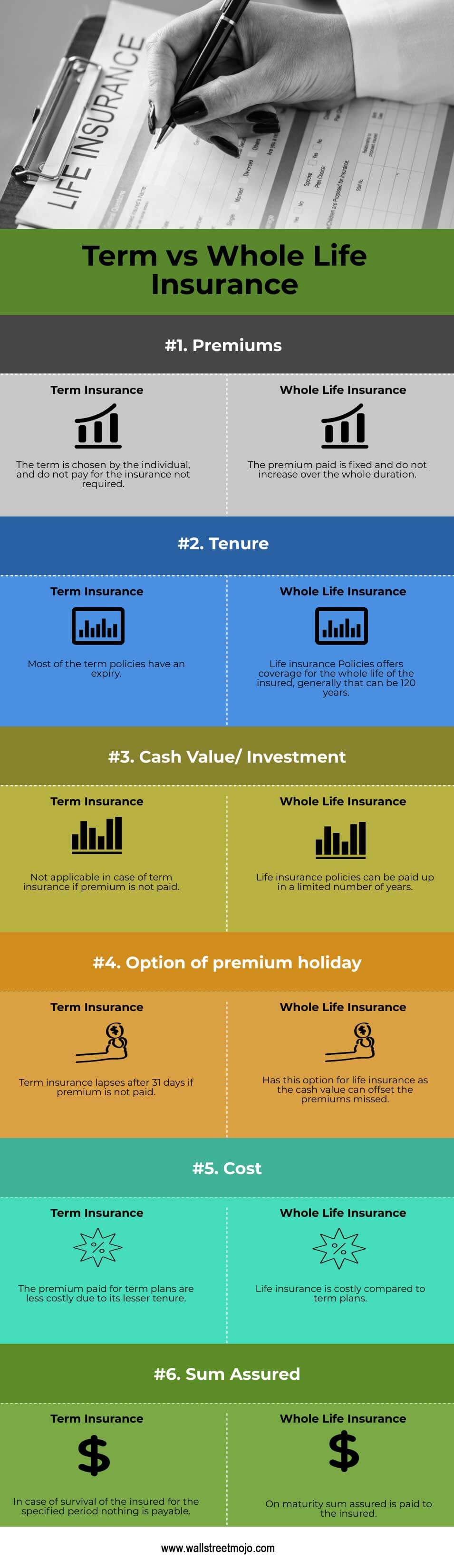

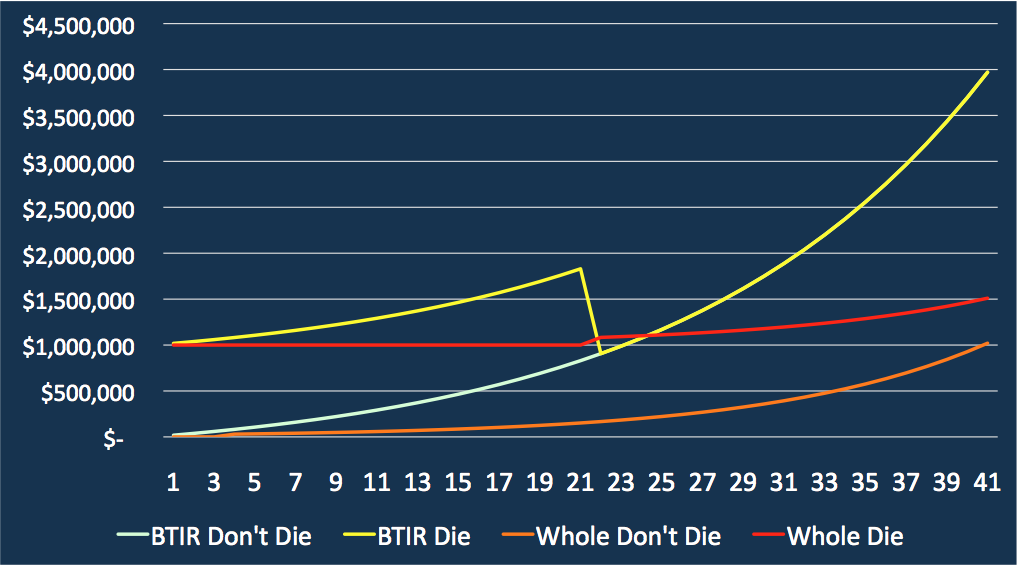

Alternatively with term life insurance all of your payments are put toward the death benefit for your beneficiaries with no cash value and therefore no investment component.

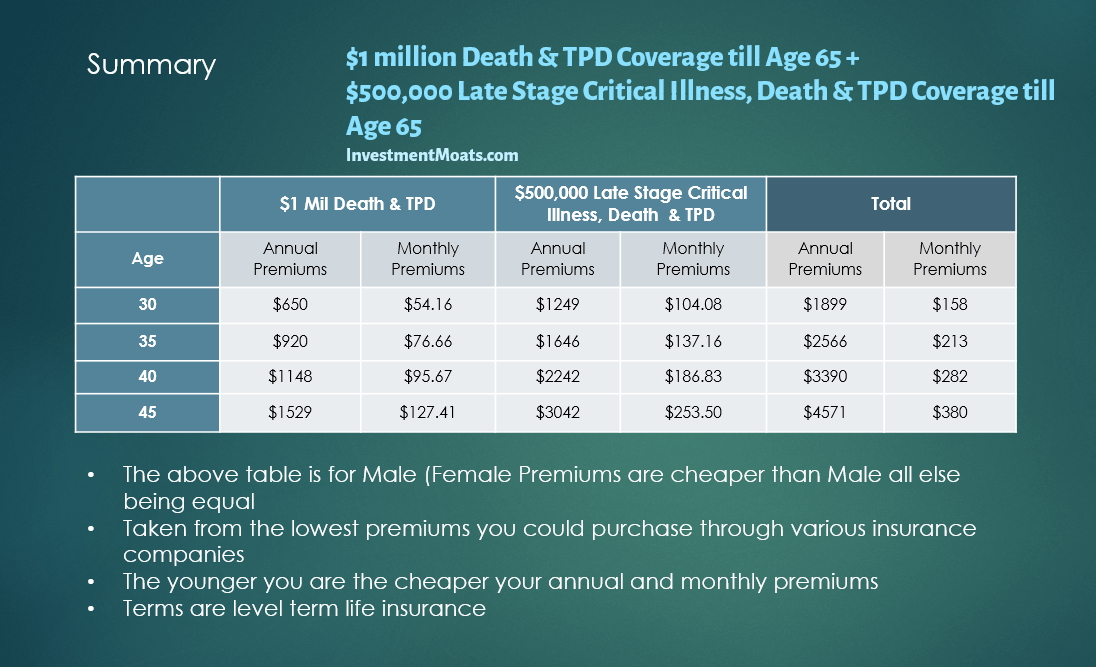

Term life insurance as an investment. Many people still consider it a sound investment in their financial security however because it pays a cash benefit to the policyholder s family or other beneficiaries upon the policyholder s death. Term insurance is the least expensive way to purchase death benefit coverage over a specific period of time. Fidelity investments term life insurance policy form nos. That s why a term life insurance policy policy which is affordable and straightforward is the right choice for most shoppers.

The death benefit is a hedge that provides cash in the event. When people talk about using life insurance as an investment they re often talking about whole life insurance and other types of. This means you can switch or convert your term policy to permanent insurance without the need for a medical exam. Once that period or term is up it is up to the policy owner to decide whether to renew or to let the coverage end.

And ftl 99200 et al is issued by fidelity investments life insurance company 900 salem street smithfield ri 02917 and for new york residents empire fidelity investments term life insurance policy form no. It doesn t pay dividends so it s not really considered a financial investment. Eftl 99200 et al is issued by empire fidelity investments life insurance company new york n y. Term life insurance.

Term insurance is a life insurance plan offered by an insurance company that provides comprehensive financial coverage against premiums paid for a limited period to the beneficiary of the policy. Term life insurance is pretty basic. A type of life insurance with a limited coverage period. However the policy may be convertible.

This coverage provided under term insurance plans is paid as death benefit upon the demise of the insured during the policy term. Life insurance as an investment in estate planning to be clear the vast majority of life insurance is purchased for risk management. Term life insurance could be a good investment for someone who is living on a lot of credit and has a lot of significant financial commitments but still a high income to work with see.

/life_insurance-5bfc371046e0fb0083c33fed.jpg)